BANKEEDGE Launches New Training Centre in Kalyan to Develop Job-Ready Banking & Finance Professionals

Kalyan, Maharashtra | February 2026 – BANKEEDGE Academy of Banking & Finance, a leading institution focused on BFSI skill development and employability, has announced the launch of its new training centre in Kalyan, Maharashtra. The new centre aims to prepare graduates and young professionals for successful careers in the banking and financial services industry. The Kalyan […]

BANKEEDGE Launches New Training Centre in Bangalore to Develop Job-Ready Banking & Finance Professionals

Bangalore, Karnataka | December 2025 – BANKEEDGE Academy of Banking & Finance, a leading institution focused on BFSI skill development and employability, has announced the launch of its new training centre in Bangalore, aimed at preparing graduates and young professionals for successful careers in the banking and financial services industry. The Bangalore centre is strategically […]

BANKEDGE Launches New Training Centre in Coimbatore to Prepare Job-Ready Bankers

Coimbatore, Tamil Nadu | 18th December 2025 – BANKEDGE Academy of Banking & Finance, one of India’s leading institutions focused on BFSI skill development and employability, has announced the launch of its new training centre in Coimbatore, aimed at upskilling young graduates aspiring to build successful careers in the banking and financial services sector. The […]

📉 RBI Monetary Policy & Its Impact on Banking Jobs

🚀 Introduction: Why Should Students Care About RBI Policy? When you hear news like “RBI increases repo rate by 0.25%”, most students switch the channel. It sounds like boring economics—but here’s the truth: RBI’s monetary policy decisions directly impact banking jobs, hiring trends, and the kind of skills banks demand. So if you want a […]

🏦 Private Banking Hiring Trends 2025: What Fresh Graduates Need to Know

🚀 Introduction: The Big Question Students Ask “Are banks still hiring?”If you’re a fresh graduate looking at the BFSI sector, this question is probably running in your head. With AI, fintechs, and automation reshaping the industry, it’s easy to assume banking jobs are shrinking. But here’s the truth—private banks in India are still hiring in […]

💳 Digital Banking Boom in India: Career Opportunities for Students in the BFSI Sector

🚀 Introduction: From Passbooks to Payment Apps Not long ago, banking meant standing in queues with passbooks and withdrawal slips. Fast forward to 2025, and you can open an account, apply for a loan, and invest in mutual funds—all from your smartphone. This transformation isn’t random. It’s the result of India’s digital banking boom, fueled […]

🌐 AI in Banking Careers: The Future of Jobs in the BFSI Sector

🚀 Introduction: Should You Fear AI or Embrace It? Walk into any bank today, and chances are the first person to greet you won’t be a person at all—it’ll be a chatbot. From answering queries to approving loans, artificial intelligence (AI) has quietly become the backbone of modern banking. This leaves one big question: If […]

BANKEDGE Launches Kukatpally Centre in Hyderabad to Empower Youth for Private Banking Careers

Hyderabad, India – August 7, 2025 BANKEDGE, a premier Banking and Finance Academy with a pan-India presence, proudly announces the launch of its latest centre in Kukatpally, Hyderabad. This move reaffirms BANKEDGE’s commitment to developing future-ready banking professionals and bridging the skill-employability gap in the BFSI (Banking, Financial Services, and Insurance) sector. The new Kukatpally […]

Independence Day 2025: Empowering Careers, Building the Future of Banking

Every year on 15th August, India celebrates not just the historic moment of our nation’s freedom but also the spirit of self-reliance, growth, and progress. Independence is more than a date in history—it’s the power to shape our own future. In today’s fast-changing economy, true independence also comes from being financially secure and career-ready. And […]

Banks may play safe in aligning study loans with follow-up loans

Upgrading the existing loan, treated as restructured, can be done only after 10 per cent of the revised repayment instalments is paid Banks’ may turn more circumspect when considering student borrowers’ application for a second education loan. The Reserve Bank of India (RBI) has rejected Banks’ request to not treat realignment of the existing tenure […]

Interest rate changes affect Banks Profitability

How Interest Rate Changes Affect the Profitability of Banking? When interest rates rise, profitability in the banking sector increases. This is in part because higher interest rates are normally a sign of a booming economy. But one should understand that profits rise mostly because the banks can earn a higher yield on every rupee they […]

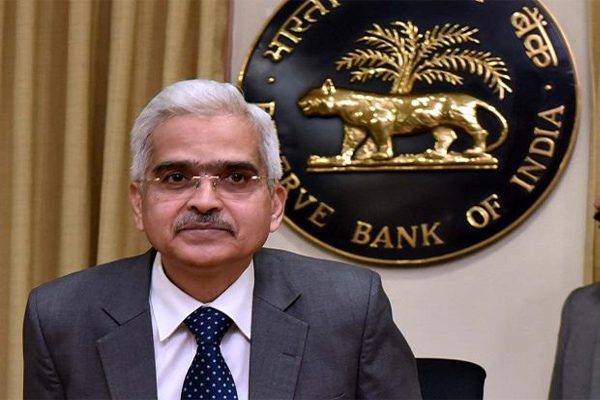

Bankers rush to fuel deposit growth

Staving off competition from mutual funds, banks look for ways to regain old depositors and find new ones Credit growth should not outrun deposits by miles, Reserve Bank of India Governor Shaktikanta Das cautioned in July, as that may lead to structural liquidity issues. According to the latest RBI data, banks’ credit grew 14 per […]

Safeguarding deposits

Risk-based deposit insurance is need of the hour Bank deposits are among the safest asset classes in the world allowing banks the leeway to raise a sizeable share of their resources at one of the most competitive rates. Given the share of savings mobilised by them, they are also subjected to increased regulatory oversight. Worldwide, […]

Card Disclosure Norms

The Financial Action Task Force (FATF), the global watchdog against money laundering and terrorist financing, is considering new disclosure norms for cross-border online transactions, including credit cards, government officials told Business Today TV. The proposed changes could also involve real-time tracking of the transactions. This shift may affect both international and domestic transactions, a source […]

ATM withdrawal limit for HDFC, SBI, ICICI PNB and other top banks in India

ATM withdrawal limit: Automated Teller Machines (ATMs) enable you to access funds from your savings and current accounts conveniently and easily. It lets you withdraw money anytime and anywhere. However, there are limits on the number of transactions you can make in a time frame and the maximum amount you can withdraw at one time […]

The danger of retail credit boom

A rise in lending to the retail sector could render the banking system vulnerable, after it has just overcome its NPA problem. A renewed focus on retail lending, or the provision of personal loans, by India’s banking system (and the non-bank financial companies they support), is giving the otherwise confident Reserve Bank of India some […]

Bank deposits are growing, but how well are they protected?

Fixed deposits (FD) with banks are the most common investment. But how well protected are FDs? It turns out that only 44 per cent of bank deposits were covered by insurance as of September 2023. And this proportion has been on a decline since 2021, per RBI data. In September 2022, 49 per cent of […]

RBI unveils Pravaah portal, Retail Direct Mobile App and FinTech Repository

Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday unveiled three major initiatives of the Reserve Bank, namely the Pravaah portal, the Retail Direct Mobile App and a FinTech Repository. These initiatives were earlier announced as part of RBI’s bi-monthly Statement on Development and Regulatory Policies in April 2023, April 2024 and December 2023 […]

PUBLIC FINANCIAL MANAGEMENT SYSTEM: ITS IMPACT ON GOVERNMENT PROGRAMS

Public Financial Management (PFM) is essential for governments to handle money properly. It’s like a guide that helps governments use public money wisely, transparently, and effectively. In this blog, we’ll explore why PFM is important, how it has evolved, and its impact on various government activities. WHAT IS PFM AND WHY WAS IT INTRODUCED? […]

Bankers body convene meet over SC ruling on interest-free loans

The Supreme Court ruling comes amidst a series of appeals filed by various bank staff unions and officers’ associations challenging the taxation rules. Stunned by a recent ruling by the Supreme Court, the All India Bank Officers’ Confederation (AIBOC) will convene a meeting of its senior officials on Sunday to decide the future course […]

RBI asks fintechs not to pursue blistering growth

SYSTEMIC CONCERN. Players told to target 15-20% growth Vs current 30% plus run rate. After asking banks and non-banking finance companies to take a calibrated approach to growth, the Reserve Bank of India has signalled fintechs to tamp down. In a meeting recently held with fintech heads, the regulator is said to have told many […]

Why retail loans remain unstoppable

PIQUE INTEREST. Banks are lending more than ever, including unsecured credit, even as the RBI moves to curb overreach Bank loan offers are flooding customers via SMS, WhatsApp message, email, calls, and advertisements, promising to meet every kind of need — from home and vehicle purchase to education and wedding expenses. And they are finding […]

HDFC Bank to keep margins at current levels

HDFC Bank managing director Sashidhar Jagdishan said the lender “will not be chasing growth for the sake of growth” and “will be delighted even if the margins remain at the current levels”. Addressing analysts on Saturday, soon after the bank declared its fourth quarter results, he declined to give any guidance but said the bank […]

Paytm starts user migration to new UPI IDs

Paytm authorized to migrate users to Axis Bank, HDFC Bank, SBI, YES Bank for UPI payments, ensuring seamless transition with new UPI IDs for uninterrupted transactions. Paytm’s parent company, One 97 Communications (OCL), has been authorized by the National Payments Corporation of India (NPCI) to migrate users to new banks for UPI payments. This follows NPCI’s […]

POSSIBLE INCREASE IN NPAs IN 2025

A latest report from ICRA, the rating Agency, after two years of decline, gross fresh non-performing asset (NPA) generation is set to rise for both private and public sector banks (PSBs) in FY25. Further, the rating agency also revised downwards its outlook for the Indian banking sector to “stable” from “positive” for FY25. This is […]

PSBs to be allowed to transfer shares to IEPF

The finance ministry is considering amending the Banking Companies (Acquisition and Transfer of Undertakings) Act, 1970, which governs public-sector banks (PSBs), to make suitable provisions for allowing PSBs to transfer shares to the Investor Education and Protection Fund (IEPF) when dividends of such shares remain unclaimed by the investors for seven consecutive years. The Section […]

Low credit score? Go for loan against insurance policy

Expect smaller loan approvals in policy’s early years, which may necessitate selling of investments instead New regulations on the surrender value of insurance policies have come into force from April 1. Surrender value is the amount paid by an insurance company when a customer ends a policy before maturity. Under the new guidelines released by […]

FY25 begins with surplus liquidity in banking system and VRRR auctions

The Reserve Bank of India (RBI) has kicked off liquidity management operations in the new financial year by con- ducting four variable rate re- verse repo (VRRR) auctions — two each on April 2 and April 3 — to suck out surplus liquidity from the banking system and reinforce its “withdrawal of accommodation” monetary policy […]

BM Finance Fundas: 2 insurance rules in effect from today you must know about

There are two guidelines that are going to impact insurance policyholders, starting from April 1, 2024. One is mandatory e-Insurance policies for new policyholders and the other is regarding the surrender charges of the life insurance plans such as endowment policies. Here’s what policyholders need to know: e-Insurance mandatory It is mandatory to hold insurance […]

Travel credit cards seeing strong growth as Indians warm up to reward miles, discounts

Travel-based co-branded credit cards are seeing strong growth led by steady demand as more and more users utilise these cards for reward miles and discounts for their domestic and overseas travel. Travel credit cards were the fastest growing category in 2023, with demand rising 27 per cent on year, especially in Tier-2 and Tier-3 towns […]

Should you buy or hold the Stocks of AU SFB

AU Small Finance Bank merger with Fincare SFB to be effective from April 1, 2024. Here is a question – whether Should you buy, sell or hold the stock? AU Small Finance Bank’s merger with Fincare Small Finance Bank is expected to help AU Bank achieve sustainable growth, boost profitability and support stronger return ratios, […]

Axis Bank, HDFC, SBI, YES Bank Partner With One97 Communications Limited For UPI Services

· The National Payments Corporation of India (NPCI) has granted approval to One97 Communications Limited (OCL) to engage as a Third-Party Application Provider (TPAP) under the multi-bank model for Unified Payments Interface (UPI). · Under this arrangement, four banks—Axis Bank, HDFC Bank, State Bank of India, and YES Bank—will serve as Payment System Provider (PSP) […]

How to avoid falling into Credit Card Debt?

To avoid falling into debt with a credit card, you can Give yourself a 72-hour rule on big purchases and impulse buys. Pay off charges right away. Don’t save your credit card info on shopping sites. Find an alternative when you feel like shopping. Don’t finance expenses with your credit card. Let us go […]

The Ban! The Remedy! Comeback?

January 31st, 2024 – a news was out that shook the Fintech companies, merchant users and of course the retail users, who are none else than we, the general audience. Prelude to the Latest News The Governing Body of banking and finance, RBI, had issued a ban on Paytm Payments Bank (PPBL) for non-compliance […]

What a personal loan costs you

Personal loans are a way to use tomorrow’s income today, and the process involved is simple. But you must note that the interest rates are much higher than, say, for a car loan. This is because personal loans are unsecured loans. This means that the loan is not backed by any asset. The loan amount […]

HDFC Bank gears up to list NBFC arm HDB Financial

HDFC Bank has set the ball rolling for the much-anticipated initial public offering of its subsidiary HDB Financial Services. The country’s largest lender by market capitalisation intends to schedule the launch of the share sale in its financial services arm in the last quarter of calendar 2024 or the first quarter of 2025, said sources […]

RBI Widens the Scope in BBPS to Increase Non-Bank Entities Participation

A New Regulation is in place for Non-Banking Entities In view of making a substantial expansion in payment landscape through various payments system like Unified Payments Interface (UPI), Internet Banking, Pre-paid Payment Instruments (PPIs), RBI felt the need to review and update their regulations. The new regulations allow a number of non-banking payment providers to […]

RBI’s Updated Framework for Sandbox in Fintech

RBI’s new regulatory guidelines on various FINTECH processes In the aftermath of impeding ban on Paytm, there were rumours that other UPI payments system may also go through similar scrutiny. It appeared as if RBI was standing against Fintech companies and its success. Even the RBI Governor had to speak up on the issue and […]

Income Tax rules for cash deposit and withdrawal

General Guidelines: Individuals depositing Rs 10 lakh or more in a savings account during a financial year will have the transaction reported to the income tax authorities by the bank. TDS will be levied on cash withdrawals exceeding certain limits. Failure to establish the source of income for cash deposits may result in taxation at […]

Seed Funding: A Fintech Start-up Raised 3.3 Crore Pre-seed Funding

What is this Financial Facility Known as Seed Funding and Can You Have Your Own Start-Up with its Help? Let’s Find Out. In a bizarre news by itself, a start-up named PocketATM is making rounds in the news for raising 3.3 crore pre-seed funding. Why is this start-up able to make such big news? What’s […]

UPI goes global

Unified Payments Interface, commonly known as UPI, has been a game changer for digital payments in India. From getting groceries to buying your favorite gadget, one can quickly make a UPI payment with no additional charges. UPI is no longer limited to India and the number of countries accepting it keeps growing. What is UPI […]

Tax benefits to UAE NRIs on Investment in Mutual Funds

India and UAE signed the DTAA (Double Taxation Avoidance Agreement) in 1992 in order to avoid double taxation of residents of both countries on the same income. Accordingly, we find that NRIs in UAE enjoy tax benefits on investments in Mutual Funds. Here is an article, which debates as to whether this is profitable to […]

Compare your bank FD rates

Bank fixed deposits (FDs) continue to be popular investment products not just among senior citizens, who are looking for guaranteed income, but also among investors who can’t stomach risk. But overexposure to FDs is not good, and you need to assess your asset allocation and goals to decide how much money you should park in […]

Paytm Payments Bank Ltd Under Money Laundering Scanner – Why?

On 31st January, 2024, the governing body of banking industry, the Reserve Bank of India (RBI) issued a ban on Paytm Payments Bank Ltd. (PPBL). The ban is applicable on all kinds of Paytm transactions such as wallets, FASTags, top-ups, prepaid instruments deposits in customer accounts, National Common Mobility Cards (NCMC) and any operations included […]

The Paytm Payments Bank debacle

Why has the apex banking regulator penalised Paytm Payments Bank Ltd? How is it going to affect the services of the fintech company? What are the concerns regarding money laundering? The story so far: In a major blow to fintech services provider Paytm, the Reserve Bank of India (RBI) barred its payments bank subsidiary, Paytm […]

Banking Access put to risk on deletion

If bank customers request deletion of loan data from the database of a credit information company (CIC), exercising a right under the Digital Personal DataProtection (DPDP) Act, they may no longer be able to continue with the banking system in the future, according to an IT Ministry official. The DPDP Act, 2023, was notified in August last year but […]

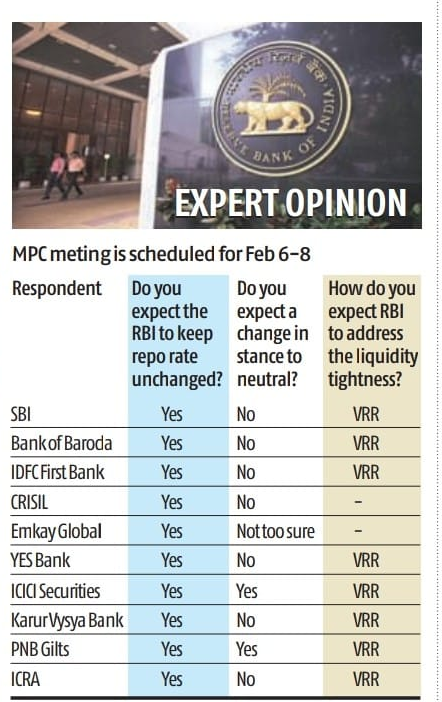

RBI might hold the rate for the sixth time

· The six member Monetary Policy Committee (MPC) of the Reserve Bank of India might maintain the status quo for the sixth consecutive policy review, as per the respondents in a Business Standard poll. · It is expected that RBI would announce its decision after a review of its policy on February 8th 2024. · […]

How secured credit cards help build credit score

Spend only as much as you can afford to repay, do not exhaust the entire credit limit and establish a strong repayment history. It is also important to regularly monitor the usage on your secured credit cards as well as your monthly credit score to see the impact. _________________________________ Radhika Binani A good credit score […]

SBI happy to help Merchants shifting from PayTM Bank

The Chairman of State Bank of India (SBI) has said that the bank is reaching out to merchants to support payment systems in the light of regulatory action on PayTM Payments Bank. The nation’s largest lender will be happy to welcome merchants and is also open to a one-time migration of accounts from the besieged […]

UPI now in France: Indian tourists can buy tickets for Eiffel Tower via UPI

France has allowed the Unified Payments Interface (UPI) to work in the country. NPCI International Payments Limited (NIPL) and Lyra, a French leader in securing e-commerce and proximity payments, have announced the acceptance of the UPI payment mechanism in France. From now on, Indian tourists can book their visit to the Eiffel Tower by purchasing […]

Interim Budget raises possibility of 50 bps repo rate cut this year

The interim Budget 2024 unveiled on Thursday has set the stage for Reserve Bank of India to go in for 50 basis points cut in repo rates this year, say foreign banks and brokerage houses. “With government gross borrowing programme likely to decline by 8.5 per cent YOY into the next year, GSec Yields (10 […]

SBI Mutual Fund Launches SBI NIFTY50 Equal Weight Index Fund, NFO Opens Tomorrow

SBI Mutual Fund has launched the SBI NIFTY50 Equal Weight Index Fund, which offers investors an opportunity for balanced diversification as compared to NIFTY 50 index funds. Minimum investment is Rs 5,000. New fund offer closes on January 29, 2024. _______________ SBI Mutual Fund has launched the SBI NIFTY50 Equal Weight Index Fund. It allocates […]

Rupee-dollar exchange rate could witness higher volatility

The rupee remained stable over the dollar in the past week. It closed at 83.11 on Tuesday compared to 83.16 last week. The Indian currency remained flat despite challenges like foreign outflows and rising crude oil prices. According to NSDL (National Securities Depository Limited), the net FPI (Foreign Portfolio Investors) outflow over the past week […]

Compare your bank FD rates

Bank fixed deposits (FDs) continue to be popular investment products not just among senior citizens, who are looking for guaranteed income, but also among investors who can’t stomach risk. But overexposure to FDs is not good, and you need to assess your asset allocation and goals to decide how much money you should park in […]

Hedge funds look to target ESG lapses for mega returns

These funds are backing litigation against broken environmental pledges, corporate misdeeds. A successful case can leave a litigation funder with returns well in excess of 25% In a corner of finance that rarely generates headlines, investors are busy mapping out paths to huge returns as they contemplate the fallout of new laws in Europe. The […]

Adding nominations to your folios

BACK TO BASICS. With the last date for making nominations to MF investments fast approaching, here’s why it is important. While making new investments, investors are often in a hurry to complete the procedure and, thereby, overlook important as pects such as nomination. Little do they know that this lapse can force their family to […]

Vehicle Loan Securitization

What is Securitization? Securitization is the process of taking an illiquid (a stock or bond or other assets which cannot be sold easily) asset or group of assets and, through financial re-engineering (a process of overhauling) and transforming it (or them) into an investable security. For example, a group of home loans or Vehicle Loans are […]

FinMin leads brainstorming session to tackle financial sector cyber crimes

Vivek Joshi, Secretary, Department of Financial Services | Photo Credit: KAMAL NARANG DFS Secretary Vivek Joshi leads crucial meeting, advocates coordinated action among policy makers, regulators, and banking leaders The country’s top policy makers, bureaucrats, bankers and regulators overseeing financial and telecom sector on Tuesday brainstormed the strategy and measures that would be taken in […]

Large Cap Funds

Equity funds that invest a larger percentage of their total assets in organizations with a high market capitalization are called Large Cap mutual funds. These companies enjoy a great reputation in the market and have a proven track record of providing wealth to investors over an extended period of time. Hence Large Cap funds are […]

RBI wants lenders to classify wilful defaulters within six months of an account turning NPA

Expands scope of regulated entities, broadens definition, refines identification process The Reserve Bank of India has issued a draft paper proposing revisions in the guidelines for handling wilful defaulters, wherein it has expanded the scope for regulated entities that can classify borrowers as wilful defaulters, broadened the definition of wilful default, and refined the identification […]

Fall in yields post HDFC merger makes funding cheaper for mortgage lenders

The merger of Housing Development Finance Corp (HDFC) with HDFC Bank has opened up space for other mortgage lenders to raise funds from the debt market at a cheaper rate as more money is now available for other companies, market participants said. The biggest beneficiary of HDFC’s exit, which used to corner more than half […]

BankEdge Celebrates Its 9th Anniversary

BankEdge, a leading name in the Banking and Finance education sector, celebrated its 9th Anniversary on September 9th. This significant milestone marks nine years of excellence in providing top-notch training and career opportunities to aspiring banking professionals. Since its establishment in 2014, BankEdge has been dedicated to shaping the future of banking by nurturing talent, […]

Indian bankers who created investor wealth

Uday Kotak’s decision to step down as managing director and chief executive officer of Kotak Mahindra Bank marks the end of an era that saw a clutch of lenders blooming into large financial conglomerates. Kotak along with Deepak Parekh, Aditya Puri, and KV Kamath played a pivotal role in development of these financial giants including […]

BANKEDGE Academy and EDUEDGE PRO Join Forces to Launch Post Graduate Program in Investment Banking and Global Markets

BANKEDGE Academy, a leading name in banking and finance education, is thrilled to announce its strategic collaboration with EDUEDGE PRO Private Limited to introduce an innovative Post Graduate Program in Investment Banking and Global Markets. This partnership aims to provide aspiring finance professionals with comprehensive and industry-relevant training to excel in the dynamic world of […]

Bankedge Academy Kanpur felicitates successfully placed candidates in leading Private Banks and Financial Institutions

Bankedge Academy, Kanpur, celebrated its 9th anniversary by felicitating students who excelled in their performance and secured placements with prominent private sector banks. The event witnessed the presence of esteemed Chief Guests, MLA Shri Anil Singh and MLA Shri Surendra Maithani from the Bharatiya Janata Party (BJP). Bankedge Academy, Kanpur, a leading educational institution, marked its anniversary by recognizing the exceptional achievements of its […]

India and New Zealand discuss introducing UPI in the island nation

India and New Zealand are discussing introducing Unified Payments Interface (UPI) in the island nation, which would promote ease of doing business, trade and tourism between both countries, the commerce ministry said in a statement on Tuesday. “Ministers (Indian and New Zealand trade ministers) welcomed early discussions between National Payments Corporation of India (NPCI) and […]

Kanpur Student Award Ceremony – Coverage by IB NEWS

Courtesy: IB NEWS – Dainik Indian Block

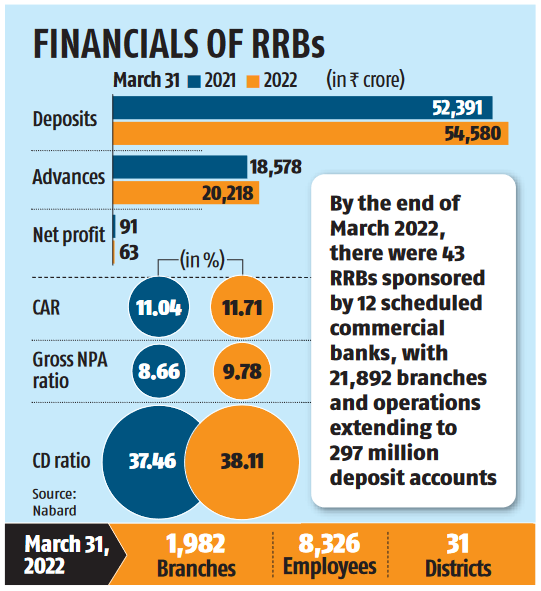

BoB sponsored UP RRB to rationalise over 250 branches

Appoints BCG to guide on revamp In what could be one of the largest branch rationalisation exercises by any regional rural bank (RRB), Baroda UP Bank — sponsored by Bank of Baroda (BoB) — has decided to merge and close down 268 branches in semiurban and rural areas of Uttar Pradesh as part of a […]

Yield on 10 Year Indian Government Bonds

One of the key factors contributing to the decline in the value of the rupee against the US dollar is the tightening yield spread between the 10-year India government bond and the US government bond. The yield on a 10 year Indian Government bonds is now only 295 basis points higher than that of US […]

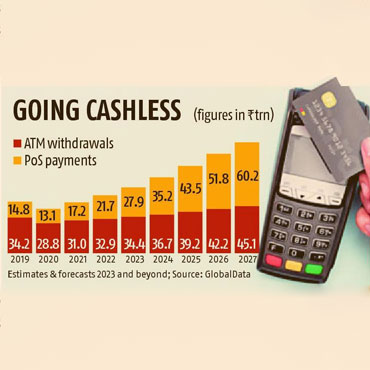

Card payments in India may touch ₹ 28 trn this year: Report

Card payments in India are likely to hit the ₹ 27.9 trillion mark in 2023, up 28.6 per cent yearonyear ( YoY), according to a report by GlobalData, a Londonbased leading data and analytics company. Card payments´ value in India, GlobalData said, grew 26.2 per cent in 2022, driven by economic growth, consumers´ increasing preference […]

Good run for banks, but for how long?

Barring a few, most banks have shown a drop in low-cost CASA. Ditto for their net interest margin. The credit quality is holding up, but some banks have reported fresh slippages. The combined net profits of 32 listed private and public sector banks (PSBs) were up 40.56 per cent in FY23 to close to about […]

What a personal loan costs you

Personal loans are a way to use tomorrow’s income today, and the process involved is simple. But you must note that the interest rates are much higher than, say, for a car loan. This is because personal loans are unsecured loans. This means that the loan is not backed by any asset. The loan amount […]

Post merger, HDFC Bank CEO flags funding risk

HDFC Bank chief Sashidhar Jagdishan on Friday flagged funding as a risk for the lender after the successful USD 40 billion amalgamation with its parent. “As you know, the risks of the merger is the funding part of it,” Jagdishan told shareholders of the largest private sector lender at its maiden annual general meeting after […]

Moody’s Downgrades 10 US Banks

Moody’s cut the credit ratings of a host of small and mid-sized U.S. banks late Monday and placed several big Wall Street names on negative review. The firm lowered the ratings of 10 banks by one rung, while major lenders Bank of New York Mellon, U.S. Bancorp, State Street, Truist Financial, Cullen/Frost Bankers and Northern Trust are now under review for a potential […]

Banks collected over ₹21,000 cr for breaching minimum balance norm

Hefty charges. Over ₹8,000 cr levied for additional ATM transactions; ₹6,000 cr for SMS: FinMin Public sector banks and five major private sector banks together collected charges amounting to over ₹35,000 crore since 2018, on account of non-maintenance of minimum balance, additional ATM transactions and SMS service charges, Finance Ministry informed the Rajya Sabha. Data […]

Fino Payments Bank to apply for small finance bank license

Mumbai: Fino Payments Bank Ltd. on Friday said that its board has approved a proposal to transition into a small finance bank. With this, Fino has become the first such entity to move towards becoming a small finance bank (SFB) since the Reserve Bank of India in 2019 allowed payments banks to apply for conversion […]

Maximize Your Savings with AU Small Finance Bank’s ‘Asli 7%’ Savings Account

The AU Savings Account offers a competitive interest rate up to 7% on the savings balance, providing a reliable and rewarding option for customers Mumbai – A Savings Account is a type of deposit account offered by banks and financial institutions, enabling customers to deposit and withdraw funds conveniently and at their will akin to the […]

What are Treasury Bills?

Treasury bills, also called as T-bills, are short-term financial instrumentsissued by the Government of India aimed to lower market risks. These are now available in three tenors viz 91 days, 182 days, and 364 days. Also, Treasury bills are zero coupon interest-free securities, which are sold at a discount and then redeemed at face value on maturity. […]

What a personal loan costs you?

Personal loans are a way to use tomorrow’s income today, and the process involved is simple. But you must note that the interest rates are much higher than, say, for a car loan. This is because personal loans are unsecured loans. This means that the loan is not backed by any asset. The loan amount […]

BANKEDGE Announces Free NISM Certification Training for Students, Enhancing Job Readiness for Branch Banking Roles

BANKEDGE, a leading provider of skill development programs for the banking and financial services industry, is pleased to announce its latest initiative to empower students seeking careers in branch banking. In an effort to enhance their job readiness and equip them with essential industry knowledge, BANKEDGE will now offer NISM Certification Training free of cost […]

DICGC asks banks to display its logo, QR code on their websites

Deposit Insurance and Credit Guarantee Corporation (DICGC) has asked all banks to prominently display its logo and QR code on their websites and internet banking portals by August 31 with a view to create awareness about the deposit insurance scheme. Deposits up to Rs 5 lakh in banks are insured by the DICGC. The scheme […]

Why do you want to join our bank?

Banking interviews can be touch, we give you some food for thought through this blog series. The titled question is probably the most common and the trickiest questions asked in a bank recruitment interview. The answer may vary from candidate to candidate as different people have different reasons to join the bank. But have you ever considered what […]

Senior Citizen Savings Scheme (SCSS) Interest Rate, Deposit Limit changed in 2023: Know impact

They say, money makes money. Yes, money is powerful and if you make good pact with money, your money can grow. It will take some smart work to grow your money, invest in assets, save and invests, plan and budget your spending. Handling money is truly an art which you need to master. Many of […]

Wilful defaulters’ impact on IBC

They stripped or ran down assets to a degree where the liquidation value was a fraction of the claims of banks By CP ChandrasekharJayati Ghosh Around a month ago, the Reserve Bank of India, in a controversial circular, reversed its long-standing policy of not allowing banks to arrive at compromise settlements with wilful defaulters or […]

Are you aware about the new rules revised rules for bank lockers?

Banks small or big, offers variety of services to its customers. Bank locker is one of the traditional service offering by the bank. Many a times, customers prefer to keep important documents, jewellery and other valuable portable assets safely in banks. Banks allocate the locker facility to customers who have a strong financial backing and […]

क्या है बैंक लॉकर की नई शर्त? क्यों ग्राहक हो रहे परेशान, जान लें क्या कहता है RBI का नया नियम

Bank locker rules: बैंक लॉकर के नए नियमों को लेकर इस समय काफी चर्चा हो रही है. कई ग्राहक तो ऐसे हैं जिन्हें इन नए नियमों के बारे में कोई जानकारी ही नहीं है. बता दें कि नए नियम ग्राहक के फायदे के ही हैं इसलिए बिना देर किए बैंक जाएं. What is new bank […]

ATM FRAUDS

Shoulder Surfing: Shoulder surfing is a social engineering technique through which personal or private information is obtained through direct observation. It is conducted by observing what someone is doing by looking over their shoulders. There are two types of shoulder surfing. The first type of attack is where direct observation is used to obtain access to […]

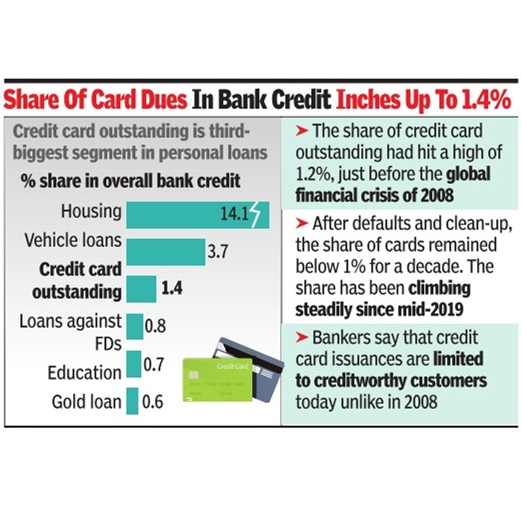

Less than 5% Indians have credit card

As a share of overall bank credit, card balances stand at 1. 4%. Among personal loans, they are the thirdlargest segment after housing (14. 1%) and auto loans (3. 7%). The share of credit card dues had hit a high of 1. 2%, just before the global financial crisis of 2008. After defaults in small-ticket […]

Interview strategies Series – Team Bankedge

What to do Before Interviews? Before you go for an interview you need to prepare yourself well. This is because in the process of an interview every aspect of yours will be analysed very critically. Whatever you have to say about yourself will be probed. Your answers will make room for many other questions. So […]

From Front desk to Manager, Salaries Have Gone Up in BFSI Sector: Santosh Joshi, BankEdge

Home » Special Feature » From Front desk to Manager, Salaries Have Gone Up in BFSI Sector: Santosh Joshi, BankEdge Special Feature June 21, 2023 | 1:39 pm From Front desk to Manager, Salaries Have Gone Up in BFSI Sector: Santosh Joshi, BankEdge All Things Talent Team Santosh Joshi, CEO, BankEdge Emerging technologies, a […]

Private banks’ slippages, write-offs from COVID

A report of India Ratings and Research (Ind-Ra) reveals, that Private sector banks have seen slippages and loan write-offs at 44 per cent, as against 23 per cent in case of public sector banks. In the past ten years period, Banks are seeing the best-ever asset quality according to this report. It adds to say […]

Banks cannot use muscle power to recover loan amount, says Madras High Court

Chief Justice S.V. Gangapurwala and Justice P.D. Audikesavalu record the submission of Reserve Bank of India that it had already issued elaborate guidelines to all banks with respect to the issue of engaging recovery agents June 16, 2023 11:34 pm | Updated 11:34 pm IST – CHENNAI Mohamed Imranullah S. _____________________________ If banks have to […]

BankEdge Academy provides skill-based job ready training programs in Banking and Finance

BankEdge Academy provides skill-based job ready training programs in Banking and Finance Editorial Staff How do you equip students with the necessary skills and knowledge to thrive in the dynamic world of Banking and Finance? Upon completing their graduation, students often face the pressure to secure employment and start earning, particularly in the middle-class and […]

BankEdge introduces Finstream program for undergraduate students to join the BFSI sector

Media Brief Read More

BankEdge introduces Finstream program for undergraduate students to join the BFSI sector

Content Media Solution Read More