1800 266 0777

GREAT OPPORTUNITY TO WORK WITH YES BANK BROUGHT TO YOU BY BANKEDGE

IF YOU ARE A FRESH GRADUATE,AND LOOKING FOR A JOB OPPORTUNITY,THEN DON’T MISS THIS!!

The role holder is responsible for acquiring new account from the Market. The incumbent should be able to leverage opportunities for cross sell of insurance and other bank products. The role holder should ensure compliance to KYC and other banking norms

YES BANK has been recognized as 4th largest Bank amongst the Top and Fastest Growing Banks in various Indian Banking League Tables by prestigious media houses and Global Advisory Firms, and has received several national and international honours for our various Businesses including Corporate Investment Banking, Treasury, Transaction Banking, and Sustainable practices through Responsible Banking. YES BANK is steadily evolving as the Professionals’ Bank of India with the long term mission of ’Finest Quality Large Bank in India’ by 2020.

At YES BANK, executives are offered Fast Track career progression opportunities, Learning & Development initiatives focusing on capability development, Cross functional —time bound Strategic Assignments, Internal redeployments, Job rotations and need based cross business transfers to develop their well rounded managerial and leadership capabilities.

Sales Officer Program – SOP

The role holder is responsible for acquiring new account from the Market. The incumbent should be able to leverage opportunities for cross sell of insurance and other bank products. The role holder should ensure compliance to KYC and other banking norms

Core Responsibilities

Business Acquisition

- This is a target based on the field SALES JOB

- Acquisition of Quality CASA (Current Account & Saving Account)

- Revenue Acquisition- Cross sell

- Maintaining good relationship with the customers

Quality Focus

- Compliant towards KYC and all operational risk parameters

- Comply with Bank’s policies and processes

- Ensure timely escalation of issues impacting business and appropriate solutions to address the concerns

- Ensure safety and security of Bank and customer’s assets

- Ensure timely submission of MIS reports

Self- Management Responsibilities

- Defines performance goals at the start of the year in discussion with the reporting manager and ensures that the goals are monitored and achieved during the course of the year.

- Takes ownership of his/her own learning agenda by identifying development needs in consultation with the reporting manager and working towards bridging the gaps through various means which go beyond just training.

- Understands the competencies relevant to his/her role, and works towards displaying as well as developing these effectively.

- Keeps abreast of relevant professional/industry developments, new techniques and current issues through continued education and professional networks.

Risk and Internal Control Responsibilities

- Follows risk policy and processes to mitigate the operational, regulatory, financial, informational, reputational and audit risks as instructed by the departmental manager.

- Executes the established internal control systems and compiles relevant information for departmental audits, as necessary.

- The fee for this program is ₹ 18,000 (inclusive of all taxes).

- Bankedge will arrange for a student loan for remaining ₹ 18,000 at 0% interest

through its finance partner company. - Student will pay ₹ 18,000 in 9 easy installments of ₹ 2,000 each.

- This facility is available for Bankedge candidates only.

- ABOUT YES BANK

-

YES BANK has been recognized as 4th largest Bank amongst the Top and Fastest Growing Banks in various Indian Banking League Tables by prestigious media houses and Global Advisory Firms, and has received several national and international honours for our various Businesses including Corporate Investment Banking, Treasury, Transaction Banking, and Sustainable practices through Responsible Banking. YES BANK is steadily evolving as the Professionals’ Bank of India with the long term mission of ’Finest Quality Large Bank in India’ by 2020.

At YES BANK, executives are offered Fast Track career progression opportunities, Learning & Development initiatives focusing on capability development, Cross functional —time bound Strategic Assignments, Internal redeployments, Job rotations and need based cross business transfers to develop their well rounded managerial and leadership capabilities.

- ABOUT THE JOB

-

Sales Officer Program – SOP

The role holder is responsible for acquiring new account from the Market. The incumbent should be able to leverage opportunities for cross sell of insurance and other bank products. The role holder should ensure compliance to KYC and other banking norms

Core Responsibilities

Business Acquisition

- This is a target based on the field SALES JOB

- Acquisition of Quality CASA (Current Account & Saving Account)

- Revenue Acquisition- Cross sell

- Maintaining good relationship with the customers

Quality Focus

- Compliant towards KYC and all operational risk parameters

- Comply with Bank’s policies and processes

- Ensure timely escalation of issues impacting business and appropriate solutions to address the concerns

- Ensure safety and security of Bank and customer’s assets

- Ensure timely submission of MIS reports

Self- Management Responsibilities

- Defines performance goals at the start of the year in discussion with the reporting manager and ensures that the goals are monitored and achieved during the course of the year.

- Takes ownership of his/her own learning agenda by identifying development needs in consultation with the reporting manager and working towards bridging the gaps through various means which go beyond just training.

- Understands the competencies relevant to his/her role, and works towards displaying as well as developing these effectively.

- Keeps abreast of relevant professional/industry developments, new techniques and current issues through continued education and professional networks.

Risk and Internal Control Responsibilities

- Follows risk policy and processes to mitigate the operational, regulatory, financial, informational, reputational and audit risks as instructed by the departmental manager.

- Executes the established internal control systems and compiles relevant information for departmental audits, as necessary.

- PROGRAM FEES

-

- The fee for this program is ₹ 18,000 (inclusive of all taxes).

- Bankedge will arrange for a student loan for remaining ₹ 18,000 at 0% interest

through its finance partner company. - Student will pay ₹ 18,000 in 9 easy installments of ₹ 2,000 each.

- This facility is available for Bankedge candidates only.

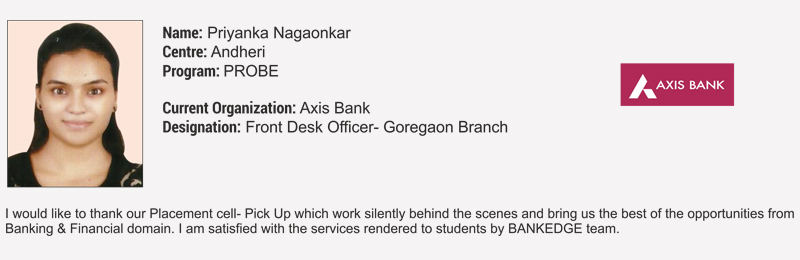

OUR STUDENTS ARE PLACED HERE

Ten Reasons Why You Should Join the Banking Sector in India!

1. Scope for Individual Growth

For talented and dynamic professionals, the competitive environment of the banking sector provides ample scope for individual, vertical growth. It provides employees an ambiance that is conducive to scaling new personal heights and improving job profiles

2. Variety

The banking sector is one of the most diverse sectors to work in. The choice of jobs as well as the variety in types of work that it offers ensures that there is a profile that will definitely suit your interests and aptitude. From Bank Probationary Officer to Financial Analyst, from Account Manager to Specialist IT Officer, there is a wide range of options to choose from.

3. Challenges

The work in the banking sector is multifaceted and you can keep monotony away by challenging yourself at work. This is a highly motivating factor for people who are ambitious and seek to develop their personality. With both physically and mentally stimulating work, you can work at the optimum levels of endeavour.

4. Opportunity for Growth of the Economy

Finance is a major part of the focus of any government’s policies. Banking can be safely called as the backbone of the Indian economy. Working in the banking sector provides an opportunity to each employee to contribute towards the growth of the economy through his work, whether mammoth or miniscule. There is indeed no better way to simultaneously work for yourself and serve the country too!

5. Extensive Traveling

Jobs in the banking sector can involve settling in different parts of the country, and sometimes abroad too. A banking job entails a lot of travelling for various purposes. This includes both domestic and international travel. As such, one is able to work and enjoy leisure at the same time by breaking the monotony of a mundane office.

6. Handsome Salaries

Let’s face it! Money matters! Today’s generation looks at money as a source of happiness. When good money can be made from work that interests and suits you, nothing like it. In this regard, the banking sector proves to be the best bet. A handsome remuneration is what you get for your work in a bank. They also give out bonuses and other incentives over the course of your employment based on your merit and seniority.

7. Creativity

A job in the banking sector is an evolving job. With more and more money being generated every day in newer and newer ways, the roles and responsibilities of banks also change regularly. With the injection of business principles into banking, creativity at work is now valued more than ever. With the advent of mobile and internet banking and with the push for global financial inclusion, there is no ceiling to how creative you are allowed to get.

8. Exposure through Communication

A major part of banking revolves around providing essential services to customers. Communication and interaction with these customers is of utmost importance. This interaction provides the basis for exposure of employees to different types of people with varied needs and lifestyles. This experience greatly enhances one’s skill sets and confidence in the long run.

9. Job Security

A job in a public sector bank is considered a job for life. With opportunities to advance at work and not worry about being fired because of downsizing or a bad economy, it is easy to see why banking is considered so attractive a sector. Add regular perks to the mixture and banking is the sector to strive for.

10. Job satisfaction

Given all the perks and advantages of a lucrative job in the banking sector, attaining satisfaction in this work is inevitable. Since job satisfaction is one of the most important criteria in a selecting a job these days, it is also one of the most convincing reasons why one must opt for work in the banking line.