Personal loans are a way to use tomorrow’s income today, and the process involved is simple. But you must note that the interest rates are much higher than, say, for a car loan. This is because personal loans are unsecured loans. This means that the loan is not backed by any asset. The loan amount and interest rate depend on parameters such as your income, existing credit, repayment capacity, and others. As personal loans come with high interest rates, continuous default will put you on a downward spiral. Here are some of the lowest personal loan interest rates offered by various banks.

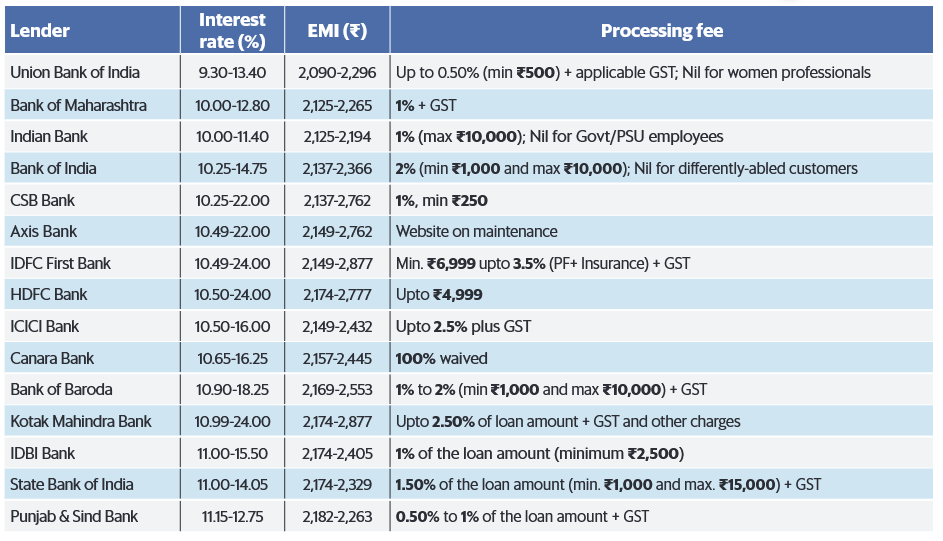

Loan amount: ₹1 lakh; tenure: 5 years

*Nil for employees having salary account with Bank of Baroda

Data as on 10 August 2023, as per banks’ websites. The EMI range is indicative and calculated on the basis of interest rate range. In an actual situation, it may include other fees and charges. The interest rates are for salaried individuals and pensioners for unsecured personal loan. Actual applicable interest rate may vary based on the credit profile, loan amount, tenure, company you work for and as per bank’s discretion. Processing fee is calculated on the loan amount.

PARAS JAIN/MINT

MyMoneyMantra.com & bank websites

No Comments