Appoints BCG to guide on revamp

In what could be one of the largest branch rationalisation exercises by any regional rural bank (RRB), Baroda UP Bank — sponsored by Bank of Baroda (BoB) — has decided to merge and close down 268 branches in semiurban and rural areas of Uttar Pradesh as part of a revamp of the organisational structure and processes of the bank.

The Gorakhpur headquartered lender has appointed Boston Consulting Group (BCG) to guide on the organisational revamp.

The bank has 1,982 branches.

According to a communique sent to the regional managers of the bank´s 29 regions, excluding Ayodhya, Baroda UP Bank has sought details of these branches that would be rationalised.

The communique, reviewed by Business Standard, says BCG, as part of the organisational revamp, has identified branch rationalisation as a key initiative and identified 268 branches for the same — which includes merger and closure.

An email sent by Business Standard seeking comment on branch rationalisation and plans of staff rationalisation remained unanswered until the time of going to press.

The RRBs were established in India under the RRB Act 1976 [23(1)]. In 2019, the government decided to merge Baroda UP Gramin Bank, Purvanchal Bank, and Kashi Gomti Samyut Gramin Bank to form Baroda UP Bank, with BoB as sponsor and head office in Gorakhpur, with effect from April 1, 2020.

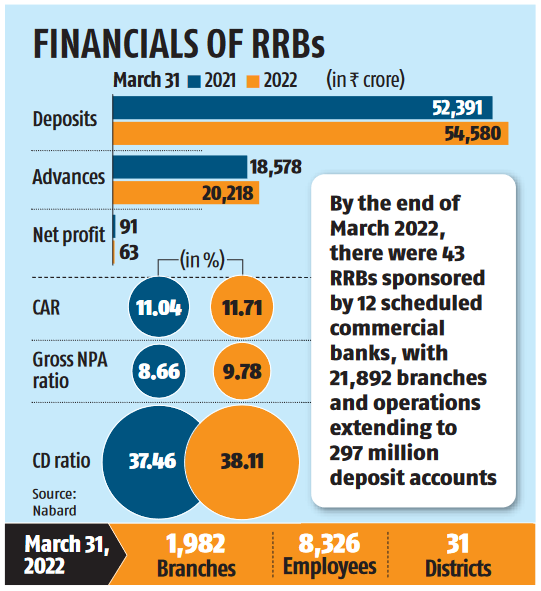

As on March 31, 2022, Baroda UP Bank had deposits of ₹ 52,391 crore and advances of ₹ 20,218 crore.

It posted a net profit of ₹ 62 crore in 202223, down from ₹ 91 crore in the previous year.

The gross nonperforming asset to gross advances ratio was 9.78 per cent by the end of March 2022, against 8.66 per cent in the previous year.

The credit deposit ratio was only 38.11 per cent.

The capital adequacy ratio of the bank was 11.7 per cent in March 2022, against the regulatory requirement of 9 per cent.

By the end of March 2022, there were 43 RRBs sponsored by 12 scheduled commercial banks, with 21,892 branches and operations extending to 297 million deposit accounts and 27 million loan accounts in 26 states and three Union Territories of Puducherry, J K, and Ladakh.

Ninety two per cent of RRB branches were in rural/ semi-urban areas.

The southern region had the highest number of RRBs, followed by the eastern region.

After two consecutive years of reporting losses in 201819 and 201920, RRBs turned the corner in 202021 and posted net profit, which further improved in 202122 (FY22).

Interestingly, at the end of March 2022, RRBs held the highest share of low cost current account savings account deposits, at 54.5 per cent of total deposits, among all categories of SCBs.

Courtesy: Business Standard dt 29th Aug 2023

No Comments