Expect smaller loan approvals in policy’s early years, which may necessitate selling of investments instead

New regulations on the surrender value of insurance policies have come into force from April 1. Surrender value is the amount paid by an insurance company when a customer ends a policy before maturity. Under the new guidelines released by the Insurance Regulatory and Development Authority of India (Irdai), a life insurance policy’s value is likely to be lower if it is surrendered within three years, and higher if it is surrendered between the fourth and the seventh year. Experts are of the view that if you need funds, you should avoid surrendering your policy and instead avail of a loan against it.

In insurance, a long tenure holds the key. Substantial benefits typically accrue only after 20 to 30 years. That is why insurers and experts recommend taking a loan instead of surrendering the policy.

Only some policies are eligible

Loan against insurance is available only against a few types of policies. “If an individual owns a traditional life insurance policy with a savings component, such as an endowment or a money back plan, they can utilise it to obtain a loan for various financial purposes,” says Vignesh Shahane, managing director and chief executive officer (CEO), Ageas Federal Life Insurance. He adds that term plans, which only provide a death benefit and lack cash value, are ineligible. Similarly, unit-linked insurance plans (Ulips) may also not qualify due to their returns being tied to the stock market.

Who offers these loans?

Life insurance companies, banks and non-banking financial companies (NBFCs) offer these loans.Experts say it is better to approach the insurer (from whom you purchased the policy) for this loan. “Banks will give you a

slightly less era mount compared to the insurer. Banks and NBFCs may also charge you as lightly higher rate,” says Ajay Pruthi, founder of plnr.in and a Sebi-registered investment advisor. Banks usually offer loans against life insurance policies in the form of an overdraft facility via the current account. “Policyholders who face frequent cash flow mismatches may consider the overdraft facility,” says Sahil Arora, chief business officer (unsecured loans), Paisabazaar.

Low-cost loan

The interest rates on these loans are lower than on a personal loan. “They are usually in the range of 9-9.5 per cent, compared to personal loans, which charge 12 per cent or more,” says Rajesh Krishnan, chief operations & customer experience officer, Bajaj Allianz Life Insurance.

The amount lent can go up to 90 per cent of the surrender value of the policy. Banks and NBFCs typically provide loans within a span of four to seven days, while insurers take three to fivedays. Some insurers have adopted online processes, reducing the waiting time to just a couple of days. “A loan against a life insurance policy is processed and disbursed fast since no extra checking or scrutiny is involved, when the loan is taken from the insurance company,” says Krishnan.

Naval Goel, CEO, PolicyX, too, adds that availing a loan against a life insurance policy is convenient.

The application process is simple. “Even individuals with low credit scores qualify for this loan since credit checks are not required,” says Krishnan.

The repayment terms of this loan are also flexible. “You can pay only the interest if you like. The principal can be paid at any point in time,” says Pruthi. He adds that it’s preferable to pay the principal as soon as possible so that the interest cost gets reduced.

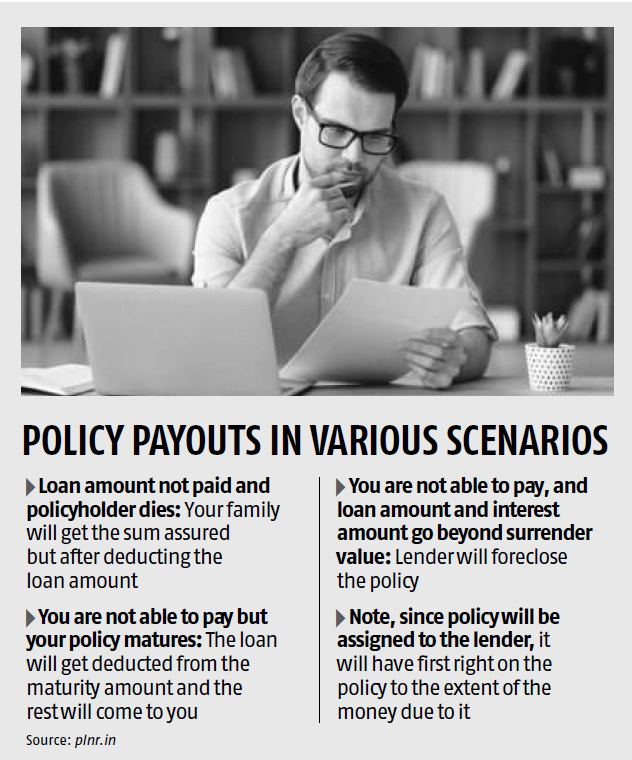

Another benefit of these policies, according to Krishnan, is that defaulting doesn’t negatively impact the credit score. “Lenders and insurers use the surrender value of the insurance policy to recover the unpaid loan amount, interest, and charges,” says Arora.

Small loan amount in initial years.

One downside of these loans is that the loan amount will be small in the initial years of a policy. It may take years for a policy to accumulate significant cash value (or surrender value), thereby limiting the amount that can be borrowed. Returns on traditional plans tend to be in the range of 5-6percent. They will drop further if you take a loan against the policy at the rate of 8-9 per cent.

Liquidate investments

A life insurance policy is for the financial security of dependents. Taking a loan against it hurts that purpose. If you have some investments, take a loan against them. “Policyholders should first explore loans against other assets like gold loans, mutual funds, stocks, bonds and property,” says Arora.

Pruthi is of the view that withdrawing from debt instruments like fixed deposits and debt mutual funds, and even equities, is better than taking this loan.

“If you don’t have assets to liquidate and there is no other choice, then a loan against an insurance policy is better than taking a personal loan,” says Pruthi.

Goel suggests that policyholders should keep paying the premium son time (on the traditional plan against which they have taken the loan) and in addition purchase a term insurance policy to have a financial safety net for the family.

_____________

Courtsey: Business Standard. Dt. 8th April 2024

Image credit: https://dhanlap.com

No Comments