Duration

3 - 4 Months

Certified by UK Charter Body

Course Fee

Rs. 1,25,000/-

(plus GST)

Installments

Rs. 6,945/-

per month

Investment Operations Certificate (IOC) is widely considered as a gold standard in global Investment Banking and Investment Operations and has been approved by 50+ global regulators including UK FCA. IOC Certification would be provided by UK’s Charter body CISI (Chartered Institute for Securities and Investments) and the training is delivered by EduEdgePro.

Many leading Investment Banks and Financial Institutions have mandated the IOC certification globally, as part of their domain requirements. Comprehensive training on IOC certification linked to placements, is exclusively offered by EduEdge Pro in India and globally, through an online 90-hour program comprised of on-demand, self-paced learning.

On successful program completion, participants would be awarded the IOC Certification and the prestigious UK ACSI designation, an important landmark in global Investment Banking Operations, that would considerably enhance your career opportunities by developing industry-relevant domain skills-sets in Investment Banking and Investment Operations.

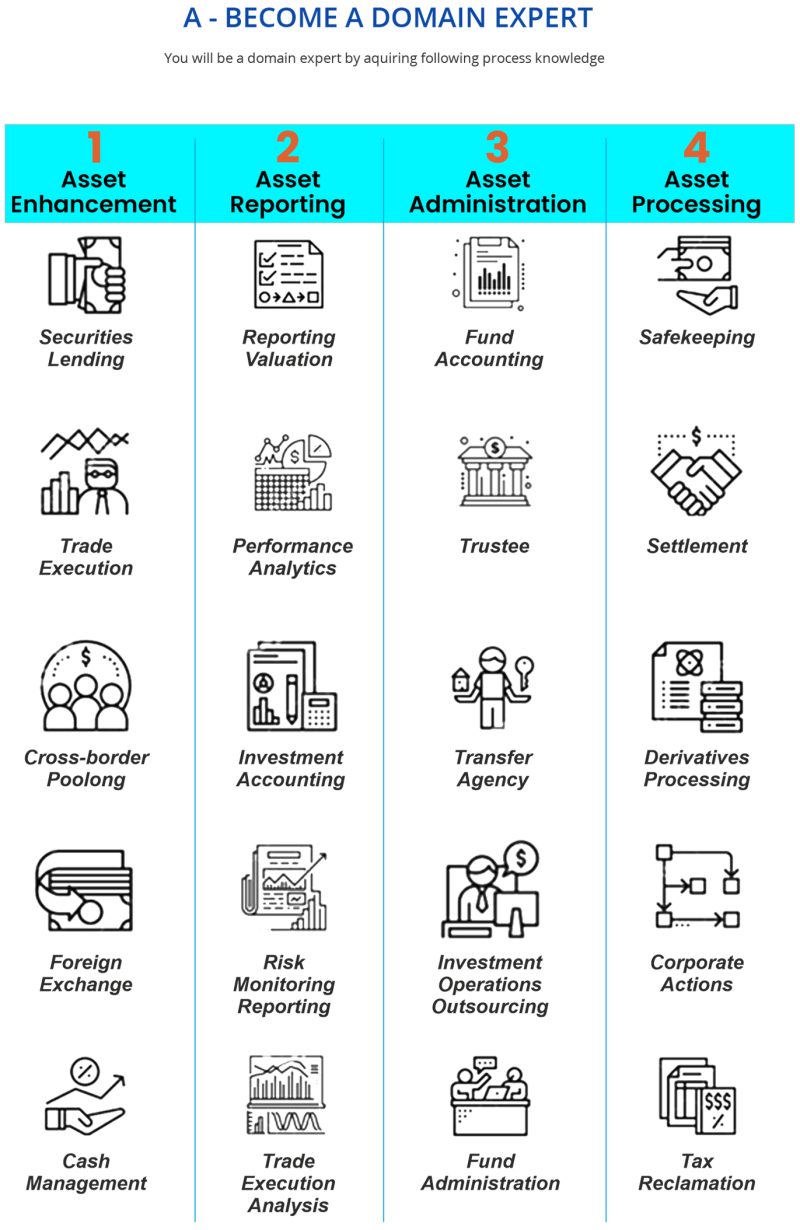

You will get an in-depth understanding of International Introduction To Securities And Investments, Global Securities Operations, Risk In Financial Services and other important domains within Investment Banking.

Besides, we will also teach you Financial Modelling using Excel, cover important concepts in Capital Markets and help prepare you for interviews in Investment Banking.

You will learn directly from industry experts, market practitioners, and seasoned finance professionals about Investment Banking, Investment Operations, Fund Administration, Financial Markets and Risk Management.

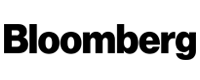

OUR INDUSTRY COLLABORATIONS

B – UK CERTIFICATION

Why is IOC important

IOC is recognized by UK regulator FCA, along with multiple regulators across the world. It has become the gold standard in international Investment Operations. IOC gives you a prestigious UK certificate, your entry door into global institutions and the pathway leads to the ACSI designation.

International qualification

The IOC is taken in over 50 countries, reflecting the global importance of operations and recognized by global regulators in important international financial jurisdictions

Recognized by the UK FCA

IOC features on the Financial Conduct Authority’s Appropriate Qualification Tables as a suitable exam for those in a number of overseeing roles

Career development

Completing the IOC demonstrates professionalism, commitment to working in the industry and offers access to higher-level qualifications

Endorsed by the Financial Skills Partnership

The IOC is listed on the FSP’s Qualifications List

Free CISI Student membership

Become associated with a chartered professional body and take advantage of an extensive range of benefits

ACSI designatory letters

C – LINKED TO PLACEMENTS IN INVESTMENT BANKING OPERATIONS

CORPORATE RECOGNITION

Leading Investment banks, Investment houses and Technology firms recognize IOC

Within the profession, it is widely acknowledged as the most appropriate higher-level qualification for professionals wanting to pursue a career in investment operations.

Many corporates including leading investment banks, investment houses and technology firms officially recognize IOC and mandate it as part of higher learning objectives

PCPIBO – PROGRAM TRACK

- Investment Banking & Divisions

- Equities Markets & Indices

- Fixed Income Securities & Markets

- Money Markets & Instruments

- Foreign Exchange Markets & Instruments

- Derivatives Markets & Products – 1

- Derivatives Markets & Products – 2

- Hedging Using Swaps Markets & Instruments

- Corporate Actions

- Trade Lifecycle

- Advanced Aspects of IB Operations

- Introduction to ISDA

- Know Your Customer (KYC)

- Anti-money Laundering (AML)

- Risk Management

- Important Regulations

- Basic Excel

- Advanced Excel

- Financial Modelling In Excel

- Soft Skills

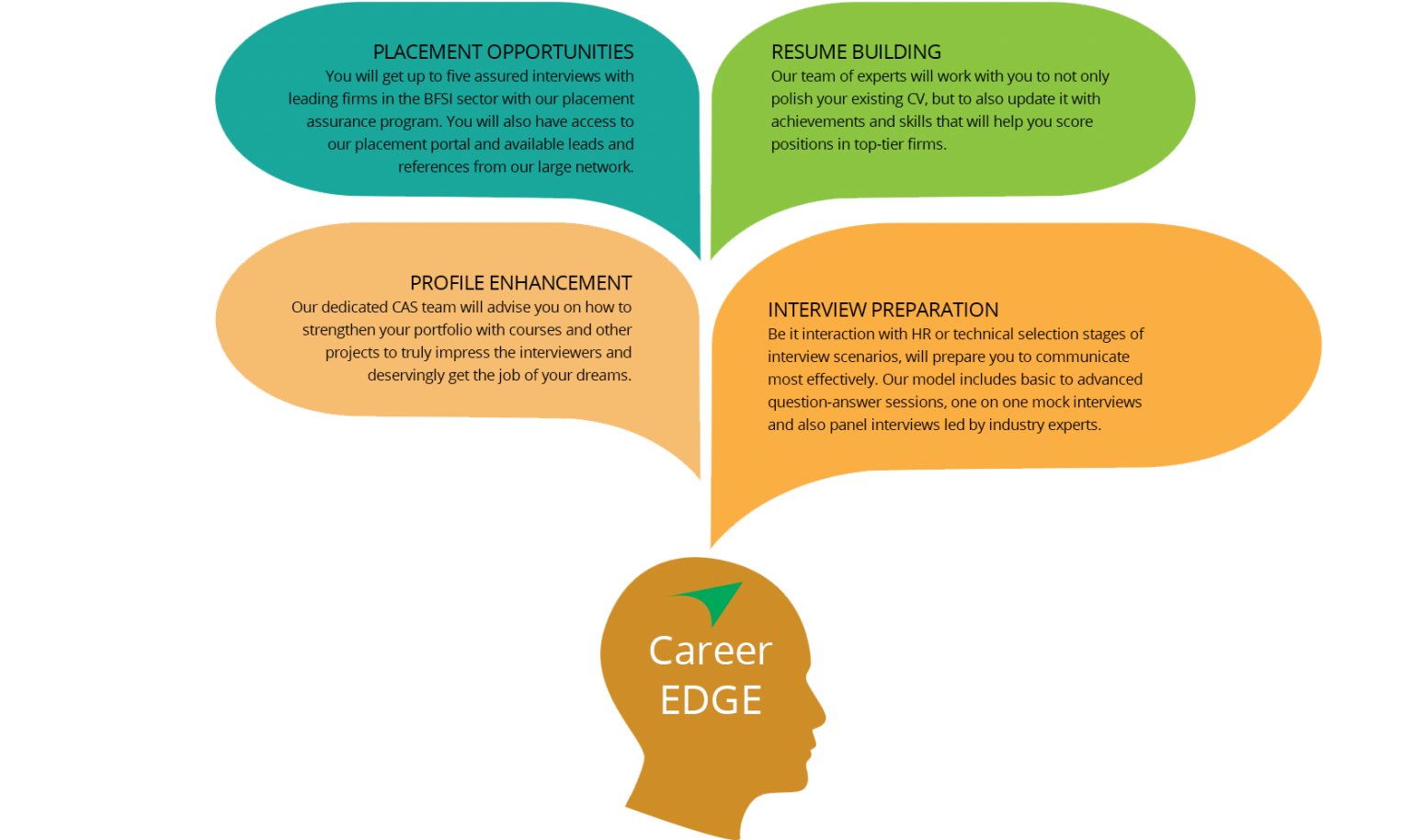

PROFESSIONAL EDGE @ BANKEDGE

INTERNATIONAL MARKETS & SECURITIES

Investment Banking & Divisions

Introduction to Investment Banking | Business verticals of Investment Banks | Investment Banking Division | Global Markets Division | Types of Financial Markets, Different Market Participants & Regulatory Agencies | Buy Side vs Sell side | Asset Management Introduction | Research Introduction

Equities Markets & Indices

Stock Market Basics | Equity Securities | Global Stock Indices & Exchanges| Equity vs Preference Shares | Dividends & Corporate Actions | Depository Receipts – ADR & GDR | Primary & Secondary Markets | Issuance/Trading | IPO Process – US & Indian Markets | Global Financial Centres & Trading | Trading Mechanics | Stock-picking: Selecting fundamentally good stocks | Sectoral Analysis | Ranking stocks in a sector

Fixed Income Securities & Markets

Fixed Income Basics | Types of Fixed Income Products | Yield & Yield Curve| Relation Between Interest Rate & Bond Price| Bond Pricing & Valuation | Optionality in Bonds – Callable vs Puttable| Clean price, Dirty Price, Accrued Interest | Measuring Interest Rate Risk | Duration & Convexity in a Bond | Bond spreads & OAS | Bond Portfolio | Credit Ratings | Securitization & products: MBS & ABS

Money Markets & Instruments

Introduction to Money Markets | Difference between Capital & Money Markets | Instruments of Money Market | T-Bills, Certificate of Deposit, Commercial Paper, Repo, Reverse Repo & others| Conventions in Money Markets | Valuation of Money Market Instruments | Advantages & Disadvantages of Money Markets

FOREIGN EXCHANGE MARKETS & INSTRUMENTS

FX Basics & Markets| Types of Quotations | FX Products | Difference Between FX & Futures | Type of FX Trade – Cash, Spot, Tomm, NDF, Forward | Trade Economics of FX Transactions | Exchange Rate determinants | Currency Hedging | FX Arbitrage

DERIVATIVES MARKETS & PRODUCTS – 1

Derivatives – An Introduction | Difference between OTC & ET Derivatives | Forwards Contracts, Futures Contract | Valuation of Forwards & Futures contracts | Margins in Futures & Settlement | Futures & Forwards Payoffs | Definition of Options | Types of Options | Types of Option Payoffs | Options Pricing | Introduction to Swaps | Interest Rate Swap & mechanics| Valuation of IRS | FX Swap & mechanics | Credit Default Swap, Credit Events & mechanics | Default Probability Maths | Valuation of Swap Market Conventions

DERIVATIVES MARKETS & PRODUCTS – 2

Introduction to Swaps | Interest Rate Swap & mechanics| Valuation of IRS | FX Swap & mechanics | Credit Default Swap, Credit Events & mechanics | Default Probability Mathematics | Valuation of CDS | Basket Swap Products | Swap Market Conventions | CDOs | CDO Tranches| CMOs | Issues in Collateralized products & Credit Crisis

HEDGING USING SWAPS MARKETS & INSTRUMENTS

Interest Rate Swap & Hedging/Trading illustrations | FX Swaps & Hedging/Trading illustrations | Equity Swap & Hedging/Trading illustrations | Credit Default Swap & Hedging/Trading illustrations | Settlement Process of Swaps | Duration of Swaps | Hedging Ratios in Swaps | Hedging a Bond Portfolio with Swaps

INVESTMENT BANKING OPERATIONS & PROCESSES

CORPORATE ACTIONS

What is Corporate Actions | Purpose of Corporate Action | Types of Corporate Actions | Dividends & types – cash, SCRIP, DRIP | Bonus Issues | Rights | Stock Splits & Reverse Splits| Mergers, Demergers & Liquidations | Takeover & Exchanges | Convertible Bonds | Important Dates in Corporate Actions | Trade life Cycle in Corporate Action Events

TRADE LIFECYCLE

Structure of Front office, Middle office & Bank office | Overview of Trade Lifecycle | Participants involved in Trade Lifecycle | Trade Initiation & Order Placement | Order Routing and Execution | Trade Confirmation | Post-trade Processing | Clearing and Settlement | Trade Reconciliation | Trade Reporting

ADVANCED ASPECTS OF IB OPERATIONS

Custodial Services | Depositories | STP, FIX Protocol, SWIFT | Payment Systems | FZ Settlement | Failed Settlement | Safekeeping | Nominees | Cash Management | Securities Lending | Transfer Agency | NAV Calculations | Taxation

STOCK BORROWING & LENDING

Securities Lending & Borrowing | Market Participants of SBL | Securities Traded in SBL | Triplicate SBL | Stock Lending Difference from Repo | Reasons for SBL | Difference between SBL/SLB & Repo | Collateral | Types & Participants of Collateral Management | Process in Collateral Management | Key Terms in Collateral Management

RECONCILIATION

Definition | Position within the TLC | Different Types of Reconciliations: Nostro, Depot, Trade, Exchange, Static Data, Intra, & Inter Recon | Life cycle of Typical Reconciliation Process | Risks Addressed by Reconciliation | Integrity of the Reconciliation Framework

REFERENCE DATA MANAGEMENT

Introduction to Reference Data Management | Securities Identification Numbers | Static Data | SWIFT, Markit and others | Instrument Set-up | Investor Set-up | SSI Set-up | Counter Party Identifiers | Other Reference Data Example

INTRODUCTION TO ISDA

ISDA Overview | Role of ISDA | Architecture | Hierarchy | ISDA Master Agreement | Provisions | Schedule | Various ISDA Documents | Derivative Products | ISDA Protocols | Credit Support Annex (CSA) | Confirmations | Best Practices

SPECIALIZED TOPICS

IMPORTANT REGULATIONS

FATCA | GDPR | MIFID | MAR/MAD | UCITS | BASEL 2/2.5/3 | AML

KNOW YOUR CUSTOMER (KYC)

KYC Process | KYC requirements and procedures| Collecting customer information and verifying identities| Customer Due Diligence (CDD) | Different levels of due diligence based on risk assessment | KYC Documentation | Enhanced Due Diligence (EDD) | Extra measures taken for politically exposed persons (PEPs) and high-risk clients | Source of Funds and Source of Wealth (SOF/SOW) | Customer Identification Program (CIP)

ANTI-MONEY LAUNDERING (AML)

Money Laundering Definition and stages | AML Laws and Regulations | Risk-Based Approach (RBA) | Customer Risk Profiling | Transaction Monitoring and Analysis | Customer Due Diligence (CDD) | Politically Exposed Persons (PEPs) | Trade-Based Money Laundering (TBML) | Terrorist Financing | Suspicious Activity Reports (SARs) | Conducting AML audits and reviews

RISK MANAGEMENT

Principles of Risk Management | International Risk Regulation | Risk Identification and Assessment Framework | Metrics used in Risk Management – Value-at-Risk and Expected Shortfall | Operational Risk | Credit Risk | Market Risk | Value-at-Risk Models | Liquidity Risk | Corporate Governance and Risk Oversight | Model Risk |Enterprise Risk Management (ERM)

FUNDS & COLLECTIVE INVESTMENT SCHEMES

Introduction to Collective Investments | Open-Ended Funds | Close-Ended Funds | Tax-Efficient Savings | Mutual Funds | Hedge Funds | Private Equity and Venture Capital Funds | Tax Treatment of Collective Investments | Charges and Pricing of Collective Investments | NAV Calculations | Benchmarking | How Fund Managers pick Stocks

FINAL FRONTIER

BASIC EXCEL

Basic of Excel | Important Excel Formulae | Look-up Functions | Aggregation Functions | Pivot Tables and Charts | Data Validations | Conditional Formatting | Graphs and Illustrations in Excel

ADVANCED EXCEL

Optimization in Excel | Scenario Analysis | Sensitivity Analysis | Advanced Pivots | Power Query Editor and Data Transformation/Cleaning in Excel | Power Pivots | Dashboarding through Excel/PowerBI| Introduction to Macros

FINANCIAL MODELLING IN EXCEL

Projections in Excel | Valuation Models and Templates in Excel | DCF Modelling | FCFF/FCFE Modelling | Relative Valuation and Multiples | Transaction Multiples

SOFT SKILLS

Resume Building | Presentation Skills | Interpersonal Skills | Interview Preparation – Functional & Soft skills | Domain Mock Interviews | HR Mock Interviews

- 1. International Markets & Securities

INTERNATIONAL MARKETS & SECURITIES

Investment Banking & Divisions

Introduction to Investment Banking | Business verticals of Investment Banks | Investment Banking Division | Global Markets Division | Types of Financial Markets, Different Market Participants & Regulatory Agencies | Buy Side vs Sell side | Asset Management Introduction | Research Introduction

Equities Markets & Indices

Stock Market Basics | Equity Securities | Global Stock Indices & Exchanges| Equity vs Preference Shares | Dividends & Corporate Actions | Depository Receipts – ADR & GDR | Primary & Secondary Markets | Issuance/Trading | IPO Process – US & Indian Markets | Global Financial Centres & Trading | Trading Mechanics | Stock-picking: Selecting fundamentally good stocks | Sectoral Analysis | Ranking stocks in a sector

Fixed Income Securities & Markets

Fixed Income Basics | Types of Fixed Income Products | Yield & Yield Curve| Relation Between Interest Rate & Bond Price| Bond Pricing & Valuation | Optionality in Bonds – Callable vs Puttable| Clean price, Dirty Price, Accrued Interest | Measuring Interest Rate Risk | Duration & Convexity in a Bond | Bond spreads & OAS | Bond Portfolio | Credit Ratings | Securitization & products: MBS & ABS

Money Markets & Instruments

Introduction to Money Markets | Difference between Capital & Money Markets | Instruments of Money Market | T-Bills, Certificate of Deposit, Commercial Paper, Repo, Reverse Repo & others| Conventions in Money Markets | Valuation of Money Market Instruments | Advantages & Disadvantages of Money Markets

FOREIGN EXCHANGE MARKETS & INSTRUMENTS

FX Basics & Markets| Types of Quotations | FX Products | Difference Between FX & Futures | Type of FX Trade – Cash, Spot, Tomm, NDF, Forward | Trade Economics of FX Transactions | Exchange Rate determinants | Currency Hedging | FX Arbitrage

DERIVATIVES MARKETS & PRODUCTS – 1

Derivatives – An Introduction | Difference between OTC & ET Derivatives | Forwards Contracts, Futures Contract | Valuation of Forwards & Futures contracts | Margins in Futures & Settlement | Futures & Forwards Payoffs | Definition of Options | Types of Options | Types of Option Payoffs | Options Pricing | Introduction to Swaps | Interest Rate Swap & mechanics| Valuation of IRS | FX Swap & mechanics | Credit Default Swap, Credit Events & mechanics | Default Probability Maths | Valuation of Swap Market Conventions

DERIVATIVES MARKETS & PRODUCTS – 2

Introduction to Swaps | Interest Rate Swap & mechanics| Valuation of IRS | FX Swap & mechanics | Credit Default Swap, Credit Events & mechanics | Default Probability Mathematics | Valuation of CDS | Basket Swap Products | Swap Market Conventions | CDOs | CDO Tranches| CMOs | Issues in Collateralized products & Credit Crisis

HEDGING USING SWAPS MARKETS & INSTRUMENTS

Interest Rate Swap & Hedging/Trading illustrations | FX Swaps & Hedging/Trading illustrations | Equity Swap & Hedging/Trading illustrations | Credit Default Swap & Hedging/Trading illustrations | Settlement Process of Swaps | Duration of Swaps | Hedging Ratios in Swaps | Hedging a Bond Portfolio with Swaps

- 2. Investment Banking Operations & Processes

INVESTMENT BANKING OPERATIONS & PROCESSES

CORPORATE ACTIONS

What is Corporate Actions | Purpose of Corporate Action | Types of Corporate Actions | Dividends & types – cash, SCRIP, DRIP | Bonus Issues | Rights | Stock Splits & Reverse Splits| Mergers, Demergers & Liquidations | Takeover & Exchanges | Convertible Bonds | Important Dates in Corporate Actions | Trade life Cycle in Corporate Action Events

TRADE LIFECYCLE

Structure of Front office, Middle office & Bank office | Overview of Trade Lifecycle | Participants involved in Trade Lifecycle | Trade Initiation & Order Placement | Order Routing and Execution | Trade Confirmation | Post-trade Processing | Clearing and Settlement | Trade Reconciliation | Trade Reporting

ADVANCED ASPECTS OF IB OPERATIONS

Custodial Services | Depositories | STP, FIX Protocol, SWIFT | Payment Systems | FZ Settlement | Failed Settlement | Safekeeping | Nominees | Cash Management | Securities Lending | Transfer Agency | NAV Calculations | Taxation

STOCK BORROWING & LENDING

Securities Lending & Borrowing | Market Participants of SBL | Securities Traded in SBL | Triplicate SBL | Stock Lending Difference from Repo | Reasons for SBL | Difference between SBL/SLB & Repo | Collateral | Types & Participants of Collateral Management | Process in Collateral Management | Key Terms in Collateral Management

RECONCILIATION

Definition | Position within the TLC | Different Types of Reconciliations: Nostro, Depot, Trade, Exchange, Static Data, Intra, & Inter Recon | Life cycle of Typical Reconciliation Process | Risks Addressed by Reconciliation | Integrity of the Reconciliation Framework

REFERENCE DATA MANAGEMENT

Introduction to Reference Data Management | Securities Identification Numbers | Static Data | SWIFT, Markit and others | Instrument Set-up | Investor Set-up | SSI Set-up | Counter Party Identifiers | Other Reference Data Example

INTRODUCTION TO ISDA

ISDA Overview | Role of ISDA | Architecture | Hierarchy | ISDA Master Agreement | Provisions | Schedule | Various ISDA Documents | Derivative Products | ISDA Protocols | Credit Support Annex (CSA) | Confirmations | Best Practices

- 3. Specialized Topics

SPECIALIZED TOPICS

IMPORTANT REGULATIONS

FATCA | GDPR | MIFID | MAR/MAD | UCITS | BASEL 2/2.5/3 | AML

KNOW YOUR CUSTOMER (KYC)

KYC Process | KYC requirements and procedures| Collecting customer information and verifying identities| Customer Due Diligence (CDD) | Different levels of due diligence based on risk assessment | KYC Documentation | Enhanced Due Diligence (EDD) | Extra measures taken for politically exposed persons (PEPs) and high-risk clients | Source of Funds and Source of Wealth (SOF/SOW) | Customer Identification Program (CIP)

ANTI-MONEY LAUNDERING (AML)

Money Laundering Definition and stages | AML Laws and Regulations | Risk-Based Approach (RBA) | Customer Risk Profiling | Transaction Monitoring and Analysis | Customer Due Diligence (CDD) | Politically Exposed Persons (PEPs) | Trade-Based Money Laundering (TBML) | Terrorist Financing | Suspicious Activity Reports (SARs) | Conducting AML audits and reviews

RISK MANAGEMENT

Principles of Risk Management | International Risk Regulation | Risk Identification and Assessment Framework | Metrics used in Risk Management – Value-at-Risk and Expected Shortfall | Operational Risk | Credit Risk | Market Risk | Value-at-Risk Models | Liquidity Risk | Corporate Governance and Risk Oversight | Model Risk |Enterprise Risk Management (ERM)

FUNDS & COLLECTIVE INVESTMENT SCHEMES

Introduction to Collective Investments | Open-Ended Funds | Close-Ended Funds | Tax-Efficient Savings | Mutual Funds | Hedge Funds | Private Equity and Venture Capital Funds | Tax Treatment of Collective Investments | Charges and Pricing of Collective Investments | NAV Calculations | Benchmarking | How Fund Managers pick Stocks

- 4. Final Frontier

FINAL FRONTIER

BASIC EXCEL

Basic of Excel | Important Excel Formulae | Look-up Functions | Aggregation Functions | Pivot Tables and Charts | Data Validations | Conditional Formatting | Graphs and Illustrations in Excel

ADVANCED EXCEL

Optimization in Excel | Scenario Analysis | Sensitivity Analysis | Advanced Pivots | Power Query Editor and Data Transformation/Cleaning in Excel | Power Pivots | Dashboarding through Excel/PowerBI| Introduction to Macros

FINANCIAL MODELLING IN EXCEL

Projections in Excel | Valuation Models and Templates in Excel | DCF Modelling | FCFF/FCFE Modelling | Relative Valuation and Multiples | Transaction Multiples

SOFT SKILLS

Resume Building | Presentation Skills | Interpersonal Skills | Interview Preparation – Functional & Soft skills | Domain Mock Interviews | HR Mock Interviews

INTRODUCTION TO Eduedge PRO

Executive Education Programs

Offered to: Corporates

What do we offer

Our Executive Education Programs would offer corporates customized training solutions for their functional, technical, business and leadership requirements

Modes of Training

In-person and online delivery

(Instructor-led)

Outcomes

Enhance leadership skills, build foundations in general management, specialize in multi-disciplinary domains and build connections to a distinguished network of peers

Continual Professional Development

Offered to: Individual professionals

What do we offer

Continual Professional Development programs and curriculum across domains such as BFSI, Fintech, Analytics, Data Science and Technology

Modes of Training

EdTech – Online

(Self-paced)

Outcomes

Seek to improve the life journey of those industry professionals wishing to upgrade themselves by helping them renew their purpose, build solid foundations and recalibrate their functional and technical learning curve

Industry Oriented Tracks

Offered to: Universities

What do we offer

Certification programs, Industry tracks and industry-oriented workshops across BBA, BCom, B.Tech., PGDM/MBA, PGP programs

Modes of Training

In-person and online delivery

(Instructor-led)

Outcomes

As a powerhouse in Executive Education, we seek to bridge the gap between academic learning and industry requirements in Universities and educational institutions.

How our Training programs have gained wide

acceptability across Corporates & Universities

70+

FUNCTIONAL TRAININGS

Our Functional training programs build domain expertise across areas such as BFSI, Fintech, Analytics, Data Science and Technology

50+

CORPORATE CLIENTS

Our illustrious clients include big 4 Consulting firms, Investment Banks, Commercial Banks, Mutual Funds, MNC conglomerates, Analytics firms, Technology companies, Exchanges and Regulators

20,000+

CORPORATE PARTICIPANTS

We have trained Consultants, BFSI specialists, Analytics managers, Investment Bankers, Commercial Bankers, Mutual Fund specialists, Technology teams and Data Scientists

25+

TECHNICAL TRAININGS

Our Technical training programs build practical expertise across industry-wise platforms such as Python, PowerBI, SQL, Hadoop, Bloomberg, Excel, etc

20+

UNIVERSITY CLIENTS

Our Technical training programs build practical expertise across industry-wise platforms such as Python, PowerBI, SQL, Hadoop, Bloomberg, Excel, etc

40,000+

UNIVERSITY STUDENTS

We have trained students from Undergraduate and Postgraduate programs such as BBA, BCOM, B.Eng., MBA, PGP and MSc

PROGRAM CHAIR

MR. HARJEET SINGH

CFA, FRM, CAIA, PRM

Stanford University (M.Sc. Financial Mathematics)

Entrepreneur-EdTech, FinTech

Entrepreneur

Financial Mathematician

Hedge Fund / Algorithmic Trading Expert

MS, Financial Mathematics from Stanford University, US Holds International Charters-CFA, FRM, PRM, CAIA Holder of multiple scholarships – Ratan Tata, JN Tata, Prafulla Mukherji University topper – Bachelors of Engineering (Information Technology)

Global Markets experience on Wall Street, London and Amsterdam Worked with leading Investment Banks, Institutions & Consulting Firms Experience with Nomura, Merrill Lynch, Morgan Stanley, UBS, SCB Worked in Investment Management, Treasury, Quantitative Finance, Hedge Funds Founded and established own Asset Management company and hedge funds

Consulted Ministry of Finance, GOI on Financial Markets policies and frameworks Consulted 10+ banks on areas in Investment Management & Risk Management Consulted NSE, MCX and SEBI in Algorithmic Trading & Financial Markets Trained 50+ corporates including MNCs, Investment Banks, Consulting firms, KPOs Conducted training for 100+ Financial Institutions in Financial Markets

Founder-Director, EduEdge Pro, an EdTech Initiative Introduced Industry-oriented tracks in India, an integrated curriculum into Universities Founder & Board Member, Stelios Asset Management Pvt. Ltd., a FinTech Initiative Runs India’s first fully automated, algorithmic-driven SEBI-registered AIF CAT III India- focused Hedge Fund

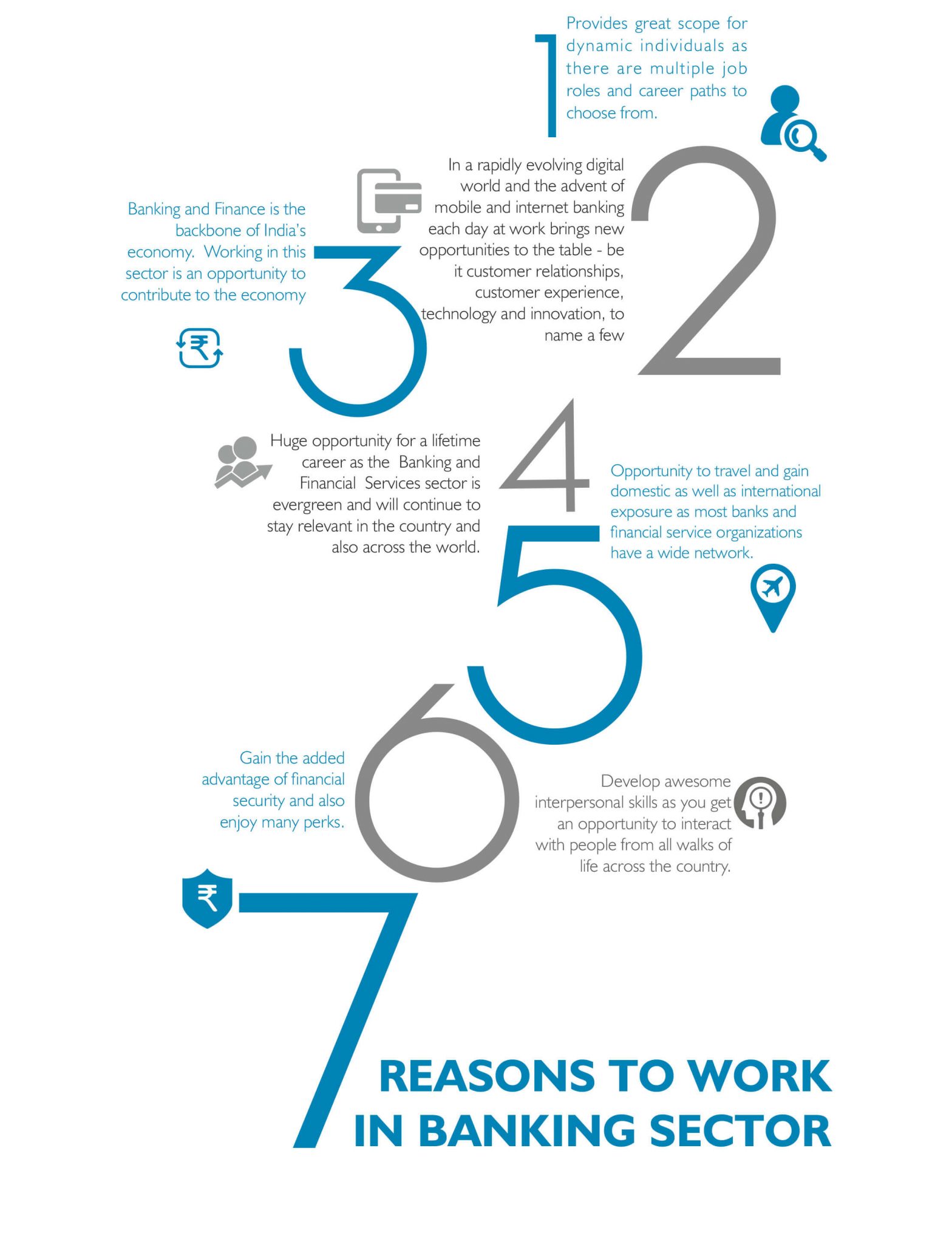

REASONS TO WORK IN BANKING SECTOR

WHAT CAN I BECOME?

Financial Analyst

OPERATIONS Analyst

investment Analyst

RISK ANALYST

EQUITY Analyst

DERIVATIVES ANALYST

TREASURY Analyst

PROCESS SPECIALIST

PRODUCT SPECIALIST

FIXED INCOME ANALYST

FUND OPERATIONS Analyst

HOW DO YOU TRAIN?

Through practical scenarios, realistic simulations and hands-on assignments, you will cohesively comprehend the BFSI sector and develop a supreme ability to contribute value to the workplace from day one.

Case Studies

Real-world case studies and complex business scenarios prepare you to successfully make the transition from academics to the retail banking industry.

In-class Simulations

Rise above traditional rote learning through the use of simulations that recreate challenges faced by the BFSI sector. Through vivid trading simulations, understand how multi-million dollar transactions flow through banks and affect various processes.

Assessments and Teach-backs

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

Industry Interactions

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

WHAT SUPPORT CAN I EXPECT?

Learn and we’ll place you! Make a successful transition in your career with partnerships of top tier hiring firms in the BFSI sector.

I WANT TO JOIN! HOW CAN I?

The Post Graduate Diploma In Investment Banking & Global Markets program stands tall in the category of finance courses because of its depth,

expertise and accurate relevance to the banking industry.

It is a valuable walk from knowledge to prosperity.

Fee Structure

LUMPSUM – INR 1,25,000/-

INSTALLMENT – INR 6,945/-

WAIT! I HAVE SOME QUESTIONS

What is the format of this program?

PCP – IBO program with a rigorous focus on Investment Banking Operations is widely considered as a gold standard in global Investment Banking and Investment Operations.

The PGP program is structured in an evolutionary pathway that covers the below:

- International Markets & Securities

- Investment Banking Operations & Processes

- Specialized Topics

- Final Frontier

What is the duration of the Program?

The Program is a 3-4 month weekend program.

It would be offered on the weekends to enable optimal learning for those participants who are already working in the industry.

What study material will be provided to us for the program?

You would be provided with extensive study material throughout the PGP program:

- Detailed notes

- Recommended Textbooks

- Case studies

- Excel frameworks

- Modelling templates

- Trainer slides

- Interview preparation workshops and study notes

What is the eligibility criteria for admission?

EDUCATION

Any Undergraduate Degree holder like BCA, BBA, B.Tech, B.Engg., B.COM. etc. Student pursuing final year can also apply

WORK EXPERIENCE

Work experience is not mandatory.

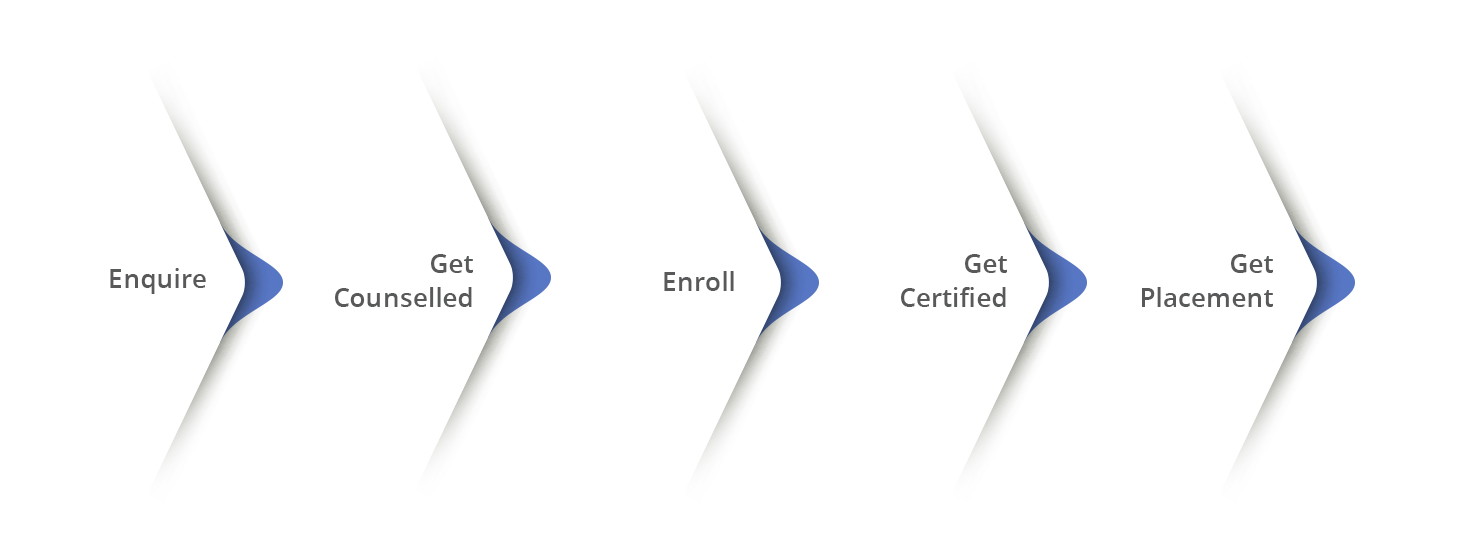

What is the application process for admission?

The Application process consists of a few simple steps as shown below. An offer of admission would be made to the selected candidates and accepted by the candidates by paying the admission fee.

- Program Counselling

We have a dedicated admission counsellor who are here to help guide you in applying to the program. They are available to:

Address questions related to application.

Assist with Financial Aid (if Required) Guide career role and opportunities after certified.

Help you to understand the program detail and pedagogy.

- Application

Complete your application to kick start the admission process.

Rate your various skills of OOPs language, quantitative and logical ability.

Submit application fee: ₹ 500/-

Submit the form successfully and scheduled your interview with us.

- Interview

Interview is with admission committee, who will review the candidate profile.

Selection will be determined on the basis of academic records, work experience, test scores and interview.

Upon qualifying a confirmation letter for admission to the PG Certification will handover to the candidate.

- Documentation

After interview on the basis of confirmation letter, the required papers mentioned in the mandatory list of documents as per eligibility criteria. You would be required to submit your marksheets, education certificates, work experience proofs amongst other necessary documents.

- Payment Processing

Block your seat with the initial amount of fees and begin with your prep course and start your Data Science journey. Full or annual program fee to be deposited within 1 week of offer letter / program start –whichever is earlier.

- Confirmation

Your admission will be confirmed basis the selection procedure, document authentication

and fee payment. A welcome letter, ID card, student number and portal access will be shared upon successful completion of the admission process.

What is PCP-IBO?

PCP – IBO program with a rigorous focus on Investment Banking Operations is widely considered as a gold standard in global Investment Banking and Investment Operations. It includes the prestigious Investment Banking Operations Certificate (IOC) from UK Charter body, Chartered Institute of Investments and Securities (CISI). IOC international certification has been approved by 50+ global regulators including UK FCA. IOC Certification would be provided by UK’s Charter body CISI (Chartered Institute for Securities and Investments) and the training is delivered by EduEdgePro.

Many leading Investment Banks and Financial Institutions have mandated the IOC certification globally, as part of their domain requirements. Comprehensive training on IOC certification linked to placements, is exclusively offered by EduEdge Pro in India and globally, through the comprehensive PCP – IBO program, comprising of online, live synchronous, on-demand and self-paced learning modules.

Why should I choose your program?

PCP – IBO also includes modules on advanced domain knowledge in Investment Banking Operations, essential to being successful in the industry. Besides, we also cover comprehensive Excel and Financial Modelling training besides soft skills training, interview grooming and 100% placement assistance.

CAREER OUTCOMES

- Learn domain knowledge related to Investment Banking, Risk Management and Investment Operations

- Multi-asset class coverage

- Online delivery. Start instantly and learn at your own schedule.

- Take UK certification exams online.

- Placement Assistance

- Access to 200+ e-Learning modules in Analytics, FinTech, Global Regulations and Capital Markets from UK CISI

Earn the prestigious ACSI designation that you can use after your name

What are the fees for the program?

Indian participants: INR 1,25,000 plus GST

FINANCING OPTIONS: 0% Interest EMI option available with partner banks Easy procedure with partner banks EMI as low as INR 6,945 per month

What roles can be expected after this specialized PGP?

Investment Banker, Financial Analyst, Research Analyst, Treasury Manager, Research Analyst, Sales and Traders, Bond Analyst, Portfolio Manager, Risk Analyst, Investment Banker, Financial Analyst, Research Analyst, Treasury Manager, Research Analyst, Sales and Traders