Duration

9 Months

Certified by

Bankedge

Course Fee

Rs. 1,25,000/-

(all inclusive)

Installments

12 EMIs

@ 0% Interest

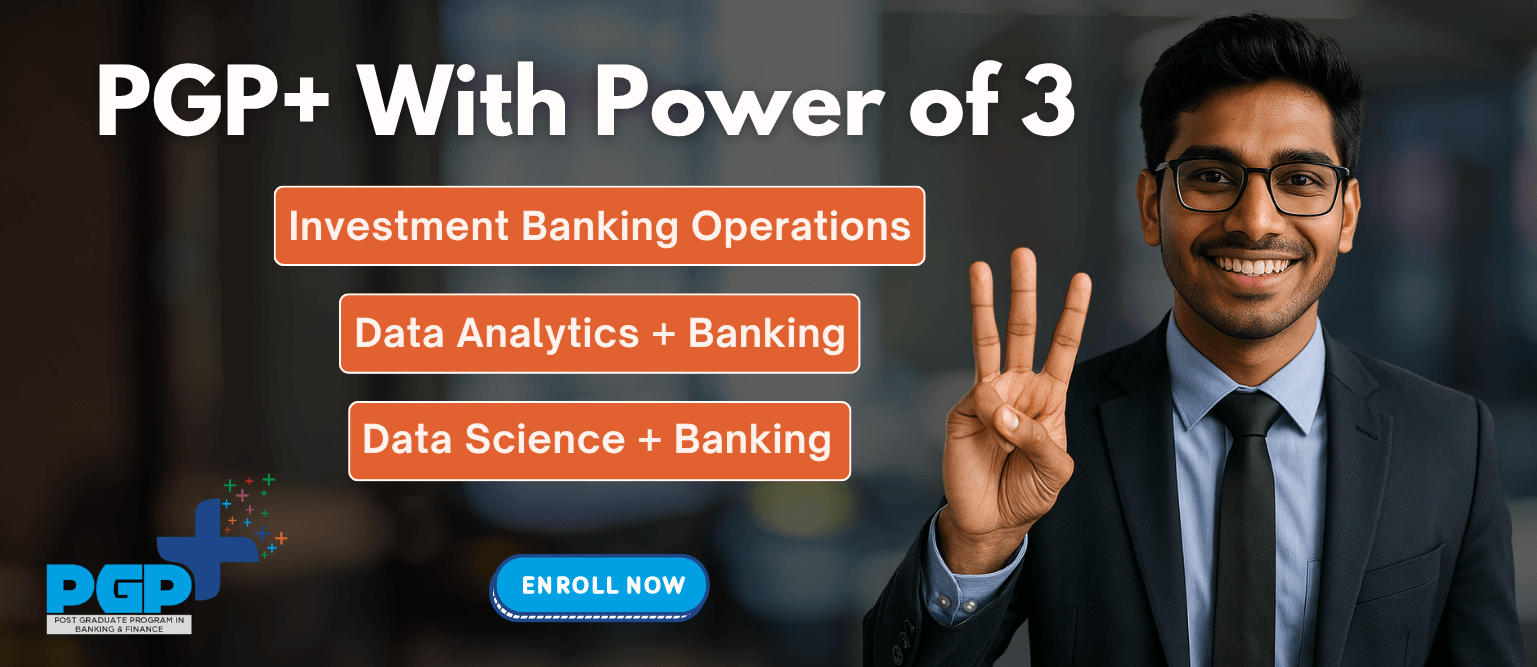

Elevate your career with BANKEDGE’s PGP+, an intensive eight-month journey crafted for both fresh graduates and seasoned professionals. Choose one of three specialized certification tracks—

- Investment Banking Operations

- Banking with Data Science

- Banking with Data Analytics

Gain hands-on expertise in Commercial Banking Operations, Investment Banking workflows, Financial Analysis, and Banking Technology solutions. PGP+ is tailored to nurture the skills employers demand, empowering you to excel in frontline and back-office roles at India’s top private and foreign banks.

Why PGP+?

Flexible Learning: Seamlessly blend virtual classrooms, on-demand online libraries, and live instructor-led sessions to fit your work-life balance.

Industry-Ready Curriculum: Dive into real-world case studies and projects that mirror the day-to-day challenges of banking and finance professionals.

Expert Faculty & Support: Learn from seasoned bankers and data specialists, backed by 24×7 high-tech support.

Career Advancement: Build the competencies that hiring managers seek—whether you’re entering the sector or aiming for your next promotion.

Transform your ambition into achievement. With BANKEDGE PGP+, you’ll emerge job-ready, confident, and equipped to thrive in today’s rapidly evolving banking landscape.

OUR STUDENTS ARE PLACED HERE

APPLICATION PROCESS

Candidate to appear for Pre-Selection aptitude Test and Interview

Candidate to submit all required documents upon selection

Subject to satisfactory verification BANKEDGE will issue conditional Offer Letter / welcome letter

ELIGIBILITY

Graduates Aged between 21 to 24 for

Minimum 50% Marks aggregate

Good English Communication Skills

CURRICULUM

Indian Financial System

Money and Interest

RBI and its functions

Accounting Guidelines

Bank Reconciliation

Liabilities products (An overview)

Various types of accounts (Individual, Proprietorship etc.)

Banking Business

KYC guidelines

Banking Laws

Technology in Banking

SB/CA/TD deposits

Third Party products viz MF and Insurance

Cash and Clearing Transactions in Detail

Corporate Banking

Fraud Management

Remittances and Cash Management Service

Details of Credits in Banks

Cardinal Principles

Priority and Non-Priority Sector Advances

Fund Based and Non-Fund based advances

Working capital operating cycle

Projected Net working capital

Term Loan Processes and Disbursement

NPA Management including BASEL Norms and RBI guidelines

Introduction to Foreign Trade

Exchange rate mechanism and SWIFT messages

Forex Offices and Forex Dealings

Imports- RBI and FEMA guidelines, Merchanting Trade, Regulatory Returns

Exports – FEMA guidelines and ICC rules, EEFC, ECGC Guarantee, Regulatory reporting

Forex guarantees, Invocation and Payment

Foreign Inward Remittances, FEMA regulations, Issue of FIRC

Foreign Outward Remittances, FEMA guidelines, Procedure of issuing DD/TT, ESOP, LRS

R-Returns- Guidelines, Technical issues and Documentation

Domestic Trade covering NI Act, Inward and Outward Collections, Supply Bills, Inland LC, Performance Guarantee, Financial Guarantee and others

Investment and Risk Management – Equity and Debt and Alternate Assets

Risk Proofing and Asset Allocation

Risk Management through Insurance

Introduction to Investment Banking

Cash Equities and Fixed Income

Foreign Exchange and Money Markets

Derivatives Markets

Job Readiness

Specialisation in Data Science

- Applications of Data Science in BFSI: Fraud Detection & Segmentation

- Data Handling: Cleaning & Processing using Python, SQL, and Excel

- Statistical Analysis and Machine Learning Models (Credit Scoring & Risk Assessment)

- Data Visualization using Tableau & Power BI Dashboards

- Predictive Analytics: Customer Churn, Cross-Selling, and Loan Approvals

- Data Privacy and Regulatory Compliance in Financial Institutions

- Hands-on Capstone Projects and Real-Time Dashboard Development

Specialisation in Data Science

- Data science applications in BFSI: fraud detection & segmentation

- Data handling: cleaning & processing with Python, SQL & Excel

- Statistical analysis & ML models (credit scoring & risk)

- Data visualization: Tableau & Power BI dashboards

- Predictive analytics: churn, cross-sell & loan approvals

- Data privacy & regulatory compliance

- Hands-on capstone projects & real-time dashboards

Self-Awareness

Self-Monitoring

Team Building

Communication

Social Graces

Interview

PGP+ – POST GRADUATE PROGRAM IN BANKING AND FINANCE @ BANKEDGE

- Indian Financial System

- Money and Interest

- RBI and its functions

- Accounting Guidelines

- Bank Reconciliation

- Liabilities products ( An overview)

- Various types of accounts (Individual, Proprietorship etc.)

- Banking Business

- KYC guidelines

- Banking Business

- Technology in Banking

- SB/CA/TD deposits

- Third-Party products viz MF and Insurance

- Cash and Clearing Transaction in Details

- Corporate Banking

- Fraud Management

- Remittances and Cash Management Service

- Details of Credits in Banks

- Cardinal Principles

- Priority and Non-Priority Sector Advances

- Fund Based and Non-Fund based advances

- Working capital operating cycle

- Projected Net working capital

- Term Loan Processes and Disbursement

- NPA Management including BASEL Norms and RBI guidelines

- Introduction to Foreign Trade

- Exchange rate mechanism and SWIFT messages

- Forex Offices and Forex Dealings

- Imports- RBI and FEMA guidelines, Merchanting Trade, Regulatory Returns

- Exports – FEMA guidelines and ICC rules, EEFC, ECGC Guarantee, Regulatory reporting

- Forex guarantees, Invocation and Payment

- Foreign Inward Remittances, FEMA regulations, Issue of FIRC

- Foreign Outward Remittances, FEMA guidelines, Procedure of issuing DD/TT, ESOP, LRS

- R-Returns- Guidelines, Technical issues and Documentation

- Domestic Trade covering NI Act, Inward and Outward Collections, Supply Bills, Inland LC, Performance Guarantee, Financial Guarantee and others

- Investment and Risk Management – Equity and Debt and Alternate Assets

- Risk Proofing and Asset Allocation

- Risk Management through Insurance

Unit 1: Introduction to Investment Banking

- Introduction to Financial System

- Types of Financial Markets

- Market Participants and Regulators

- Buy Side and Sell Side of Business

Unit 2 : Cash Equities and Fixed Income

- Equity and Preference Shares

- Depository Receipts

- Primary and Secondary Market

- Stock Exchanges and Financial Centres

- Bonds – Characteristics, Securitization, and Types

- Interest, Bond Price and Yield

- Yield to Maturity

Unit 3 : Foreign Exchange and Money Markets

- Forex and Features of Forex

- Market Participants

- Quotes and Trades

- Forex Future and Options

- Money Market Basics

- Instruments of Money Market

- Difference Between Capital and Money Markets

Unit 4 : Derivatives Markets

- Introduction to Derivatives

- Exchange Traded and Over the Counter Derivatives

- Forwards, Futures and Options

- Payoffs and Pricing

- Swaps and Types – Equity, Interest Rate and Forex

- Hedging and Speculation

- Credit Default Swap and Credit Events

Unit 5 : Job Readiness

- Communication Skills

- Resume Building

- Level 1 – Refresher Session

- Domain Teachback – Session 1

- Level 1 – Domain Mocks

Data Analytics Track

- Applications of Data Science in BFSI: Fraud Detection & Segmentation

- Data Handling: Cleaning & Processing using Python, SQL, and Excel

- Statistical Analysis and Machine Learning Models (Credit Scoring & Risk Assessment)

- Data Visualization using Tableau & Power BI Dashboards

- Predictive Analytics: Customer Churn, Cross-Selling, and Loan Approvals

- Data Privacy and Regulatory Compliance in Financial Institutions

- Hands-on Capstone Projects and Real-Time Dashboard Development

Data Science Track

- Data science applications in BFSI: fraud detection & segmentation

- Data handling: cleaning & processing with Python, SQL & Excel

- Statistical analysis & ML models (credit scoring & risk)

- Data visualization: Tableau & Power BI dashboards

- Predictive analytics: churn, cross-sell & loan approvals

- Data privacy & regulatory compliance

- Hands-on capstone projects & real-time dashboards

- Self-Awareness

- Self-Monitoring

- Team Building

- Communication

- Social Graces

- Interview

- Retail Banking

- Indian Financial System

- Money and Interest

- RBI and its functions

- Accounting Guidelines

- Bank Reconciliation

- Liabilities products ( An overview)

- Various types of accounts (Individual, Proprietorship etc.)

- Banking Business

- KYC guidelines

- Banking Business

- Technology in Banking

- SB/CA/TD deposits

- Third-Party products viz MF and Insurance

- Cash and Clearing Transaction in Details

- Corporate Banking

- Fraud Management

- Remittances and Cash Management Service

- Credit Management

- Details of Credits in Banks

- Cardinal Principles

- Priority and Non-Priority Sector Advances

- Fund Based and Non-Fund based advances

- Working capital operating cycle

- Projected Net working capital

- Term Loan Processes and Disbursement

- NPA Management including BASEL Norms and RBI guidelines

- Trade Finance

- Introduction to Foreign Trade

- Exchange rate mechanism and SWIFT messages

- Forex Offices and Forex Dealings

- Imports- RBI and FEMA guidelines, Merchanting Trade, Regulatory Returns

- Exports – FEMA guidelines and ICC rules, EEFC, ECGC Guarantee, Regulatory reporting

- Forex guarantees, Invocation and Payment

- Foreign Inward Remittances, FEMA regulations, Issue of FIRC

- Foreign Outward Remittances, FEMA guidelines, Procedure of issuing DD/TT, ESOP, LRS

- R-Returns- Guidelines, Technical issues and Documentation

- Domestic Trade covering NI Act, Inward and Outward Collections, Supply Bills, Inland LC, Performance Guarantee, Financial Guarantee and others

- Financial Risk Management

- Investment and Risk Management – Equity and Debt and Alternate Assets

- Risk Proofing and Asset Allocation

- Risk Management through Insurance

- Investment Banking Operations

Unit 1: Introduction to Investment Banking

- Introduction to Financial System

- Types of Financial Markets

- Market Participants and Regulators

- Buy Side and Sell Side of Business

Unit 2 : Cash Equities and Fixed Income

- Equity and Preference Shares

- Depository Receipts

- Primary and Secondary Market

- Stock Exchanges and Financial Centres

- Bonds – Characteristics, Securitization, and Types

- Interest, Bond Price and Yield

- Yield to Maturity

Unit 3 : Foreign Exchange and Money Markets

- Forex and Features of Forex

- Market Participants

- Quotes and Trades

- Forex Future and Options

- Money Market Basics

- Instruments of Money Market

- Difference Between Capital and Money Markets

Unit 4 : Derivatives Markets

- Introduction to Derivatives

- Exchange Traded and Over the Counter Derivatives

- Forwards, Futures and Options

- Payoffs and Pricing

- Swaps and Types – Equity, Interest Rate and Forex

- Hedging and Speculation

- Credit Default Swap and Credit Events

Unit 5 : Job Readiness

- Communication Skills

- Resume Building

- Level 1 – Refresher Session

- Domain Teachback – Session 1

- Level 1 – Domain Mocks

- Data Analytics Track

Data Analytics Track

- Applications of Data Science in BFSI: Fraud Detection & Segmentation

- Data Handling: Cleaning & Processing using Python, SQL, and Excel

- Statistical Analysis and Machine Learning Models (Credit Scoring & Risk Assessment)

- Data Visualization using Tableau & Power BI Dashboards

- Predictive Analytics: Customer Churn, Cross-Selling, and Loan Approvals

- Data Privacy and Regulatory Compliance in Financial Institutions

- Hands-on Capstone Projects and Real-Time Dashboard Development

- Data Science Track

Data Science Track

- Data science applications in BFSI: fraud detection & segmentation

- Data handling: cleaning & processing with Python, SQL & Excel

- Statistical analysis & ML models (credit scoring & risk)

- Data visualization: Tableau & Power BI dashboards

- Predictive analytics: churn, cross-sell & loan approvals

- Data privacy & regulatory compliance

- Hands-on capstone projects & real-time dashboards

- Personality Development

- Self-Awareness

- Self-Monitoring

- Team Building

- Communication

- Social Graces

- Interview

Faculty

WILL I BE MENTORED?

Yes! For the duration of the program, you will be assigned a dedicated Program Mentor. This experienced faculty member will be your one-point contact for queries, doubts or encouragement.

REASONS TO WORK IN BANKING SECTOR

WHAT’S IN IT FOR ME?

The best use of 240 hours! Because our power-packed Post Graduate Program in Banking & Finance+ (PGP+) course entirely equips you with the fantastic skillsets required to begin a prolific career in banking operations, trade finance, and clearing services. All you have to do is learn and we’ll do the rest to ensure that your future is as bright as it should be.

Job Relevant Skills

Master the knowledge that lies within the functioning of retail banking operations. And that’s not all – get an in-depth understanding of complex systems and process know-how.

Get Hired

We are certain of the quality of our program which is why it comes with 100% placement assistance. With 15000+ placements completed with 60% salary hikes, we offer extensive career support to kick start your banking career.

Gain Industry Certifications

Armed with the PGP+ certificate, you will be thrilled to find Bankedgeians successfully employed in most private sector banks and NBFCs. Shine bright among other applicants with our certificate that is recognized by top recruiters across the BFSI sector.

Learn Live

Lived enabled instruction is proven to provide the best student outcomes. Learn from the finest in our state-of-the-art classrooms located across India and carve the career of your dreams.

WHAT IS THIS PROGRAM ABOUT ?

360-Degree Learning

Practical Learning

We include banking simulations and case studies to create a realistic practical experience where true learning takes place.

Industry-Aligned Curriculum

Our retail banking course covers everything from complex systems to basic and advanced knowledge required to prosper in the BFSI sector.

Tech-enabled Learning

Learning Management Systems

We are particular about wanting learning to continue beyond the classroom. And so, you are given full access to our seamless, online LMS.

Tech-Aided

The use of internal and external technology enables you to fruitfully engage with your coursework and keep track of reading material.

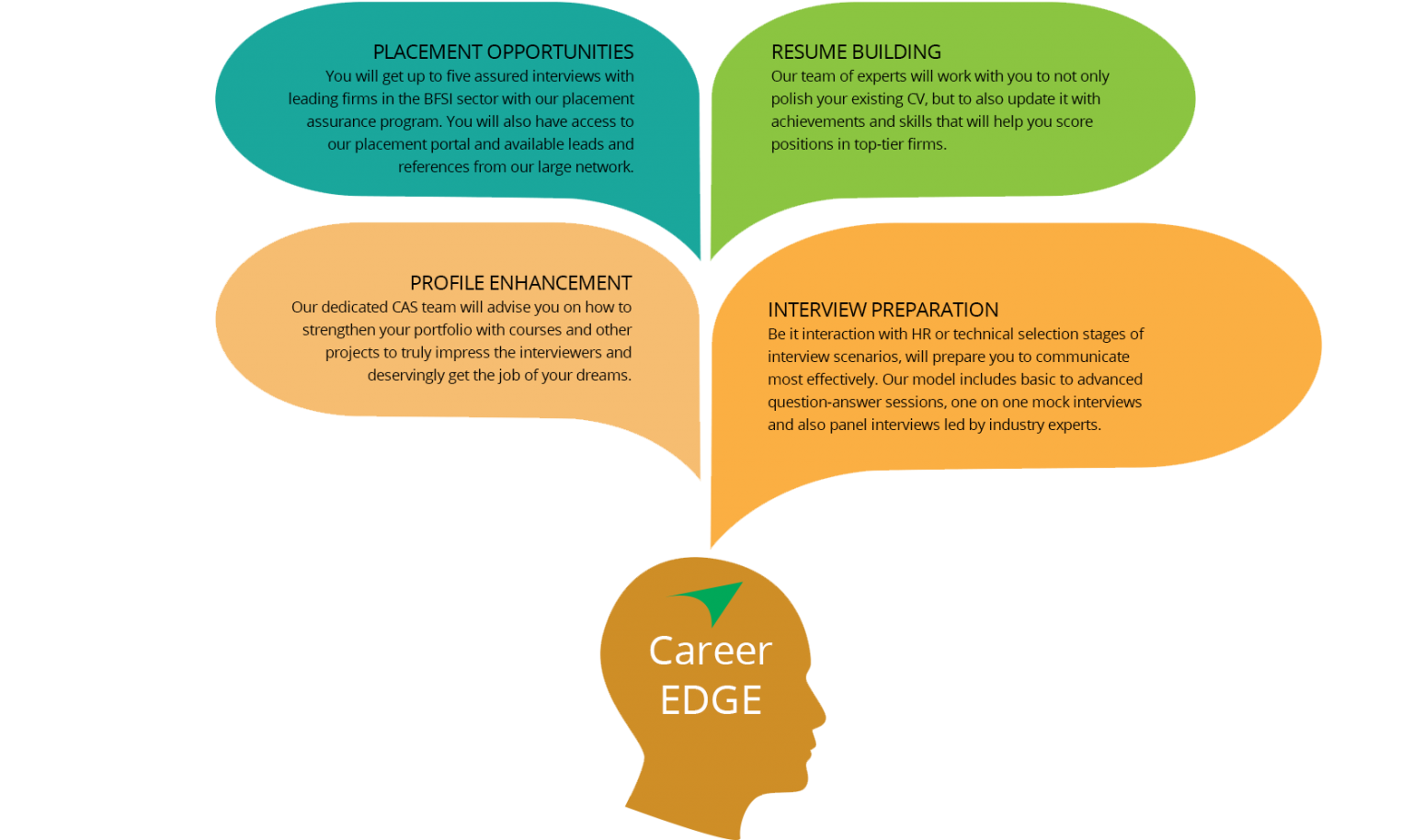

Career Services

Placement Assurance

Our career assistance team guides you through the placement process by providing expert tips on the BFSI sector. Their support thoroughly runs from the beginning of your resume building to the conclusion of your interview preparation.

Skill Building

Apart from empowering you with domain-specific knowledge, we ensure that you also develop soft skills that will enhance your ability to effectively communicate and present your ideas.

Learn Live

Industry-Endorsed Curriculum

Crafted by industry experts, our curriculum is holistic, practical and comprehensive. In other words, you are learning the best from the best.

Networking Opportunities

Connect with the experts and our alumni to further augment your learning and maximize every opportunity that comes your way.

WHAT CAN I BECOME?

Trade Finance Executive

Forex Transactions Executive

Trade Finance Officer

Transactions Operations Executive

Account Manager

Customer Service Officer

Credit Relationship Manager

Fraud Management Officer

Assistant Acquisition Manager

Teller Service Executive

Relationship Officer

Wealth Manager

Executive (Wealth Management)

Credit Manager

Fraud Detection & Vigilance Officer

HOW DO YOU TRAIN?

Through practical scenarios, realistic simulations and hands-on assignments, you will cohesively comprehend the BFSI sector and develop a supreme ability to contribute value to the workplace from day one.

Case Studies

Real-world case studies and complex business scenarios prepare you to successfully make the transition from academics to the retail banking industry.

In-class Simulations

Rise above traditional rote learning through the use of simulations that recreate challenges faced by the BFSI sector. Through vivid trading simulations, understand how multi-million dollar transactions flow through banks and affect various processes.

Assessments and Teach-backs

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

Industry Interactions

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

WHAT SUPPORT CAN I EXPECT?

Learn and we’ll place you! Make a successful transition in your career with partnerships of top tier hiring firms in the BFSI sector.

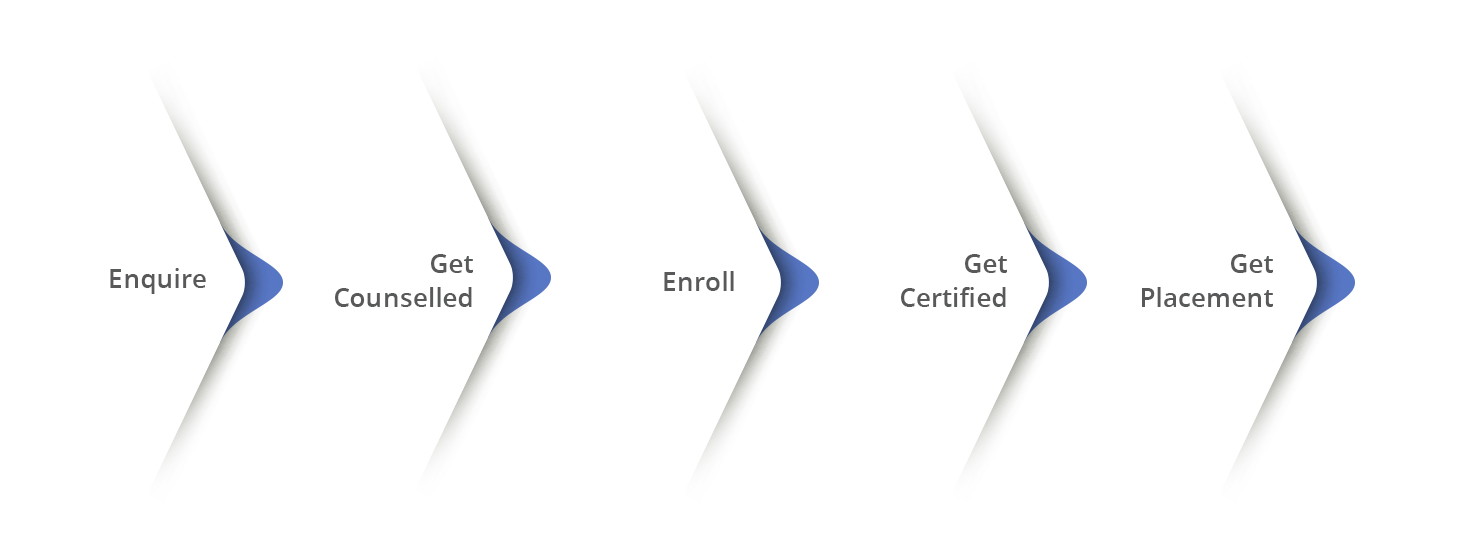

I WANT TO JOIN! HOW CAN I?

The PGP+ program stands tall in the category of finance courses because of its depth, expertise, and accurate relevance to the banking industry.

It is a valuable walk from knowledge to prosperity.

Learn with us and get placed at leading institutions in the BFSI sector!

To be eligible for the course, you must be a recent graduate from any stream with 0-3 years of work experience.

Fee Structure

LUMPSUM – INR 1,25,000/-

INSTALLMENT – INR 6945/-

REGISTRATION – INR 6945/-

WAIT! I HAVE SOME QUESTIONS

Who is eligible to enroll in PGP+?

Fresh graduates with a bachelor’s degree and professionals with 2–5 years of work experience in banking, finance, IT, or related fields.

What is the program duration and schedule?

The course runs for 8 months on a part-time basis, with live lectures during evenings and weekends, complemented by self-paced learning modules.

What delivery modes are offered?

Hybrid format: live online lectures via Zoom, on-demand resources in the LMS (Moodle), and optional weekend workshops.

Which specializations can I choose?

Investment Banking Operations, Banking with Data Science, or Banking with Data Analytics to match your career goals.

What career opportunities will PGP+ unlock in India?

Roles include Relationship Manager, Investment Banking Analyst, Credit Analyst, Operations Manager, Data Scientist, BI Analyst, and Risk Analytics Consultant.

What are the expected salary packages for fresh graduates?

Entry-level salaries in India range from ₹4–12 LPA, depending on the role and specialization.

What salary can experienced professionals (2–5 yrs) expect?

Mid-level packages typically range from ₹8–25 LPA in India, with potential for higher compensation based on skill set and industry demand.

Are there placement assistance and networking opportunities?

Yes, we provide dedicated career services, alumni networks, corporate partnerships, and recruitment drives to facilitate job placements.

Is certification recognized by employers?

The dual certification (BANKEDGE PGP+ plus track-specific credential) is widely recognized by top banks, consulting firms, and fintech companies.

How do I apply and what is the enrollment deadline?

Apply online at https://bankedge.in/pgp-plus/; early-bird registration (30 days prior) is recommended to avail discounts. Final enrollment closes one week before the cohort start date.