India and UAE signed the DTAA (Double Taxation Avoidance Agreement) in 1992 in order to avoid double taxation of residents of both countries on the same income. Accordingly, we find that NRIs in UAE enjoy tax benefits on investments in Mutual Funds. Here is an article, which debates as to whether this is profitable to the NRIs and the challenges that are faced.

The going has always been good for non-resident Indians (NRIs), particularly those based out of the United Arab Emirates (UAE). For one, they do not have to pay any income tax in that country. Two, they can also take advantage of a double taxation avoidance agreement (DTAA) signed between the UAE and India, and thus avoid capital gains taxes on investments made here, say financial experts.

To be sure, India has signed DTAAs with multiple countries, but not all of them have the same two conditions mentioned above.

Typically, if an investor were to put in ₹10,000 every month in an equity mutual fund (MF) for 20 years, they would get around ₹1 crore assuming an annual growth rate of 12%. However, the gains would be subject to 10% long-term capital gains taxation, which would be around ₹7.6 lakh. Debt MFs are taxed at a higher rate based on the investor’s income tax slab rate. But an NRI from the Emirates is exempt from paying any capital gains tax, thanks to the DTAA signed between India and the UAE in 1992 to avoid double taxation of residents of both countries on the same income. “This treaty alleviates the burden on taxpayers and promotes cross-border economic activities,” said Sagar Soman, a chartered accountant (CA) whose practice caters to NRI clients who are mostly high-net-worth individuals.

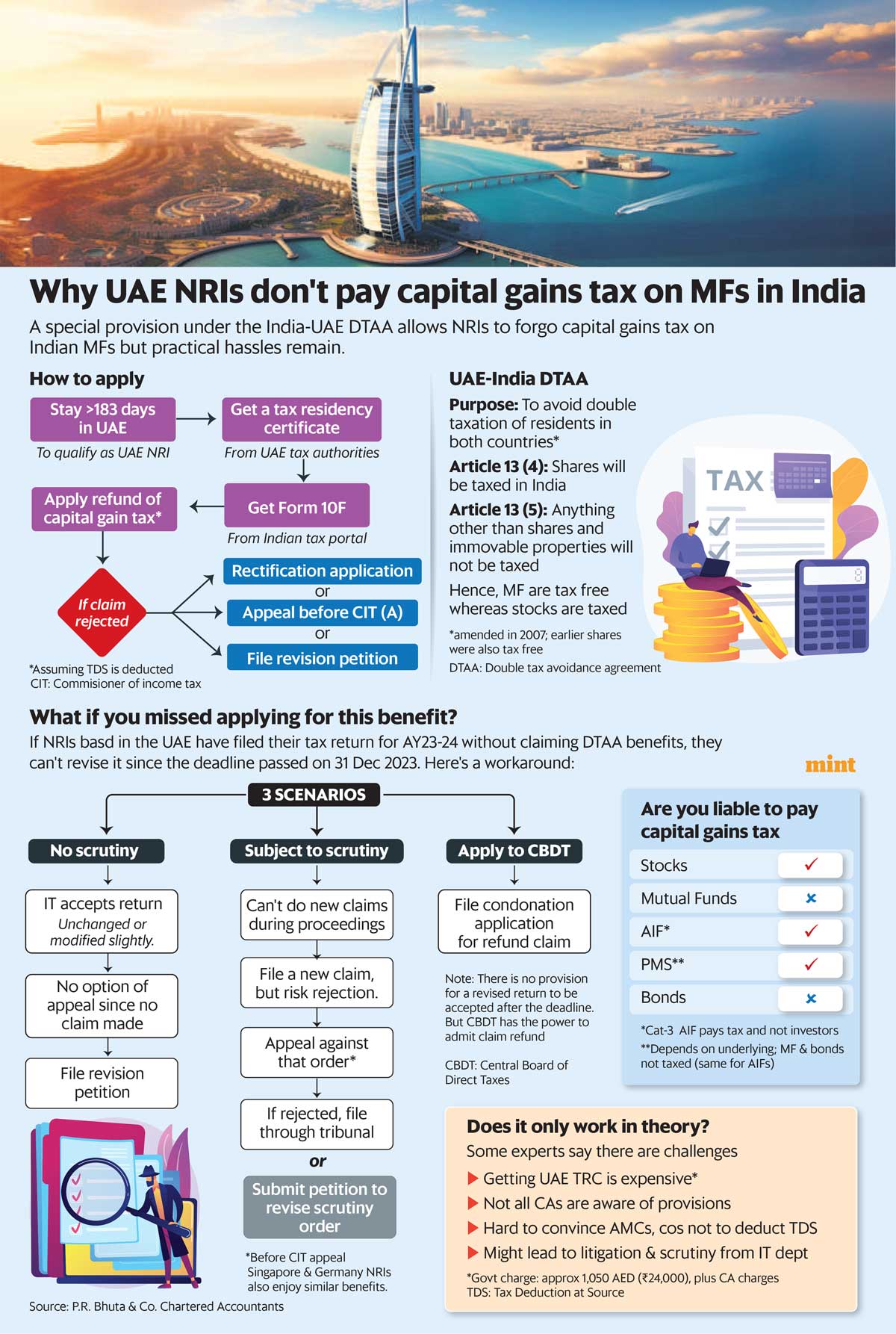

To be eligible for this benefit, investors need to prove that they were present in the UAE for a total of 183 days, continuously or otherwise, in the calendar year concerned. They also need to furnish a tax residency certificate and file Form 10F online with the tax authorities.

Do note that capital gains tax is applicable on the purchase and sale of stocks directly. Earlier, this was exempted. When the treaty was amended, shares were included to be taxed in India, but there was no specific mention of MFs. Under another clause for capital gains, it is mentioned that gains on assets apart from shares and immovable properties will be taxed in the country of residency, the UAE in this case.

Gautam Nayak, a partner at CNK & Associates, a chartered accountancy firm, points out that as per the DTAA, gains on assets such as MFs, corporate bonds or government securities (G-secs) will be taxed only in the country of residence, which is the UAE. And since there is no tax on personal income there, these gains become effectively tax-free under the agreement. For immovable property and shares, there are specific provisions in the agreement that allow it to be taxed in India.

As for portfolio management services (PMS), since the underlying securities are bought and sold in the name of the holder and through the holder’s brokerage account, the taxation depends on the assets that the PMS manager is buying. If these are shares, the gains would be taxed. Other securities are exempt from capital gains taxation. Income from category-1 and category-2 alternative investment funds (AIFs)—those that invest in a broader range of assets, including real estate and start-ups is also treated as pass through income. It is taxable in the hands of the recipient and depends on the type of underlying security.

In the case of category-3 AIFs, which trade in shares, securities and derivatives, taxation happens at the scheme level and the income is exempt for the investors. So, UAE NRIs don’t get any specific benefit for income in this case.

When it comes to interest-bearing instruments, the tax in India cannot exceed 12.5% of the gross interest earned. Indian residents pay taxes on interest bearing instruments, such as fixed deposits, as per the slab rates they fall under, which is generally higher.

Although the above tax treaty provides special benefits to NRIs based out of the UAE, experts say there are real-life challenges in its implementation.

“It sounds good only in theory,” said Harsh Roongta, co-founder and principal officer of Fee Only Investment Advisors.

Roongta said that getting a tax residency certificate for the UAE is costly but not very difficult to get. Comparatively, getting a tax residency certificate for Singapore is easier to get and is likely cheaper.

Also, not many CAs are aware of the DTAA benefits. “It is complex because it involves understanding of double tax treaties, how the Indian Supreme Court has looked at such treaties, UAE laws, etc.,” said Nayak. “It’s something which most CAs struggle with.”

UAE NRIs can submit tax residency certificates and show the online filed Form 10F to asset management companies (AMCs) to claim the benefits. But Roongta said it is difficult to convince AMCs to not deduct tax at source since they do not want to take the risk of getting into such a complicated tax arrangement.

On the other hand, Karan Batra, managing partner at Chartered Club, said that claiming benefits under the DTAA might often lead to litigation and scrutiny from the income tax department. He said that not all tax officials are aware of this clause, which makes it difficult to convince them. Batra specializes in tax matters related to the UAE and India.

“If it’s a big amount, then it’s fine, otherwise the CA who’s representing you might charge more if it goes for scrutiny,” said Batra.

Courtesy: Mint dt. 14th Feb. 2024