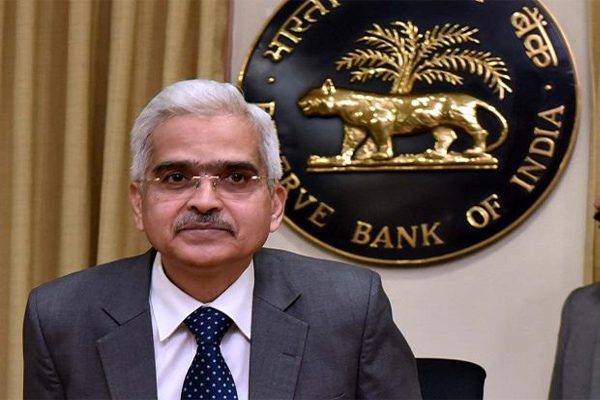

RBI Governor Shaktikanta Das held a meeting with the MD and CEOs of public sector banks and select private sector banks today, in Mumbai. Reserve Bank of India’s (RBI) Governor Shaktikanta Das on July 3 held meetings with the MDs and CEOs of public sector banks and select private sector banks in Mumbai and urged

RBI Governor Shaktikanta Das held a meeting with the MD and CEOs of public sector banks and select private sector banks today, in Mumbai. Reserve Bank of India’s (RBI) Governor Shaktikanta Das on July 3 held meetings with the MDs and CEOs of public sector banks and select private sector banks in Mumbai and urged