What is Securitization?

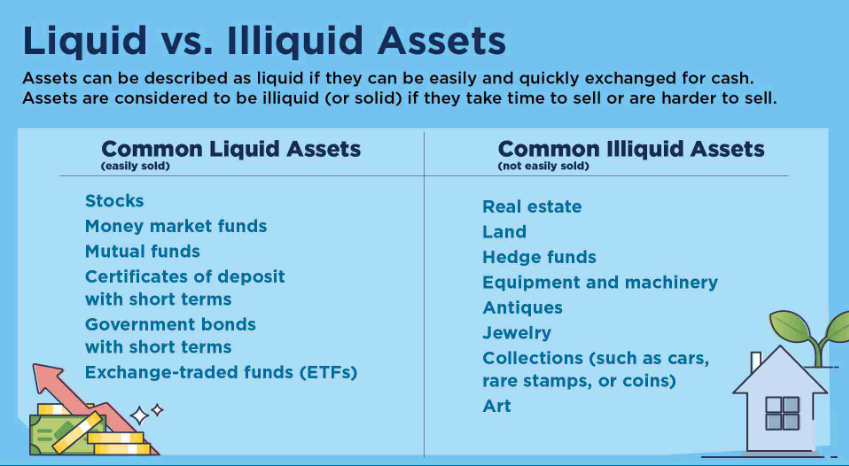

Securitization is the process of taking an illiquid (a stock or bond or other assets which cannot be sold easily) asset or group of assets and, through financial re-engineering (a process of overhauling) and transforming it (or them) into an investable security.

For example, a group of home loans or Vehicle Loans are sold by the original lender to another financial institution, which turns the package of mortgaged asset or the Vehicles, into one distinct unit that the public can invest in. Here, the investors are then paid the interest and principal payments from these various mortgaged assets or Vehicles provided as security, and the new lender will treat these loans as if these are loans disbursed by them to different homeowners or Vehicle owners. It is a process of taking over the entire loan in lot, through a process of negotiation and settlement.

For example, a group of home loans or Vehicle Loans are sold by the original lender to another financial institution, which turns the package of mortgaged asset or the Vehicles, into one distinct unit that the public can invest in. Here, the investors are then paid the interest and principal payments from these various mortgaged assets or Vehicles provided as security, and the new lender will treat these loans as if these are loans disbursed by them to different homeowners or Vehicle owners. It is a process of taking over the entire loan in lot, through a process of negotiation and settlement.

Its features are:

- It increases liquidity and access to Credit

- However, the products created, asset-backed securities, are branded as accused of lacking transparency.

- Remarks are made that securitization encourages banks and other lenders to not care about the quality of the loans that they underwrite.

How Does Securitization Work?

Securitization usually happens in the following way:

- The financial institution holding the assets, otherwise known as the originator, gathers data on the loans or income-producing assets that it no longer wants to service (they could be mortgages, Vehicle Loans or something else).

- It then removes them from its Balance Sheet and pools them into a reference portfolio.

- The assets in the reference portfolio are sold to an entity such as a Special Purchase Vehicle (SPV), which turns them into a security that the public can invest in.

- Each security represents a stake in the assets from the portfolio.

- Investors buy the created securities in exchange for a specified rate of return after due negotiation.

- In most cases, the original lender continues to service the loans from the reference portfolio, collecting payments from the borrowers and then passing them on, minus a fee, to the SPV or trustee.

- Finally, the generated cash flows are then paid to the investor.

Here is an interesting article on Securitization’s gaining importance on Vehicle Loans these days.