An RBI circular that requires lenders to take a quick call on classifying wilful defaulters will also allow borrowers to shake off the tag by entering into a compromise settlement with banks.

In June 2023, the central bank, in its circular on compromise settlements, had allowed one-time settlement of wilful defaults only if a higher authority approved it. The norms had caused controversy with bank unions and the Congress attacking the government over the new rules.

Last week, RBI came out with a draft master direction on the treatment of wilful defaulters. According to RBI, the objective is to provide for a non-discriminatory and transparent procedure, while complying with the principles of natural justice for classification of a borrower as a wilful defaulter by the lender.

“Any account included in the list of wilful defaulters, where the lender has entered into a compromise settlement with the borrower, shall be removed from the list only when the borrower has fully paid the compromise amount,” it stated.

While the regulator has said that other proceedings against the wilful defaulters will continue, bankers say that some criminal cases such as those involving bouncing of cheques or borrowers causing “wrongful loss” would lose ground.

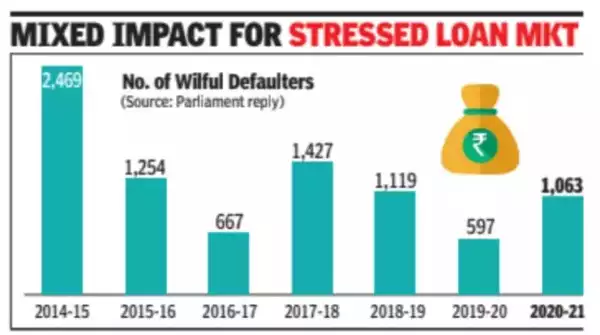

The draft norms are expected to be notified after RBI receives feedback from stakeholders. Besides enabling compromise settlements, the norms require the lenders to decide on wilful defaulter classification in six months. Overall, the norms are expected to have a mixed impact on the market for stressed loans.

“The draft circular also proposes a restriction on the lenders that despite a settlement being accepted, no fresh facility will be granted for one year and no funding on floating a new company by the defaulters for five years. Further, the settlement shall be without prejudice to the pending legal proceedings initiated against the wilful defaulter,” said Ashish Pyasi, a counsel representing borrowers.

“These measures in the draft are aimed at streamlining both pre and post-settlement concerns that arise for the lenders. However, for the wilful defaulters, once the matter is settled, most of the proceedings will come to an end as the nature of proceedings involved includes recovery proceedings,” said Pyasi.

“The draft guidelines are welcome. From the asset reconstruction company perspective, regulatory empowerment to declare wilful default in respect of restructuring support finance, or in case of change in management under 9(a) of Sarfaesi Act, would align the guidelines with applicable ARC regulatory framework,” said Hari Hara Mishra, CEO, Association of ARCs in India.

Courtesy: Times of India dt. 25th Sept 2023.

No Comments