Lenders’ expectations based on resilient demand and elections in key states.

Lenders’ expectations based on resilient demand and elections in key states.

Lenders in India, comprising banks and nonbanking financial companies, anticipate robust growth in retail credit during the upcoming festival season, stretching from September to December 2023. This expectation is based on resilient demand, government initiatives, and elections in key states.

Nonetheless, the possibility for interest rate wars remains limited due to the Reserve Bank of India´s (RBI´s) tight grip on liquidity.

Concerns about potential impacts on margins and credit quality are also constraining such rate competition, observe bankers.

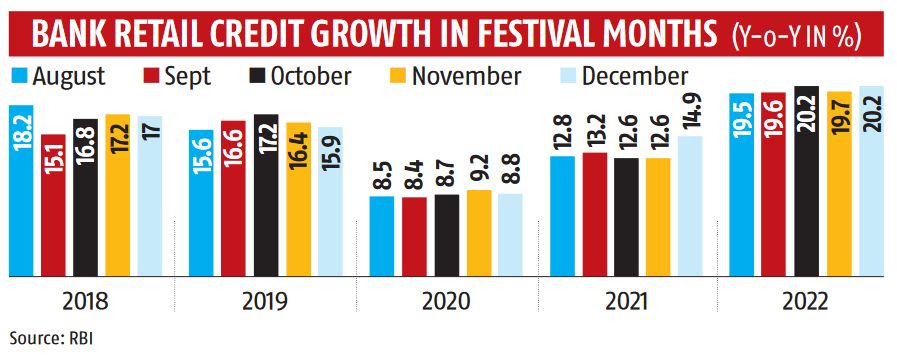

In the period between August and December 2022, amidst economic recovery and pentup demand following the second wave of the pandemic, bank retail credit experienced a yearonyear ( YoY) growth between 19.5 per cent and 20.2 per cent.

In the current year, up until June 2023, the overall retail loan pool has expanded by approximately 21 per cent YoY. According to RBI data, housing loans have grown by 15 per cent, credit card loans by 36 per cent, and vehicle loans by 23 per cent.

Suresh Khatanhar, deputy managing director of retail banking at IDBI Bank, says that competition among players will primarily revolve around turnaround time and enticing customer schemes, rather than ratecut wars.

Partnerships between retailers and consumer goods companies will play a pivotal role, along with the introduction of festival season offers.

Mumbai based Union Bank of India has announced the waiver of processing charges for home and vehicle loans for new customers with a credit score of 700 and above.

This offer is valid from the middle of August until November 15, 2023.

The RBI´s lending survey, released in conjunction with the August monetary policy review, indicated that bankers maintain an optimistic outlook regarding loan demand in the third and fourth quarters of 202324 (FY24), spanning across major categories of borrowers.

Easy loan terms and conditions are expected to continue in the second half of FY24.

A senior executive from State Bank of India (SBI) stated that demand remains strong for retail loans in a resilient economy.

Additionally, elections for Vidhan Sabha in states such as Madhya Pradesh, Rajasthan, Chhattisgarh, and Telangana could result in increased giveaways and higher spending.

The Union finance ministry´s renewed efforts for loan camps in rural areas are contributing to the push.

As a result, public sector banks are anticipated to put in extra efforts to scale up credit uptake among small borrowers.

While there´s a push for growth, lenders are cautious not to compromise a healthy credit profile achieved through tight underwriting, provisioning, and the use of artificial intelligence to harness data from social media, according to an executive from a finance company.

Lenders will need to make substantial changes in software and technology systems to incorporate the Reserve Bank of India (RBI)´ s directive that bars charging penalty as penal interest on borrowers for defaults and breach of loan contracts.

Bankers said they will need extensive communication with customers for new rules regarding rest of interest rates and switching to fixed interest regime.

Courtesy: Business Standard Dt. 21st August 2023

No Comments