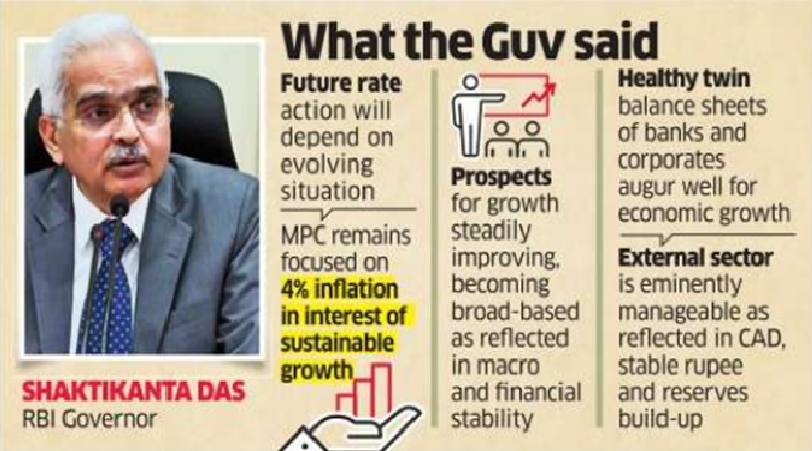

The Reserve Bank of India kept the interest rates unchanged for the second straight monetary review meeting amid abating price pressures and showed a favourable picture on medium term economic growth that is likely to be the best among the world economies. The RBI Governor showed a clearer path to the future, though the political

The Reserve Bank of India kept the interest rates unchanged for the second straight monetary review meeting amid abating price pressures and showed a favourable picture on medium term economic growth that is likely to be the best among the world economies. The RBI Governor showed a clearer path to the future, though the political