1800 266 0777

Duration

9 Months

Certified by

Moody’s Analytics, CFA Institute and

AIWMI - Association of International

Wealth Management of India

Course Fee

Rs.1,75,000/-

(all inclusive)

Installments

18000 per month

The Post Graduate Certificate Program in Investment Banking and Global Market is being offered by EduEdge Pro, in collaboration with industry partners and collaborators such as Moody’s Analytics, CFA Institute and AIWMI – Association of International Wealth Management of India.

This Program is designed to provide deep rigorous training in Fundamental Analysis & Applied Equity Research, Technical & Global Intermarket Analysis , Risk Management & Treasury, and Investment Banking including Prospectus & Pitchbook creation for the participants looking to upgrade themselves in the Investment Banking and Global Markets arena.

Investment banking division of an Investment bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital raising) and mergers and acquisitions (M&A) advisory services.

Global markets division of an Investment bank involves managing capital and includes Sales and Trading, Equity Research, Global Strategy, Fund Management as some of the important divisions.

Anyone who wants to have a solid understanding of Investment Banking and Global Markets should take this specialization.

The programme provides real-time knowledge and skills pertaining to investment banking. In short, the programme will enable participants to take informed and effective decisions in the areas of Investment Banking, M&A, IPOs, Valuation, Global Markets, Treasury, Equity Research, Technical Analysis., and also provide them with hands-on knowledge and skills to become a successful Investment Banker.

OUR STUDENTS ARE PLACED HERE

ELIGIBILITY

Any Undergraduate

Degree holder like BCA

BBA, B.Tech, B.Engg.

B.COM. etc.

PROGRAMMING EXPERTISE

It is not required to have a Programming background, although desirable.

WORK EXPERINCE

Work experience is not mandatory .However it is desired that you have an internship or full-time experience so that you can move up the learning curve faster through prior industry domain knowledge

CURRICULUM

Equity Research Introduction

Fundamental Analysis Frameworks and use cases

Applied Valuation for Equity Research

Introduction to Report Writing & Reading reports

Golden Rules and Frameworks for Writing

Technical Analysis Frameworks and Strategies

Applied Technical Analysis to Futures and Options

Integrated Frameworks for Technical Analysis

Foundations of Risk Management

Understanding Regulatory Capital under Basel 2/3

Market Risk Measurement and Frameworks in Basel 2.5/3/3.5

Credit Risk Measurement and Frameworks

Treasury Management

Investment Banking Frameworks

IPOs, QIP and FPOs process

IPO (Initial Public Offering) Process

QIP (Qualified Institutional Placement) Process

FPO (Follow-on Public Offering) Process

Investment Banking Prospectus and Pitchbook

Key Components of IB Prospectus

Pitchbook in Investment Banking

PROFESSIONAL EDGE @ BANKEDGE

FUNDAMENTAL ANALYSIS AND APPLIED

EQUITY RESEARCH

- Equity Research Introduction

- Fundamental Analysis Frameworks and use cases

- Applied Valuation for Equity Research

- Introduction to Report Writing & Reading reports

- Golden Rules and Frameworks for Writing

TECHNICAL ANALYSIS AND GLOBAL INTER-MARKET ANALYSIS

- Technical Analysis Frameworks and Strategies

- Applied Technical Analysis to Futures and Options

- Integrated Frameworks for Technical Analysis

APPLIED GLOBAL MARKETS - RISK MANAGEMENT AND TREASURY

- Foundations of Risk Management

- Understanding Regulatory Capital under Basel 2/3

- Market Risk Measurement and Frameworks in Basel 2.5/3/3.5

- Credit Risk Measurement and Frameworks

- Treasury Management

INVESTMENT BANKING AND CAPITAL RAISING

- Investment Banking Frameworks

- IPOs, QIP and FPOs process

- IPO (Initial Public Offering) Process

- QIP (Qualified Institutional Placement) Process

- FPO (Follow-on Public Offering) Process

- Investment Banking Prospectus and Pitchbook

- Key Components of IB Prospectus

- Pitchbook in Investment Banking

- Module 1

-

FUNDAMENTAL ANALYSIS AND APPLIED

EQUITY RESEARCH- Equity Research Introduction

- Fundamental Analysis Frameworks and use cases

- Applied Valuation for Equity Research

- Introduction to Report Writing & Reading reports

- Golden Rules and Frameworks for Writing

- Module 2

-

TECHNICAL ANALYSIS AND GLOBAL INTER-MARKET ANALYSIS

- Technical Analysis Frameworks and Strategies

- Applied Technical Analysis to Futures and Options

- Integrated Frameworks for Technical Analysis

- Module 3

-

APPLIED GLOBAL MARKETS - RISK MANAGEMENT AND TREASURY

- Foundations of Risk Management

- Understanding Regulatory Capital under Basel 2/3

- Market Risk Measurement and Frameworks in Basel 2.5/3/3.5

- Credit Risk Measurement and Frameworks

- Treasury Management

- Module 4

-

INVESTMENT BANKING AND CAPITAL RAISING

- Investment Banking Frameworks

- IPOs, QIP and FPOs process

- IPO (Initial Public Offering) Process

- QIP (Qualified Institutional Placement) Process

- FPO (Follow-on Public Offering) Process

- Investment Banking Prospectus and Pitchbook

- Key Components of IB Prospectus

- Pitchbook in Investment Banking

REASONS TO WORK IN BANKING SECTOR

PROGRAM HIGHLIGHTS

The best use of 240 hours! Because our power-packed Post Graduate Diploma In Investment Banking & Global Markets course entirely equips you with the fantastic skillsets required to begin a prolific career in Investment Banking operations and Global Markets. All you have to do is learn and we’ll do the rest to ensure that your future is as bright as it should be.

Program Coverage

This PG Diploma will help you learn

applications of Investment Banking

and Global Market applied to important domain areas such as

Banking, Global Market, Equity

Research, Bond, Wealth Management, Treasury, Risk Management and many more.

9 month Weekend Program

The Program would be offered on the weekends to enable optimal learning to those participants who are working in the Industry

Industry Partners

Our industry partners would rovide you the appropriate domain and industry expertise to tackle investment Banking challenges in the real world.

Careers and Placement help

Our program would fast track your career progression Investment Banking through our dedicated Placement Assistance and Industry Networking.

PEDAGOGY

Blended Learning

The Program would offer an optimal blended mix of On campus bootcamp sessions, online sessions, self-paced sessions to maximize learning

Industry-oriented Curriculum

Industry focused curriculum offered in a flexible online blended interactive format that works for busy professionals

Capstone Project & Live Lab

The Capstone Project gives you the opportunity to apply Investment Banking and Global Markets concepts

WHAT CAN I BECOME?

Investment Banker

Financial Analyst

Research Analyst

Treasury Manager

Research Analyst

Sales and Traders

Bond Analyst

Portfolio Manager

Risk Analyst

Investment Banker

Financial Analyst

Research Analyst

Treasury Manager

Research Analyst

Sales and Traders

HOW DO YOU TRAIN?

Through practical scenarios, realistic simulations and hands-on assignments, you will cohesively comprehend the BFSI sector and develop a supreme ability to contribute value to the workplace from day one.

Case Studies

Real-world case studies and complex business scenarios prepare you to successfully make the transition from academics to the retail banking industry.

In-class Simulations

Rise above traditional rote learning through the use of simulations that recreate challenges faced by the BFSI sector. Through vivid trading simulations, understand how multi-million dollar transactions flow through banks and affect various processes.

Assessments and Teach-backs

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

Industry Interactions

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

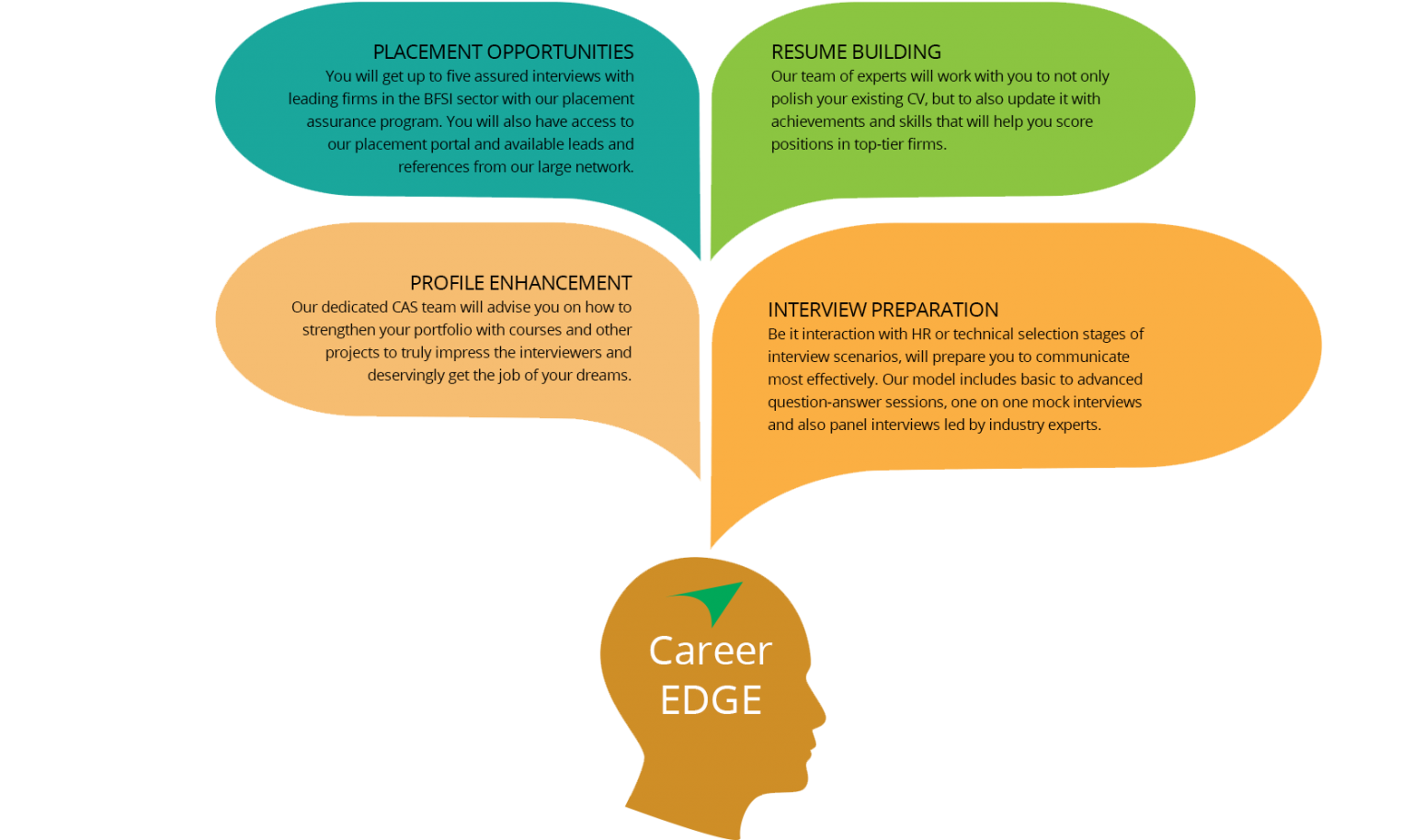

WHAT SUPPORT CAN I EXPECT?

Learn and we’ll place you! Make a successful transition in your career with partnerships of top tier hiring firms in the BFSI sector.

I WANT TO JOIN! HOW CAN I?

The Post Graduate Diploma In Investment Banking & Global Markets program stands tall in the category of finance courses because of its depth,

expertise and accurate relevance to the banking industry.

It is a valuable walk from knowledge to prosperity.

Fee Structure

LUMPSUM – INR 1,75,000/-

INSTALLMENT – INR 18,000/-

WAIT! I HAVE SOME QUESTIONS

What is the Format of the PGP+ Program?

The Program offers a unique pathway that helps you understand and master the critical elements, concepts, and models in Investment Banking and Global Markets

The PGP program is structured in an evolutionary pathway that covers the below:

- Fundamental analysis and applied equity research

- Technical analysis and global intermarket analysis

- Applied global markets – risk management and treasury

- Investment banking and capital raising

What is the duration of the Program?

The Program is a 9-month weekend program.

It would be offered on the weekends to enable optimal learning for those participants who are already working in the industry.

What study material will be provided to us?

You would be provided with extensive study material throughout the PGP program:

- Detailed notes

- Recommended Textbooks

- Case studies

- Excel frameworks

- Modelling templates

- Trainer slides

- Interview preparation workshops and study notes

What is the eligibility criteria for admission?

EDUCATION

Any Undergraduate Degree holder like BCA, BBA, B.Tech, B.Engg., B.COM. etc. Students Pursuing final year can also apply

WORK EXPERIENCE

Work experience is not mandatory. However, it is desired that you have an internship or full–

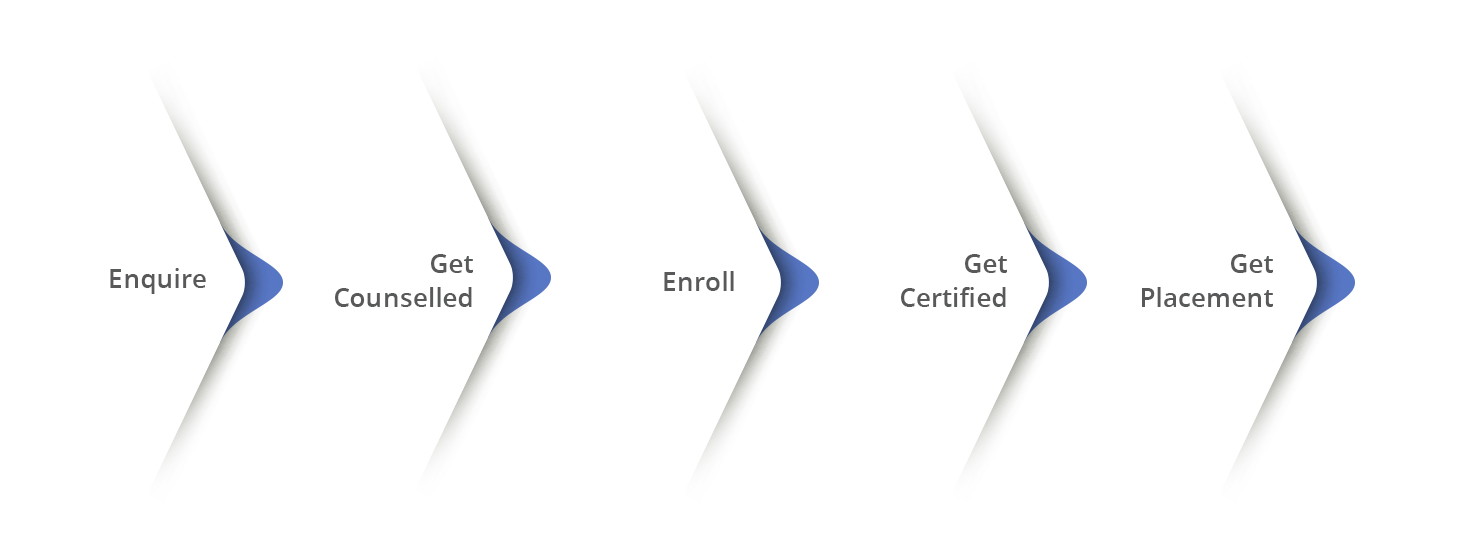

What is the application process for admission?

The Application process consists of a few simple steps as shown below. An offer of admission would be made to the selected candidates and accepted by the candidates by paying the admission fee.

- Program Counselling

We have a dedicated admission counsellor who are here to help guide you in applying to the program. They are available to:

Address questions related to application.

Assist with Financial Aid (if Required) Guide career role and opportunities after certified.

Help you to understand the program detail and pedagogy.

- Application

Complete your application to kick start the admission process.

Rate your various skills of OOPs language, quantitative and logical ability.

Submit application fee: ₹ 500/-

Submit the form successfully and scheduled your interview with us.

- Interview

Interview is with admission committee, who will review the candidate profile.

Selection will be determined on the basis of academic records, work experience, test scores and interview.

Upon qualifying a confirmation letter for admission to the PG Certification will handover to the candidate.

- Documentation

After interview on the basis of confirmation letter, the required papers mentioned in the mandatory list of documents as per eligibility criteria. You would be required to submit your marksheets, education certificates, work experience proofs amongst other necessary documents.

- Payment Processing

Block your seat with the initial amount of fees and begin with your prep course and start your Data Science journey. Full or annual program fee to be deposited within 1 week of offer letter / program start –whichever is earlier.

6. Confirmation

Your admission will be confirmed basis the selection procedure, document authentication

and fee payment. A welcome letter, ID card, student number and portal access will be shared upon successful completion of the admission process.

Why should I choose your program?

Program Coverage

This PG program will help you learn applications of Investment Banking and Global Market applied to important domain areas such as Banking, Global Market, Equity Research, Bond , Wealth Management , Treasury, Risk Management and many more.

Careers and Placement help

Our program would fast track your career progression Investment Banking through our dedicated Placement Assistance and Industry Networking

Industry Partners

Our industry partners would provide you the appropriate domain and industry expertise to tackle Investment Banking challenges in the real world.

9-month Weekend Program

The Program would be offered on the weekends to enable optimal learning to those participants who are working in the Industry

Capstone Project & Live Lab

The Capstone Project gives you the opportunity to apply Investment Banking and Global Markets concepts

Industry-oriented curriculum

Industry focused curriculum offered in a flexible online blended interactive format that works for busy professionals

Blended Learning

The Program would offer an optimal blended mix of On campus bootcamp sessions, online sessions, self-paced sessions to maximize learning.

The PGP program is structured in an evolutionary pathway that covers the below:

- Fundamental analysis and applied equity research

- Technical analysis and global intermarket analysis

- Applied global markets – risk management and treasury

- Investment banking and capital raising

Mentoring and Content creation by global experts in Investment Banking and Global Markets. The Founder mentors of the program run their own Asset Management company and are industry experts and veterans.

What are the fees for the program?

Indian participants: INR 1,75,000 plus GST

International participants: USD 6500 plus taxes

FINANCING OPTIONS: 0% Interest EMI option available with partner banks Easy procedure with partner banks EMI as low as INR 18,000 per month

SCHOLARSHIPS: Available on outstanding merit record

CORPORATE DISCOUNTS: Available on nominations of 2+ participants Kindly contact us for further details

What is Investment Banking and Global Markets?

Investment banking division of an Investment bank or financial institution that serves governments, corporations, and institutions by providing underwriting (capital raising) and mergers and acquisitions (M&A) advisory services. Global markets division of an Investment bank involves managing capital and includes Sales and Trading, Equity Research, Global Strategy, Fund Management as some of the important divisions

What roles can be expect after this specialized PGP?

POPULAR JOBS

- Investment Banker An investment banker mainly offers financial services and advice to corporate entities. They handle mergers and acquisitions (M&A), business restructuring, spinoffs, stock splits, share buybacks, initial public offerings (IPOs), and secondary stock issues or bond issues.

- Financial Analyst Business analyst are consulting services, planning and executing customer projects, executing day-today reporting and settlement, analyzing the credit worthiness of banking clients, preparing financial and market analysis. Typical roles include M&A, PE and VC analysts

- Research Analyst A research analyst is responsible for researching, analyzing, interpreting, and presenting data related to markets, operations, finance/accounting, economics, customers, and other information related to the field they work in.

GLOBAL MARKETS ROLES

- Treasury Manager

The Treasury Manager is responsible for managing the organization’s treasury function. Generally found in larger, more geographically spread companies with international trading operations, the Treasury Manager protects the business against currency movements. - Research Analyst

A research analyst is responsible for researching, analyzing, interpreting, and presenting data related to markets, operations, finance/accounting, economics, customers, and other information related to the field they work in. - Sales and Traders

Traders make money by trading secondary markets and placing long/short bets on markets. Sales team sell products/services to corporate or institutional clients including hedging services, FX flows, credit, etc. - Bond Analyst

Bond analysts work with hedge funds and other investment teams. They provide guidance to companies and businesses in making investment strategies and decisions and giving their professional opinions and recommendations to financial institutions. - Portfolio Manager

Portfolio Managers are professionals who manage investments portfolio for their clients (individual or institutional), with the goal of achieving their clients’ investment objectives. - Risk Analyst

Risk Analyst evaluate the risk in portfolio decisions, forecasting potential losses, and deciding how to curb potential losses and volatility using diversification, currency futures, derivatives, short selling, and other investment decisions.