RISK FACTOR. SEBI mandated asset management firms to stress-test open-ended debt schemes every month

Scheduled commercial banks (SCBs) are well capitalised and capable of absorbing macro-economic shocks even in the absence of any further capital infusion, per the results of macro stress tests for credit risk conducted by the Reserve Bank of India.

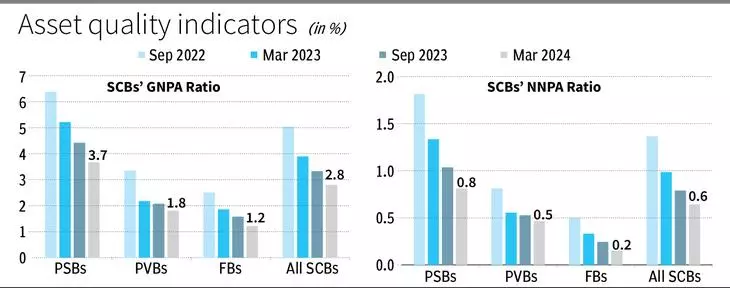

Further, SCBs’ gross nonperforming assets (GNPAs) ratio, which moderated to a 12-year low of 2.8 per cent in March 2024 from 3.9 per cent in March 2023 (a 10-year low), may improve to 2.5 per cent by March 2025 under the baseline scenario.

Domestic financial conditions are buttressed by healthy balance-sheets across financial institutions, marked by strong capital buers, improving asset quality, adequate provisioning and robust earnings, the central bank said in its latest Financial Stability Report (FSR).

“No SCB would breach the minimum capital requirement of 9 per cent over a yearahead horizon,” the RBI said

Under the baseline scenario, the aggregate CRAR (capital to risk-weighted assets ratio) of 46 major banks is projected to slip from 16.7 per cent in March 2024 to 16.1 per cent by March 2025

This ratio may go down to 14.4 per cent in the medium stress scenario and to 13 per cent under the severe stress scenario by March 2025, which is still above the minimum capital requirement.

The CRAR is computed by dividing the capital of a bank with aggregated risk weighted assets for credit risk, market risk and operational risk. The higher the CRAR of a bank the better capitalised it is.

STRESS TEST FOR GNPA

If the macro-economic environment worsens to a severe stress scenario, banks’ GNPA ratio may rise to 3.4 per cent.

Under the severe stress scenario, the GNPA ratios of public sector banks (PSBs) may increase from 3.7 per cent in March 2024 to 4.1 per cent in March 2025, whereas it may go up from 1.8 per cent to 2.8 per cent for private sector banks (PVBs) and from 1.2 per cent to 1.3 per cent for foreign banks.

The report said that special mention accounts–2 (whereby principal or interest payment is overdue between 61-90 days) ratio, which is a leading indicator of asset quality, is also showing relatively low levels of future impairment

STRESS TEST: NBFCS

Under the baseline scenario, one-year ahead GNPA ratio for the system (sample of 163 NBFCs) is estimated at 3.5 per cent (against actual 4 per cent as at March-end 2024, which is a new low).

System level CRAR is estimated at 21.7 per cent (26.6 per cent in March 2024), with CRAR of 8 NBFCs falling below the minimum regulatory requirement of 15 per cent.

RBI Governor Shaktikanta Das said the FSR highlights the strengthening of balance sheets of financial institutions with low levels of impairments, robust earnings and strong buers that render the financial system resilient to shocks.

The results of stress tests demonstrate that capital levels of banks and NBFCs will remain above the regulatory minimum even under severe stress scenario

Notwithstanding the ongoing front-running investigation on Quant Mutual Fund by SEBI, the banking regulator RBI has found 28 open-ended debt schemes of 12 mutual funds with total assets under management of ₹1.76-lakh crore under stress in April.

The capital market regulator SEBI has mandated asset management companies to carry out stress-test on all open-ended debt schemes every month to evaluate the impact of various risk parameters including interest rate, credit and liquidity faced by these schemes on their net asset values, said RBI in its Financial Stability Report on Thursday.

The Association of Mutual Funds in India and AMCs specify the threshold limits of impact for risk parameters and any breach of these limits need to be reported and remedial action taken, it added.

The RBI said all the MFs have reported initiation of remedial action to be completed in the prescribed timeframe.

The regulator considers redemption at risk (RaR) and conditional redemption at risk (CRaR) as part of liquidity risk management for open-ended debt schemes. While RaR represents likely outflows at a given confidence interval, the CRaR denotes the behaviour of the tail at the given confidence interval.

LIQUIDITY RATIOS

All AMCs are mandated to maintain these liquidity ratios above the threshold limits which are derived from scheme type, asset composition and potential outflows modelled from investor concentration in the scheme.

MFs are required to carry out back-testing of these liquidity ratios for all openended debt schemes (except overnight, gilt and gilt funds with 10-year constant duration) on a monthly basis.

The LR-RaR and LRCRaR computed by top 10 MFs (based on AUM) for 13 categories of open-ended debt schemes for March were well above the respective threshold limits for most of the MFs.

A few instances of the ratios falling below the threshold limits were addressed by the respective AMCs in a timely manner, said RBI in its report.

NET INFLOW

In April, the mutual fund industry has seen a net inflow of ₹1.90-lakh crore in debt schemes against a net outflow of ₹1.98-lakh crore in March. Banks have the phenomenon of pulling out money before the quarterly and financial year end and ploughing it back the next month to avoid mark-tomarket provisioning, said a debt fund manager.

He added that the inflows into debt schemes have been volatile on the back of prolonged expectations of repo rate cut by RBI.

The huge volatility in the inflow would have led to breach of stress test benchmarks and this gets corrected in due course, he said.

_____________________________

Courtesy: Bussiness Lines Dt.:28th June 2024