Sliding Crude oil prices has elevated the position of Indian Rupee, which was hitherto struggling to bolster.

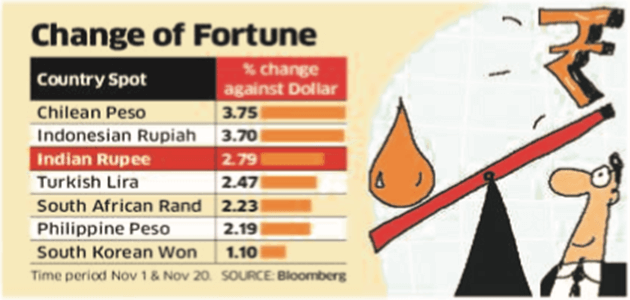

- Rupee gained 2.79% in November only to be the ththird-besterformer after Chilean peso and Indonesian Rupiah.

- Overseas investors have started investing in domestic Assets due to a 17% slump in oil prices in November 2018.

- Expected fall in trade deficit also otherwise paves way for a gain in rupee value. The local unit is expected to rise by another 2-3% this year end.

- Foreign buyers have invested Rs. 10,523 crore so far in the domestic securities and out of this around Rs. 5,686 crores the highest monthly inflow was recorded in November month in the current financial year.

- Brent oil prices have fallen by more than 25 percent which had reached a four year high of Rs. 86.74 crore during October this year.

- Demand contraction is expected to arise next year, leading to a supply glut.

- The current account deficit (CAD) or the excess of overseas spending over revenues was 2.4% of GDP in June quarter.

- The fall in oil prices is expected to bring down the fuel import bills of India, which could lead to reduced operational costs of companies with the higher share of imports.

Note:

Rupee faced multiple challenges during the year which included

- Raising oil prices

- widened trade deficit

- Liquidity stress in the para-banking industry (NBFCs).

Many of these factors have presently been solved.