The Reserve Bank of India, has advised banks and non-banks to permit their customers to decide on the credit card network. This means, credit card issuers, especially those with a large customer base, will have to enter into tie-ups with multiple card networks.

Current Scenario

- Presently the choice of network for a card issued to a customer is decided by the issuer bank or Non-bank, which is linked to the arangements that it has with card networks that restrains them (the former) from getting the services of other networks.

Revised Guidelines:

RBI has now observed that some arrangements currently that exist between card networks and card issuers do not give the customers the choice to select their network.

- Thus RBI wants that card issuers shall provide an option to their eligible customers to choose from multiple card networks at the time of issue of card.

- Also for the existing card holders, this option may be provided at the time of next renewal.

- These directions under the afore-mentioned clause will be effective six months from the issue of the circular (a circular has been issued by RBI on 7th March 2024).

- The clause allowing customers to choose card networks, however, is not applicable to credit issuers whose active card base does not exceed 10 lakh.

- Further, the circular is not applicable to card issuers that issue credit cards on their own authorized card network.

Consequences of changes guidelines

- With card issuers expected to work out arrangements with multiple card networks, there could be competition among the latter, which could push down the Merchant Discount Rate.

- MDR is the charge recovered by the acquirer (entities that enable the acceptance of payment instruments) from the final recipient of money (the merchant).

- The networks could even throw in discounts and cashbacks to lure credit card customers. Card networks facilitate the issue of card-based products such as credit, debit cards, and prepaid cards and primarily function as a merchant payment system.

- There are five authorised card networks in India viz., American Express Banking Corp Diners Club International Ltd., MasterCard Asia/Pacific Private. Ltd., National Payments Corporation of India-RuPay, and Visa Worldwide Pte. Ltd.

- Experts feel that the Annual charges, renewal charges, and conditions vary from network to network. Normally, payments settled by global card networks are perceived as costlier vis-à-vis RuPay cards.

- For foreign travellers or remitting funds abroad, global card networks will be seamless. Thus, the customer might find it easier to get RuPay credit cards compared with MasterCard, Visa, and Amex credit cards due to the latters’ more stringent requirements.

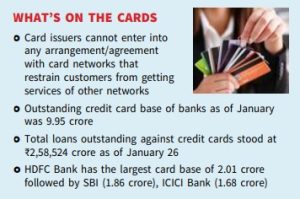

CREDIT CARD BASE

Banks had an outstanding credit card base of 9.95 crore as of January. Loans outstanding against these cards stood at ₹2,58,524 crore as of January 26,per RBI data. Six banks have a card base of more than 50 lakh, led by HDFC Bank with 2.01 crore, followed by the State Bank of India (1.86 crore), ICICI Bank (1.68 crore), Axis Bank (1.37 crore), Kotak Mahindra Bank (59.71 lakh), and RBL Bank (51.13 lakh), per RBI data.