Disinflation is a process of slowdown in the rate of increase of the general price level of goods and services in a nation’s gross domestic product over time. In other words, it is the opposite of reflation which refers to a process of economic recovery with a combination of both Fiscal and Monetary policies. A disinflation stage describes instances when the inflation rate has reduced marginally over the short term. Such stage does not threaten the economy, rathe may even benefit certain sections of society. Here are the views of RBI Governor on this.

Disinflation process may be slow, protracted: Das

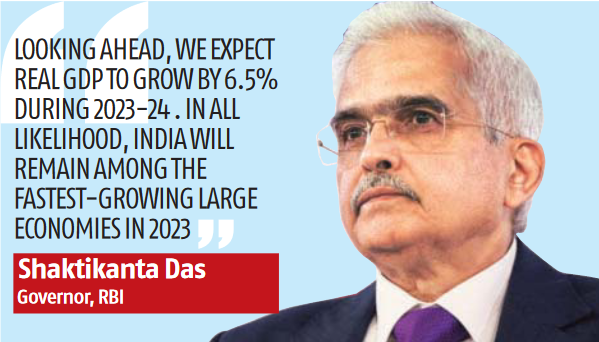

Says India likely to remain among the fastest growing economies this yr.

MANOJIT SAHA

Mumbai, 13 June

The consumer price based-inflation, which eased in recent months after staying elevated for a long time, showed signs of softening but the disinflation process is expected to be slow and protracted, Reserve Bank of India (RBI) Governor Shaktikanta Das on Tuesday. He said the headline number would converge with the RBI’s target of 4 per cent only in the medium term.

The economy, on the other hand, is likely to remain among the fastest growing economies this year, he said.

Commenting that there were signs of some softening with headline inflation easing to 4.25 per cent in May 2023,

from 7.8 per cent in April 2022, Das said “The cumulative impact of our monetary policy actions over the past one

year is still unfolding and yet to materialise fully. While our inflation projection for the current financial year 2023-

24 is lower at 5.1 per cent, it would still be well above the target.”

Data released by the government on Monday showed the consumer price-based (CPI) inflation rate for May grew

slowest in 25 months. According to the RBI Act, the central bank’s mandate is to maintain inflation at 4 per cent, within a range of 2 per cent on either side.

“As per our current assessment, the disinflation process is likely to be slow and protracted with convergence to the

inflation target of 4 per cent being achieved over the medium-term.

Based on this realisation and with a view to assess the impact of past actions, we decided on a pause in the

April and June 2023 meetings, but clarified unequivocally that this not a pivot – not a definitive change in policy

direction,” Das said in his address at the Summer Meetings organised by Central Banking in London.

Between May 2022 and February 2023, the RBI hiked the policy repo rate by 250 bps to 6.5 per cent before taking a pause. Das said the Indian economy, which grew by 7.2 per cent in FY23, was likely to be among the fastest growing

economies in the world this year.

“The Indian economy has also made rapid gains in openness and has gradually integrated with the global economy over the years. It is, however, pertinent to note that India’s growth in the past few years is mainly driven by robust domestic demand, especially private consumption and investment, amidst the global slowdown,” he said.

“Looking ahead, we expect real gross domestic product (GDP) to grow by 6.5 per cent during 2023-24. In all likelihood, India will remain among the fastest growing large economies in 2023.”

He said the RBI prioritised growth during the pandemic years even as inflation remained above the target but within the tolerance band.

Das said recognising that explicit guidance in a rate tightening cycle is inherently fraught with risks, the MPC

has also eschewed from providing any future guidance on the timing and level of the terminal rate. Commenting on the health of the banking sector, Das said the latest supervisory data indicates that all the banks are meeting the various prudential requirements.

“Stress tests also indicate that even in severe stress conditions, Indian banks will be able to meet the minimum requirements,” he said.

He emphasised that the regulator does not interfere with the business decision making of regulated entities, but the approach is to sensitise the senior management of regulated entities for remedial action on any mismatch between the adequacy of internal controls and loss absorption capacity and the risks that their business models generate.

**Courtesy: Business Standards dt 14th June 2023