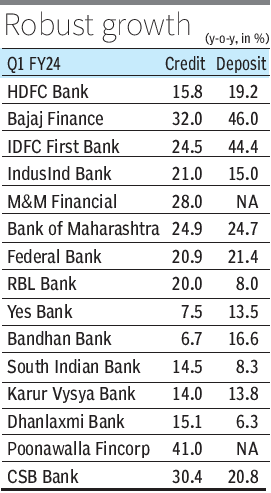

Provisional figures for the first quarter of FY24, released by banks and NBFCs, show that growth of both credit and deposit was robust in Q1, led by sustained demand for retail credit and a pick up in corporate loans.

Of the numbers declared so far, most lenders posted a rise in advances or AUMs (assets under management) of over 14 per cent with HDFC Bank and Bajaj Finance seeing 16 per cent and 32 per cent jump y-o-y, respectively.

M&M Financial Services, IndusInd Bank, IDFC First Bank, RBL Bank and Federal Bank saw 20-28 per cent loan growth, similar to the last quarter.

While Q1 is typically a slow quarter for lenders, most players reported a 4-6 per cent expansion in advances sequentially.

Sustained credit growth, especially by retail-oriented lenders, reflects that domestic consumption and the demand for credit remain strong, despite rising interest rates and elevated inflation.

Under-performace

YES Bank and Bandhan Bank continued to under-perform the sector, posting credit growth in the range of 6-8 per cent y-o-y. Both the lenders have been running down their microfinance and corporate exposures, respectively, leading to the muted growth overall.

Deposit accretion, too, maintained its momentum and most major lenders reported deposit growth of over 13 per cent y-o-y, barring RBL Bank, South Indian Bank and Dhanlaxmi Bank. Sequential trends showed steady rise in deposit, with exceptions being RBL Bank, YES Bank, Bandhan Bank and Dhanlaxmi Bank which likely slowed down due to muted loan growth.

Courtesy: thehindubusinessline.com