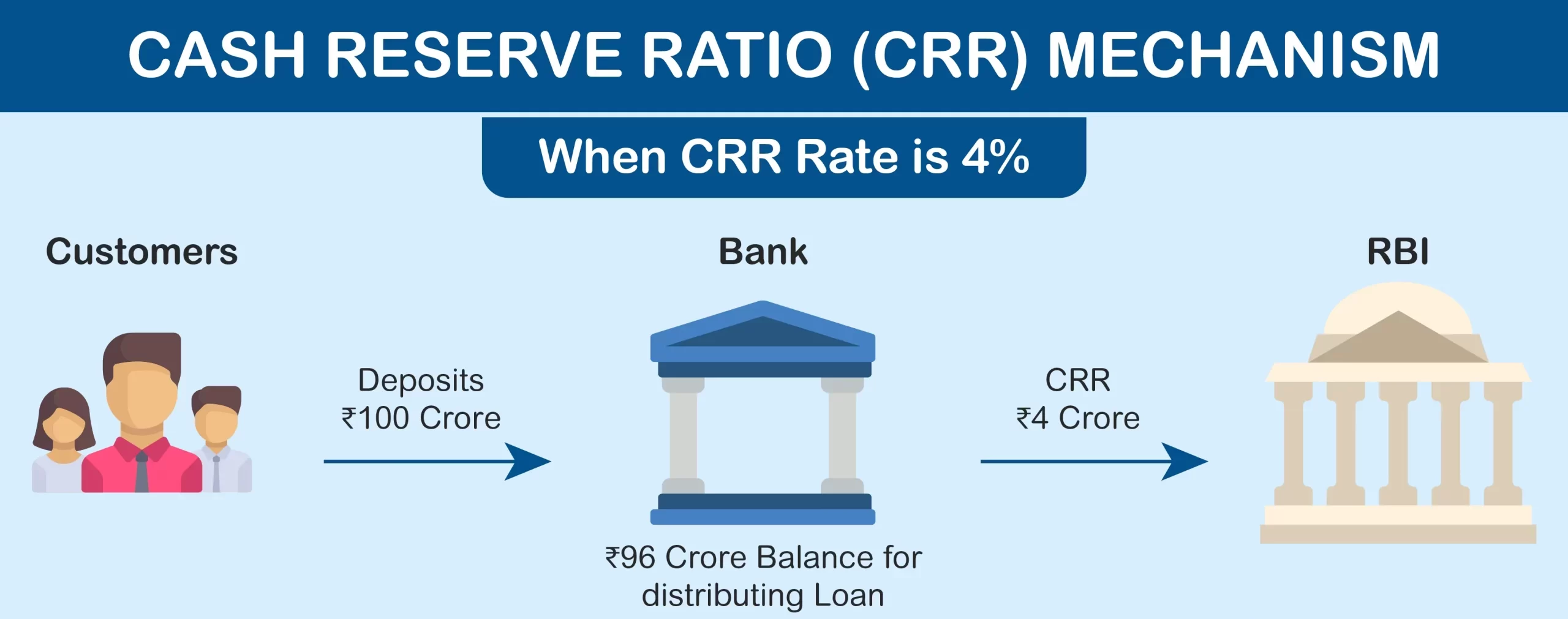

- Cash Reserve Ratio or CRR as it is termed, is a monetary policy tool used by the Central Bank to regulate money supply and control inflation.

- It is the percentage of Bank’s net Demand and Time Liabilities (NDTL) required tobe maintained as Cash Reserve with RBI.

- It includes deposits and certain other liabilities of commercial banks. Banks are under legal obligation to maintain this and non-compliance may lead to penalties and other regulatory actions.

- Increasing the CRR will reduce the lendable resources of banks, and thus lead to a scarcity of funds.

- This can push up interest rates as banks lend at higher rates to manage their reduced liquidity. Alternatively, a decrease in the CRR can increase the lendable resources, potentially leading to lower interest rates.

Here is an interesting article, which reveals the effect of an incremental CRR on the overall liquidity position of the economy.

—

The ICRR is expected to suck out between ₹20,000 crore and ₹40,000 crore from the system

On August 10, the Reserve Bank of India (RBI)asked banks to maintain an incremental Cash Reserve Ratio (ICRR) of 10 per cent on the increase in their deposits between May 19 and July 28.

What is ICRR?

Before moving on to incremental cash reserve ratio (ICRR), we need to understand the cash reserve ratio first (CRR). Banks are required to maintain liquid cash amounting to a certain proportion of their deposits and certain other liabilities with the RBI. This is a tool at the disposal of the RBI to control the liquidity in the economy and can also act as a buffer in periods of bank stress. Banks are currently required to maintain 4.5 per cent of their Net Demand and Time Liabilities as CRR with the RBI.

RBI has the option to impose incremental credit reserve ratio, in addition to the CRR, in periods of excess liquidity in the system and the central bank is now exercising it. What this means is that banks will now have to park more liquid cash with the RBI.

What are the contours of the ICRR proposed by the RBI?

RBI has stated in its monetary policy that from August 12, 2023, all scheduled banks should maintain an additional cash reserve ratio amounting to 10 per cent of the increase in their net demand and time liabilities (NDTL) between May 19, 2023 and July 28, 2023.

It may be recalled that the RBI had announced the withdrawal of the ₹2,000 notes in this period and this had resulted in banks witnessing large deposit inflows. RBI is trying to pull out some of this money from the system.

The central bank is however assuring banks that this is a temporary measure and that the ICRR will be reviewed on September 8, 2023. If liquidity balance is restored by then, the RBI may return the funds back to the banks ahead of the festival season so that credit growth in the economy is not affected.

How much money is expected to flow to the RBI as ICRR?

If we do some back of the envelope calculation, value of ₹2,000 notes in circulation was ₹3.56 lakh crore by May 19, 2023. The Central Bank had said that around 88 per cent of the ₹2,000 notes had returned to the banks by the end of July 2023. Of this, some of the notes have been exchanged for other notes with the bulk of money coming to banks as deposits.

If we assume that 85 per cent of money was received as bank deposits, then the increase in bank deposits due to the deposit of ₹2,000 notes would be around ₹2.6 lakh crore. Around 10 per cent of this amount will result in RBI impounding around ₹26,000 crore from banks as ICRR.

But the sum can be higher if the liquidity injected due to forex operations is considered. Some banks may have deployed the incremental deposits in other channels. So the ICRR money can lie anywhere between ₹20,000 crore to ₹40,000 crore.

What will the impact of the ICRR be?

RBI’s main intention is to contain inflation though this tool. As liquidity is sucked out, banks will have lesser money to lend, thus bringing down demand for goods and services, thus bringing down prices.

Short-term interest rates can move higher as the supply of funds get tight in the economy. That is another tool to bring down inflation.

“The introduction of an incremental CRR, though on a temporary basis, will impound resources of banks and have an upward impact on market rates. While there will still be surpluses in the market, the concept of impounding of resources will exert upward pressure on sentiment and hence interest rates. We can assume that this will be reversed before the festival/busy season as the RBI could have gone in for OMO to permanently take out liquidity from the system,” according to Madan Sabnavis, Chief Economist, Bank of Baroda.

“Hiking the CRR would have had monetary policy connotations, so the temporary increase is aimed to be a non-disruptive way of dealing with the issue of excess liquidity in the system in the backdrop of the recent demonetisation of the ₹2,000 notes,” notes Aurodeep Nandi, India Economist and Vice President at Nomura

**Article Source: Business Lines dt 12th Aug 2023