The Reserve Bank of India (RBI) has proposed to permit the linking of prepaid payment instruments (PPIs) with third-party unified payments interface (UPI) applications to make the digital wallet market interoperable.

The move, outlined in the RBI’s statement on developmental and regulatory policies, means wallet holders will no longer have to depend on PPI wallet issuers to make UPI payments. Individuals will be able to link their PPI wallets to third-party apps to con[1]duct these transactions.

Currently, PPI wallets can be used to make UPI transactions only through the application provided by the PPI issuer.

RBI Governor Shaktikanta Das said this move would boost adoption of digital payments for small value transactions.

Analysts suggest the proposal would democratise the wallet market.

“At the moment, the wallet market had been thrown wide open due to the RBI diktat on Paytm Payments Bank. The guideline, in a sense, serves to make PPI wallets somewhat interoperable and democratises the wallet market to that extent,” said Shivaji Thapliyal, head of research and lead analyst, YES Securities.

The RBI will later issue instructions related to UPI access for PPIs through third-party apps.

In January, the banking regulator had come down heavily on Paytm Payments Bank, barring it from accepting new deposits or account top-ups from March 15. The regulator had said users would continue to use, withdraw or transfer money to another wallet or bank account up to the balance available in the wallet after March 15.

In FY23, Thapliyal said, a Paytm wallet had a gross merchandise value (GMV) of $19.1 billion, followed by MobiKwik at $1.01 billion GMV.

Paytm Payments Bank has more than 300 million wallets, Business Standard reported in February.

“The RBI diktat had meant that the Paytm wallet business would effectively close down. However, it would be interesting to see what scenarios could emerge if third-party UPI apps, which would include Paytm, would be able to access other PPI wallets,” he said.

He said it would yet to be seen how the commercials on the third-party apps would establish with the PPI wallets in terms of sharing the merchant discount rate (MDR) and the extent of adoption allowed by merchants on the ground. “This will facilitate the linkage and usage of the PPI to make digital payments not only through a specific app but through any of the third-party UPI applications like PhonePe, Google Pay, etc. This shall bring the PPIs on par with the bank accounts for a customer to make UPI payments through third-party applications,” said Jyoti Prakash Gadia, managing director, Resurgent India.

Companies have cheered the move stating that wallet holders would enjoy the same flexibility as that of bank account holders transacting using UPI.

“The RBI’s announcement grants PPI users the ability to seamlessly integrate their accounts with a wide range of UPI-enabled services, mirroring the convenience and flexibility tradition[1]ally reserved for standard bank account holders,” said Dilip Modi, founder, Spice Money, a fintech firm.

Enabling UPI for cash deposit facility

The RBI has proposed to facilitate cash deposit facility through use of UPI aimed at enhancing customer convenience and improving efficiency of the currency handling process at banks.

“Deposit of cash through cash deposit machines (CDMs) is primarily being done through debit cards. Given the experience gained from cardless cash withdrawal using UPI at ATMs, it is now proposed to also facilitate deposit of cash in CDMs using UPI,” Das said. Currently, the facility of cash deposit is available only through the use of debit cards.

“We believe that this strategic move will serve as a catalyst in fostering the widespread adoption of cash recycler machines in the country. By enabling customers to perform both cash withdrawal and deposit transactions using UPI on the same platform, it empowers them with enhanced accessibility and efficiency,” said Ravi B Goyal, chairman and managing director, AGS Transact Technologies.

Mobile app for retail direct scheme soon

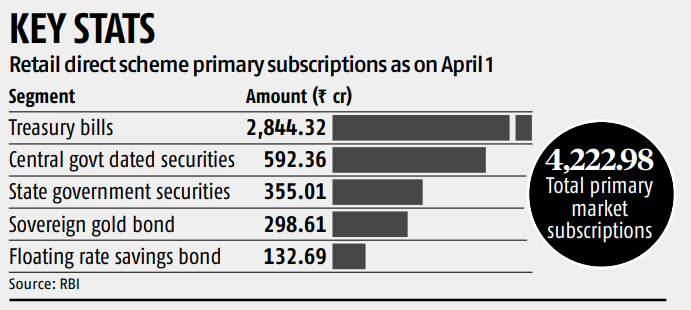

Reserve Bank of India(RBI) Governor Shaktikanta Das on Friday announced plans for the launch of a mobile app for accessing the Retail Direct Scheme to engage in the government securities market. Das highlighted in his monetary policy statement that the introduction of the app will significantly enhance convenience for retail investors and contribute to the deepening of the G-sec market.

“It is now proposed to launch a mobile app for accessing the retail direct portal. This will be of greater convenience to retail investors and deepen the G-Sec market,” he said.

Presently, retail investors have the option to invest in various financial instruments such as central government securities, treasury bills, state government securities, sovereign gold bonds, and floating rate saving bonds through the retail direct portal.

The introduction of the app will enhance transparency and streamline the process for retail investors, said market participants. They believe that the RBI’s app will foster a fairer environment in the G-sec market. However, some express concerns that it could disrupt the market and present a notable challenge to market intermediaries.

“The introduction of a mobile app granting direct access to the retail portal for Government Securities (G-Secs) represents a proactive stride towards democratising investment opportunities, empowering individuals to participate more enthusiastically in the financial markets,” said Umesh Revankar, executive vice-chairman at Shriram Finance.

Market participants said retail investors may feel more secure using the RBI’s app, given its operation with in a regulated frame work. If the RBI’s app provides lower transaction costs or even offers zero-cost transactions compared to other market intermediaries offering similar products, it could attract retail investors seeking to optimise their returns, they said.

“As a regulator, the RBI ensures compliance with regulatory requirements and safeguards investor interests. Retail investors may feel more secure using the RBI’s app knowing that it operates within a regulated framework. If the RBI’s app offers lower transaction costs or zero cost compared to other market intermediaries who offer the same products, it could attract retail investors looking to maximise their returns,” said Venkatakrishnan Srinivasan, founder and managing partner of RockfortFincap LLP.

_____________________________________

Courtesy: Business Standards. Dt.: 6th April 2024