Nearly two years after introducing a revised regulatory framework for non-banking finance companies, the Reserve Bank of India is set to review the categorisation of NBFCs in 2024.

According to sources aware of the matter, the review has become necessary given the NBFCs growth, their business models and the significant change in their operations from the time of initiating scale-based regulations.

“Some NBFCs backed by large corporate houses and conglomerates could be in focus for the purpose of this review,” said a source with knowledge of the development. Another person linked to the development hinted that this could also be a precursor to awarding bank licenses to certain NBFCs.

BANK LICENCE

“Based on specific parameters, some NBFCs could be moved to the top layer, and depending on how they perform, they could be contenders for bank licenses when opportunity open up,” said the source quoted above.

The exercise of promoting select NBFCs from upper layer could hence be a precursor and a testing process for handing out bank licenses.

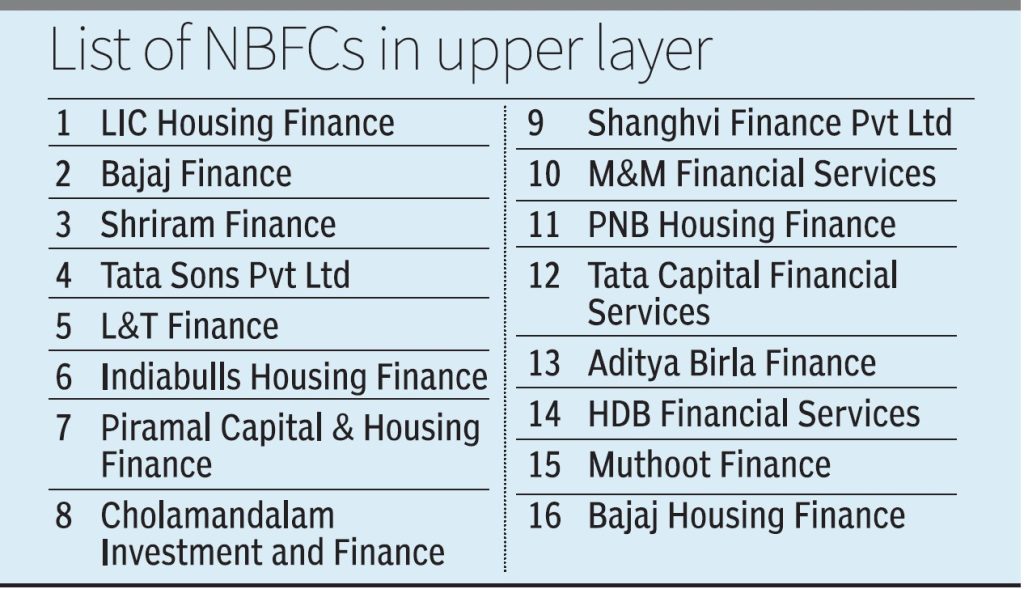

Currently, 16 non-banks are in the upper layer of which nine NBFCs, including Tata Sons Private Ltd, are led by large business houses (see table).

Tata Capital, M&M Finance, L&T Finance and Bajaj Finance are some names doing the rounds for the upgradation to the top layer.

BASIS OF UPGRADATION

But it is learnt that just the scale and size of an NBFC may not be a determining factor for upgradation.

The regulator is expected take a nuanced approach and rate non-banks on parameters such as ability to handle customer grievances, technology capability, asset granularity and composition of loan book, nature and quantum of business handled in-house, quality of board and top management, asset liability mismatch management, diversification of liabilities and so on.

“The regulator may not adopt a ‘one-size-fits-all’ approach to gauge the candidates, and the NBFC that should be moved to the top layer may be reviewed on a case-to-case basis,” said another senior social aware of the matter.

Also, the upgradation process is seen as critical to remove the thought process in many NBFCs in the upper layer that they are already functioning like banks. In fact, on February 9, RBI Deputy Governor M Rajeshwar Rao, in a speech, mentioned that significant differences continue to exist between the regulations applicable to banks and NBFCs.

Scale-based regulations came into effect on October 2021 and were implemented a year later. There are four layers — base, middle, upper and top. As on September 30, 2023, NBFCs in the base, middle and upper layers constituted 6 per cent, 71 per cent and 23 per cent of the total assets of NBFCs respectively. Presently, no NBFC is listed in the top layer.