1800 266 0777

CFPCM Certification program makes you competent to provide strategic advice in investments, insurance, tax, retirement & real estate planning. It is an global certification provided by FPSB USA which is a not for profit organisation based out of Denver, USA. It is a comprehensive skill development program to equip participants to offer authentic Financial Plans.

Certified Financial Planner – CFPCM certification is –

Preferred: One of the prominent certification program preferred by Financial Industry across the Globe.

Credible: In INDIA, Charter Members of Financial Planning Standard Board (FPSB) have resolved to give preference to CFPCM Certified Professionals in their recruitment process. The Charter Members Include companies like HSBC Bank, L&T Mutual Fund, Religare, Deutsche Bank, ICICI Bank, State Bank of India, LIC, Axis Bank, Dhanalaxmi Bank, ICICI Prudential, Metlife, SBI Life, Bajaj Capital, ICICI Prudential, Mirae Asset, SBI Mutual Fund, Barclays Bank, Edelweiss, ICICI Securities, Motilal Oswal, Birla SunLife, Standard Chartered Bank, KARVY, Tata AIG, BNP Paribas, Franklin Templeton Investments, Kotak Mahindra Bank, Reliance Capital, Tata Mutual Fund, Citibank, HDFC Securities, UTI Mutual Fund etc. to name a few.

Internationally Recognized: The most recognized and respected Financial Planning Certification in more than 25 Countries across the Globe.

Who can enroll for CFPCM Certification:

- Students pursuing/completed B.Com / BMS / BBA / BBI / BAF / BFM / M.Com

- Other Undergraduates / Graduates looking for a career in Finance

- MBA / CA / CA Inter

- Professionals working in Banking & Financial Services Industry

Job Opportunity:

| LEVELS | JOB PROFILES | QUALIFICATION EXPERIENCE |

| Entry | Trainees & Executives | Pursuing CFPCM Certification + Graduate Fresher. |

| Middle | Relationship Managers, Wealth Managers, Financial Planners / Advisors | Pursuing CFPCM Certification + Graduate Fresher. |

| Senior | Sr. Planners / Advisors, Team Leaders, Functional Heads, Business Heads | Attained CFPCM certification + Work Experience of 5 years or more. |

Level 1: Investment Planning Specialist Certification

- Personal Financial Management

- Investment Planning and Asset Management

- Regulatory Environment, Law and Compliance

Level 2: Retirement and Tax Planning Specialist Certification

- Retirement Planning

- Tax Planning and Optimization

Level 3: Risk Management and Estate Planning Specialist Certification

- Risk Management and Insurance Planning

- Estate Planning

Level 4: Certified Financial PlannerCM Certification

- Financial Planning Principles, Process and Skills

- Integrated Financial Planning

1. CFP Pathway

There are three potential routes to fulfill the education requirement and become eligible for the exam.

1) Instructor-Led Education Route

In order to successfully complete this route, enroll with an FPSB Ltd. Authorized Education Provider.

2) Individual-Led Education Route

FPSB Ltd. provides educational materials in an online platform, including textbook content, PowerPoint outlines, quizzes, and practice tests that align to the learning objectives and prepare a learner to sit for the exam. Learners must pass the FPSB Ltd. quizzes for each chapter, as well as the post-module tests for both modules to be eligible to successfully complete the education component.

3) Education Exemption Route

Individuals may apply to FPSB Ltd. for exemption from the instructor-led or individual-led education routes. This status is granted upon proof that the individual holds any of the following linked qualifications or certifications. If this waiver is accepted, individuals may bypass the education and prove eligibility to sit for the exam by successfully passing the prequalification exam in the FPSB Ltd. online platform.

2. Exam Details:

Investment Planning Specialist Certification

Retirement and Tax Planning Specialist Certification

Risk Management and Estate Planning Specialist Certification

– 2 hours, 75 multiple choice questions, computer-based test for each track exam

Certified Financial PlannerCM Certification

– 4 hours, computer-based test with case studies

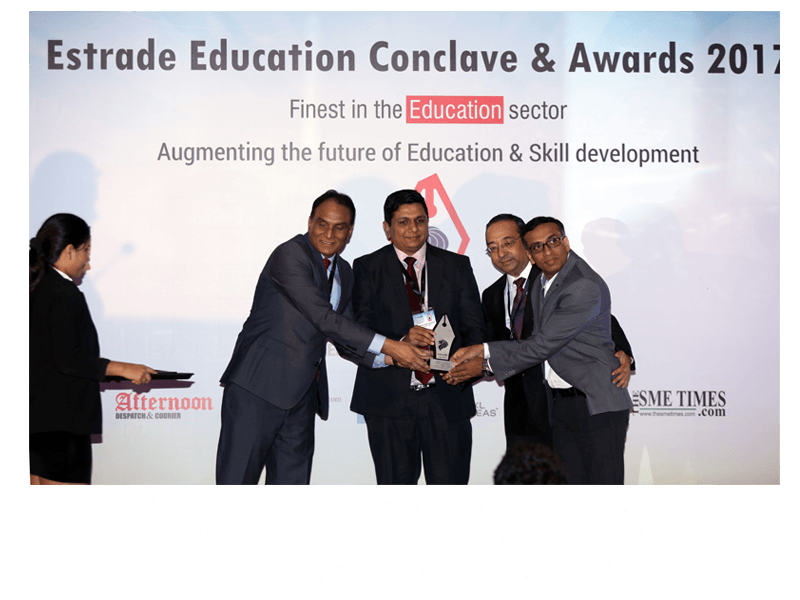

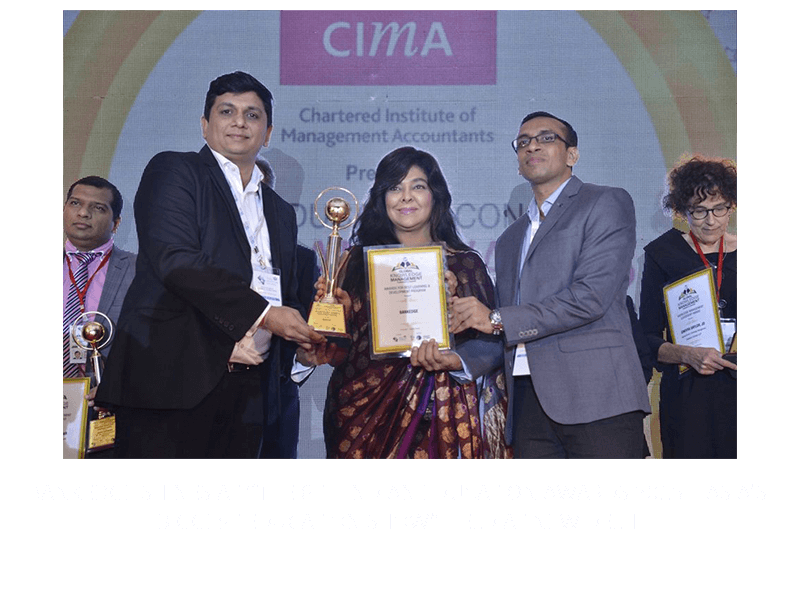

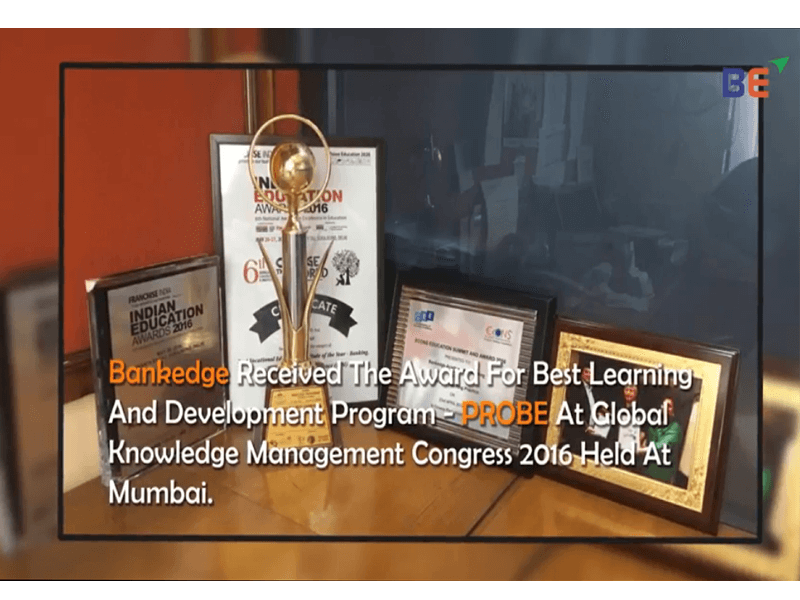

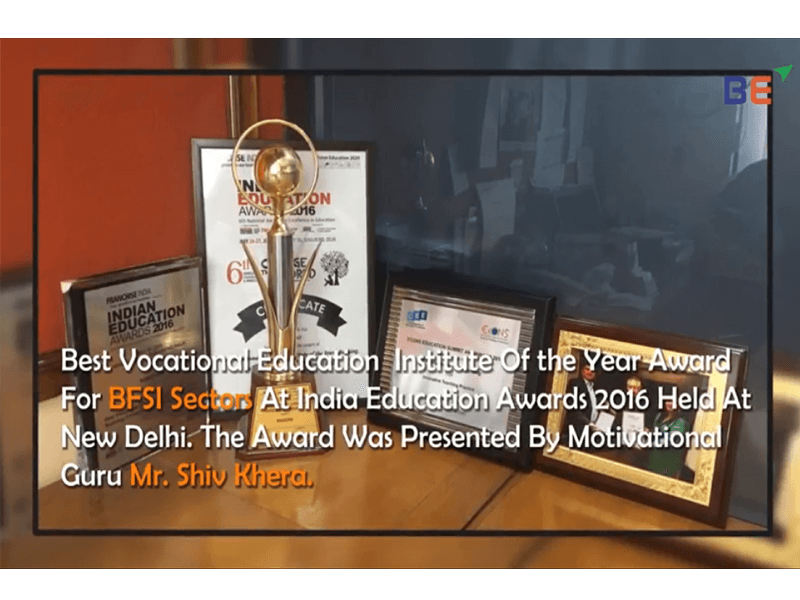

Why to prepare for CFPCM Certification with BANKEDGE

BANKEDGE is India’s Leading Banking and Financial Services Training Company that has more than 35 training locations Pan India. In last 3 Years BANKEDGE has trained and placed more than 5000 Young Graduates in various roles at Private Sector Bank and Financial Companies. BANKEDGE today is a respectable name among all BFSI majors.

For CFPCM Certification BANKEDGE has created High Standard Industry mapped Classroom as well as Online Course curriculum that helps the learner in preparing well for the CFPCM Certification. Faculties are Financial Planning Industry vetrons with more than 25 Years of Experience and all are CFPCM Certified trainers.

Placement Assistance

This is the most important element of training CFPCM Certification with BANKEDGE and here we have an Extra Edge. Through our dedicated Placement Cell – PICKUP we provided quality interview opportunities to all our candidates once they pass the CFPCM Certification. Thus we not only prepare them for training but also help the candidates in getting their dream career with India’s finest Financial Services Companies.

Our exclusive CFPCM Certification Classroom training Program offers:

- Core and practical learning

- Official Curriculum provided by FPSB Ltd.

- Webinars of Industry’s Best Financial Practitioners

- Case Studies with Mock tests

- Online Mock Tests for each level

- Doubt solving / faculty interactions

- Flexibility to attend missed classes based on class schedule

Duration:

6 to 8 months

EXTRA EDGE FROM BANKEDGE

- Guaranteed Interview Opportunities for CFPCM Certified Candidates

- Paid Internship of 6 months after CFPCM Certification (for selected candidates only and as per the availability)

- Free Advanced Excel Training

- About CFPCM

-

CFPCM Certification program makes you competent to provide strategic advice in investments, insurance, tax, retirement & real estate planning. It is an global certification provided by FPSB USA which is a not for profit organisation based out of Denver, USA. It is a comprehensive skill development program to equip participants to offer authentic Financial Plans.

Certified Financial Planner – CFPCM certification is –

Preferred: One of the prominent certification program preferred by Financial Industry across the Globe.

Credible: In INDIA, Charter Members of Financial Planning Standard Board (FPSB) have resolved to give preference to CFPCM Certified Professionals in their recruitment process. The Charter Members Include companies like HSBC Bank, L&T Mutual Fund, Religare, Deutsche Bank, ICICI Bank, State Bank of India, LIC, Axis Bank, Dhanalaxmi Bank, ICICI Prudential, Metlife, SBI Life, Bajaj Capital, ICICI Prudential, Mirae Asset, SBI Mutual Fund, Barclays Bank, Edelweiss, ICICI Securities, Motilal Oswal, Birla SunLife, Standard Chartered Bank, KARVY, Tata AIG, BNP Paribas, Franklin Templeton Investments, Kotak Mahindra Bank, Reliance Capital, Tata Mutual Fund, Citibank, HDFC Securities, UTI Mutual Fund etc. to name a few.

Internationally Recognized: The most recognized and respected Financial Planning Certification in more than 25 Countries across the Globe.

Who can enroll for CFPCM Certification:

- Students pursuing/completed B.Com / BMS / BBA / BBI / BAF / BFM / M.Com

- Other Undergraduates / Graduates looking for a career in Finance

- MBA / CA / CA Inter

- Professionals working in Banking & Financial Services Industry

Job Opportunity:

LEVELS JOB PROFILES QUALIFICATION EXPERIENCE Entry Trainees & Executives Pursuing CFPCM Certification + Graduate Fresher. Middle Relationship Managers, Wealth Managers, Financial Planners / Advisors Pursuing CFPCM Certification + Graduate Fresher. Senior Sr. Planners / Advisors, Team Leaders, Functional Heads, Business Heads Attained CFPCM certification + Work Experience of 5 years or more. - CFPCM Curriculum

-

Level 1: Investment Planning Specialist Certification

- Personal Financial Management

- Investment Planning and Asset Management

- Regulatory Environment, Law and Compliance

Level 2: Retirement and Tax Planning Specialist Certification

- Retirement Planning

- Tax Planning and Optimization

Level 3: Risk Management and Estate Planning Specialist Certification

- Risk Management and Insurance Planning

- Estate Planning

Level 4: Certified Financial PlannerCM Certification

- Financial Planning Principles, Process and Skills

- Integrated Financial Planning

1. CFP Pathway

There are three potential routes to fulfill the education requirement and become eligible for the exam.

1) Instructor-Led Education Route

In order to successfully complete this route, enroll with an FPSB Ltd. Authorized Education Provider.

2) Individual-Led Education Route

FPSB Ltd. provides educational materials in an online platform, including textbook content, PowerPoint outlines, quizzes, and practice tests that align to the learning objectives and prepare a learner to sit for the exam. Learners must pass the FPSB Ltd. quizzes for each chapter, as well as the post-module tests for both modules to be eligible to successfully complete the education component.

3) Education Exemption Route

Individuals may apply to FPSB Ltd. for exemption from the instructor-led or individual-led education routes. This status is granted upon proof that the individual holds any of the following linked qualifications or certifications. If this waiver is accepted, individuals may bypass the education and prove eligibility to sit for the exam by successfully passing the prequalification exam in the FPSB Ltd. online platform.

2. Exam Details:

Investment Planning Specialist Certification

Retirement and Tax Planning Specialist Certification

Risk Management and Estate Planning Specialist Certification

– 2 hours, 75 multiple choice questions, computer-based test for each track examCertified Financial PlannerCM Certification

– 4 hours, computer-based test with case studies - CFPCM with BANKEDGE

-

Why to prepare for CFPCM Certification with BANKEDGE

BANKEDGE is India’s Leading Banking and Financial Services Training Company that has more than 35 training locations Pan India. In last 3 Years BANKEDGE has trained and placed more than 5000 Young Graduates in various roles at Private Sector Bank and Financial Companies. BANKEDGE today is a respectable name among all BFSI majors.

For CFPCM Certification BANKEDGE has created High Standard Industry mapped Classroom as well as Online Course curriculum that helps the learner in preparing well for the CFPCM Certification. Faculties are Financial Planning Industry vetrons with more than 25 Years of Experience and all are CFPCM Certified trainers.

Placement Assistance

This is the most important element of training CFPCM Certification with BANKEDGE and here we have an Extra Edge. Through our dedicated Placement Cell – PICKUP we provided quality interview opportunities to all our candidates once they pass the CFPCM Certification. Thus we not only prepare them for training but also help the candidates in getting their dream career with India’s finest Financial Services Companies.

Our exclusive CFPCM Certification Classroom training Program offers:

- Core and practical learning

- Official Curriculum provided by FPSB Ltd.

- Webinars of Industry’s Best Financial Practitioners

- Case Studies with Mock tests

- Online Mock Tests for each level

- Doubt solving / faculty interactions

- Flexibility to attend missed classes based on class schedule

Duration:

6 to 8 months

EXTRA EDGE FROM BANKEDGE

- Guaranteed Interview Opportunities for CFPCM Certified Candidates

- Paid Internship of 6 months after CFPCM Certification (for selected candidates only and as per the availability)

- Free Advanced Excel Training

OUR STUDENTS ARE PLACED HERE

Ten Reasons Why You Should Join the Banking Sector in India!

1. Scope for Individual Growth

For talented and dynamic professionals, the competitive environment of the banking sector provides ample scope for individual, vertical growth. It provides employees an ambiance that is conducive to scaling new personal heights and improving job profiles

2. Variety

The banking sector is one of the most diverse sectors to work in. The choice of jobs as well as the variety in types of work that it offers ensures that there is a profile that will definitely suit your interests and aptitude. From Bank Probationary Officer to Financial Analyst, from Account Manager to Specialist IT Officer, there is a wide range of options to choose from.

3. Challenges

The work in the banking sector is multifaceted and you can keep monotony away by challenging yourself at work. This is a highly motivating factor for people who are ambitious and seek to develop their personality. With both physically and mentally stimulating work, you can work at the optimum levels of endeavour.

4. Opportunity for Growth of the Economy

Finance is a major part of the focus of any government’s policies. Banking can be safely called as the backbone of the Indian economy. Working in the banking sector provides an opportunity to each employee to contribute towards the growth of the economy through his work, whether mammoth or miniscule. There is indeed no better way to simultaneously work for yourself and serve the country too!

5. Extensive Traveling

Jobs in the banking sector can involve settling in different parts of the country, and sometimes abroad too. A banking job entails a lot of travelling for various purposes. This includes both domestic and international travel. As such, one is able to work and enjoy leisure at the same time by breaking the monotony of a mundane office.

6. Handsome Salaries

Let’s face it! Money matters! Today’s generation looks at money as a source of happiness. When good money can be made from work that interests and suits you, nothing like it. In this regard, the banking sector proves to be the best bet. A handsome remuneration is what you get for your work in a bank. They also give out bonuses and other incentives over the course of your employment based on your merit and seniority.

7. Creativity

A job in the banking sector is an evolving job. With more and more money being generated every day in newer and newer ways, the roles and responsibilities of banks also change regularly. With the injection of business principles into banking, creativity at work is now valued more than ever. With the advent of mobile and internet banking and with the push for global financial inclusion, there is no ceiling to how creative you are allowed to get.

8. Exposure through Communication

A major part of banking revolves around providing essential services to customers. Communication and interaction with these customers is of utmost importance. This interaction provides the basis for exposure of employees to different types of people with varied needs and lifestyles. This experience greatly enhances one’s skill sets and confidence in the long run.

9. Job Security

A job in a public sector bank is considered a job for life. With opportunities to advance at work and not worry about being fired because of downsizing or a bad economy, it is easy to see why banking is considered so attractive a sector. Add regular perks to the mixture and banking is the sector to strive for.

10. Job satisfaction

Given all the perks and advantages of a lucrative job in the banking sector, attaining satisfaction in this work is inevitable. Since job satisfaction is one of the most important criteria in a selecting a job these days, it is also one of the most convincing reasons why one must opt for work in the banking line.