Duration

2 & 1/2 Months

Certified by

Bankedge

Course Fee

Rs. 40000/-

(all inclusive)

Installments

Two EMIs of Rs. 20000/-

Bankedge BANK OFFICER Program: Your Gateway to a Rewarding Banking Career

Overview:

The BANK OFFICER Program by Bankedge is a specialized training initiative tailored for young graduates aiming for careers in Branch Banking or Back-End Operations within the Private Banking sector. This intensive 2.5-month course is meticulously designed to equip participants with essential banking knowledge and soft skills, ensuring they excel not only in interviews but also in their professional roles.

Program Highlights:

Comprehensive Banking Domain Training:

- In-depth understanding of banking operations, products, and services.

- Insight into the regulatory framework and compliance requirements.

- Practical knowledge of branch operations and back-end processes.

Essential Soft Skills Development:

- Communication Skills: Enhance verbal and written communication for effective customer interaction and professional correspondence.

- Resume Writing: Craft compelling resumes that highlight relevant skills and experiences.

- Email Etiquette: Learn the nuances of professional email communication to maintain clarity and professionalism.

- Relationship management and Presentation Skills: Develop relationship management techniques and effective presentation methods to engage clients and stakeholders.

- Customer Service: Master the art of delivering exceptional customer service, ensuring client satisfaction and loyalty.

OUR INDUSTRY COLLABORATIONS

APPLICATION PROCESS

- Candidate to appear for Pre-Selection aptitude Test and Interview

- Candidate to submit all required documents upon selection

- Subject to satisfactory verification BANKEDGE will issue conditional Offer Letter / welcome letter

ELIGIBILITY

- Graduates Aged between 21 to 24 for

- Minimum 50% Marks aggregate

- Good English Communication Skills

Curriculum

- BFSI Sector Overview & Opportunities

- Banking Business – Liability & Asset Products

- Structure Of Indian Banking System & Regulatory Framework

- Retail Banking Operations – Transactions Management

- Corporate Banking Products & Services

- Digital Banking Platform & Services

- Cash Operations, Vault Operations

- KYC & AML Process, Compliances (Financial Crime Management)

- Loan Process & Compliances

- Professional Skills

- Financial Products & Services

- Business Communication

- Customer Service Skills

- Selling Skills & Techniques

- Customer Relationship Management

- Other Banking Products – BG, LC, TF, Remittances

- Investment & Wealth Management Advisory Services

- Bank Officer KRA, Career Planning

Professional Skills

- Portfolio Management, Money Management Strategies

- Demat Account, Equity, Mutual Fund, Derivative Products

- Third Party Products

- Alternate Investment Products

- Risk Management Tools & Techniques

- Final Assessments

PROFESSIONAL EDGE @ BANKEDGE

Term 1

- BFSI Sector Overview & Opportunities

- Banking Business – Liability & Asset Products

- Structure Of Indian Banking System & Regulatory Framework

- Retail Banking Operations – Transactions Management

- Corporate Banking Products & Services

- Digital Banking Platform & Services

- Cash Operations, Vault Operations

- KYC & AML Process, Compliances (Financial Crime Management)

- Loan Process & Compliances

- Professional Skills

Term 2

- Financial Products & Services

- Business Communication

- Customer Service Skills

- Selling Skills & Techniques

- Customer Relationship Management

- Other Banking Products – BG, LC, TF, Remittances

- Investment & Wealth Management Advisory Services

- Bank Officer KRA, Career Planning

- Professional Skills

Term 3

- Portfolio Management, Money Management Strategies

- Demat Account, Equity, Mutual Fund, Derivative Products

- Third Party Products

- Alternate Investment Products

- Risk Management Tools & Techniques

- Final Assessments

- Term 1

Term 1

- BFSI Sector Overview & Opportunities

- Banking Business – Liability & Asset Products

- Structure Of Indian Banking System & Regulatory Framework

- Retail Banking Operations – Transactions Management

- Corporate Banking Products & Services

- Digital Banking Platform & Services

- Cash Operations, Vault Operations

- KYC & AML Process, Compliances (Financial Crime Management)

- Loan Process & Compliances

- Professional Skills

- Term 2

Term 2

- Financial Products & Services

- Business Communication

- Customer Service Skills

- Selling Skills & Techniques

- Customer Relationship Management

- Other Banking Products – BG, LC, TF, Remittances

- Investment & Wealth Management Advisory Services

- Bank Officer KRA, Career Planning

- Professional Skills

- Term 3

Term 3

- Portfolio Management, Money Management Strategies

- Demat Account, Equity, Mutual Fund, Derivative Products

- Third Party Products

- Alternate Investment Products

- Risk Management Tools & Techniques

- Final Assessments

Faculty

Faculty

WILL I BE MENTORED?

Yes! For the duration of the program, you will be assigned a dedicated Program Mentor. This experienced faculty member will be your one-point contact for queries, doubts or encouragement.

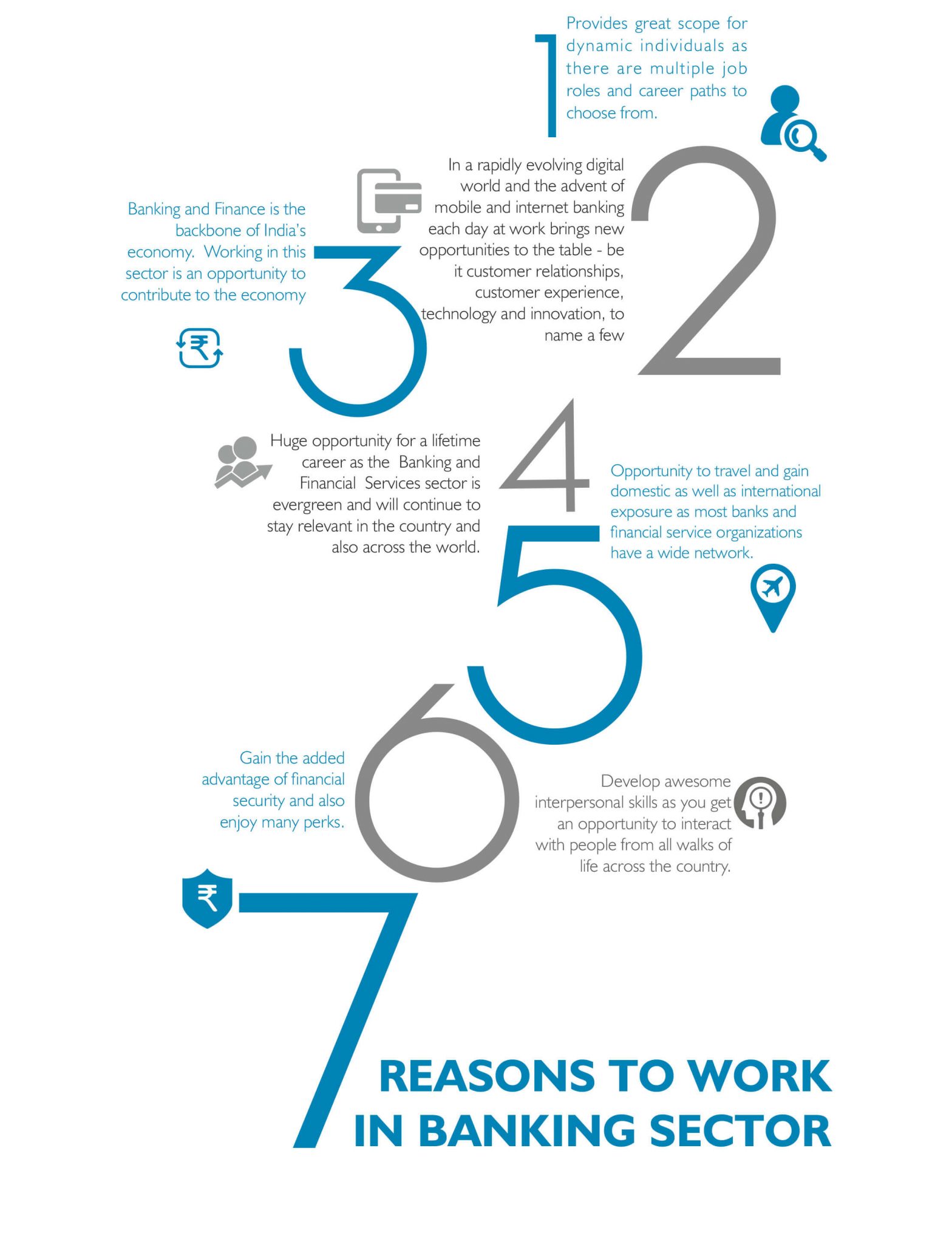

REASONS TO WORK IN BANKING SECTOR

WHAT’S IN IT FOR ME?

The best use of 100 hours! Because our power-packed Certified Bank Officer (CBO) course entirely equips you with the fantastic skillsets required to begin a prolific career in banking operations. All you have to do is learn and we’ll do the rest to ensure that your future is as bright as it should be.

Job Relevant Skills

Master the knowledge that lies within the functioning of retail banking operations. And that’s not all – get an in-depth understanding of complex systems and process know-how.

Get Hired

We are certain of the quality of our program which is why it comes with 100% placement assistance. With 15000+ placements completed with 60% salary hikes, we offer extensive career support to kickstart your banking career.

Gain Industry Certifications

Armed with the CBO certificate, you will be thrilled to find Bankedgeians successfully employed in most private sector banks and NBFCs. Shine bright among other applicants with our certificate that is recognized by top recruiters across the BFSI sector.

Learn Live

Lived enabled instruction is proven to provide the best student outcomes. Learn from the finest in our state-of-the-art classrooms located across India and carve the career of your dreams.

WHAT IS THIS PROGRAM ABOUT ?

360-Degree Learning

Practical Learning

We include banking simulations and case studies to create a realistic practical experience where true learning takes place.

Industry-Aligned Curriculum

Our retail banking course covers everything from complex systems to basic and advanced knowledge required to prosper in the BFSI sector.

Tech-enabled Learning

Learning Management Systems

We are particular about wanting learning to continue beyond the classroom. And so, you are given full access to our seamless, online LMS.

Tech-Aided

The use of internal and external technology enables you to fruitfully engage with your coursework and keep track of reading material.

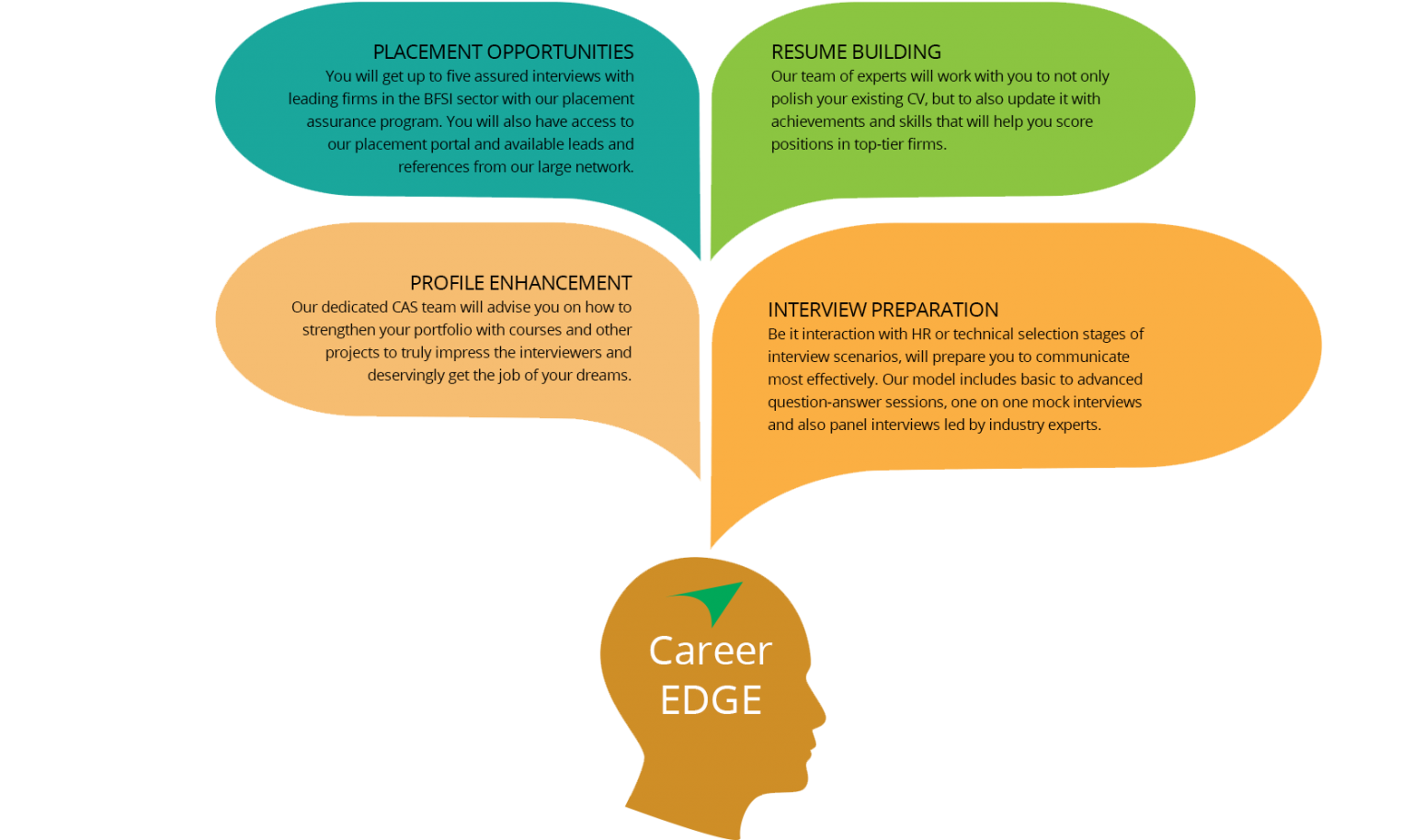

Career Services

Placement Assurance

Our career assistance team guides you through the placement process by providing expert tips on the BFSI sector. Their support thoroughly runs from the beginning of your resume building to the conclusion of your interview preparation.

Skill Building

Apart from empowering you with domain-specific knowledge, we ensure that you also develop soft skills that will enhance your ability to effectively communicate and present your ideas.

Learn Live

Industry-Endorsed Curriculum

Crafted by industry experts, our curriculum is holistic, practical and comprehensive. In other words, you are learning the best from the best.

Networking Opportunities

Connect with the experts and our alumni to further augment your learning and maximize every opportunity that comes your way.

WHAT CAN I BECOME?

Financial Analyst

OPERATIONS Analyst

investment Analyst

RISK ANALYST

EQUITY Analyst

DERIVATIVES ANALYST

TREASURY Analyst

PROCESS SPECIALIST

PRODUCT SPECIALIST

FIXED INCOME ANALYST

FUND OPERATIONS Analyst

HOW DO YOU TRAIN?

Through practical scenarios, realistic simulations and hands-on assignments, you will cohesively comprehend the BFSI sector and develop a supreme ability to contribute value to the workplace from day one.

Case Studies

Real-world case studies and complex business scenarios prepare you to successfully make the transition from academics to the retail banking industry.

In-class Simulations

Rise above traditional rote learning through the use of simulations that recreate challenges faced by the BFSI sector. Through vivid trading simulations, understand how multi-million dollar transactions flow through banks and affect various processes.

Assessments and Teach-backs

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

Industry Interactions

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

WHAT SUPPORT CAN I EXPECT?

Learn and we’ll place you! Make a successful transition in your career with partnerships of top tier hiring firms in the BFSI sector.

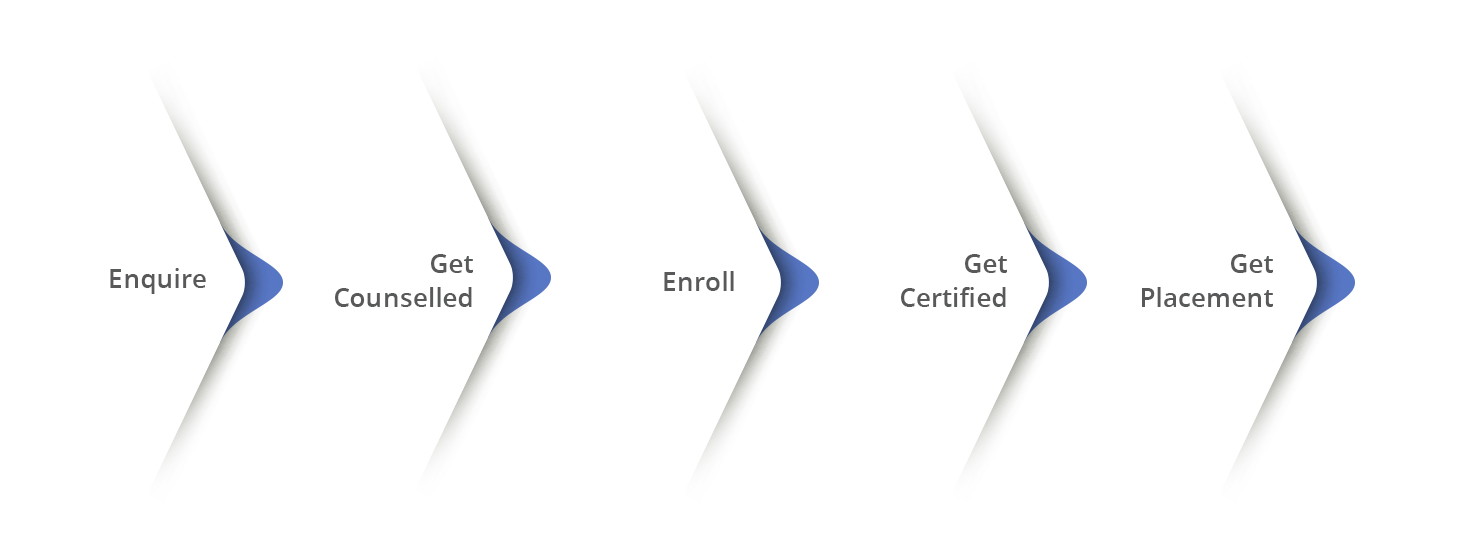

I WANT TO JOIN! HOW CAN I?

The Post Graduate Diploma In Investment Banking & Global Markets program stands tall in the category of finance courses because of its depth,

expertise and accurate relevance to the banking industry.

It is a valuable walk from knowledge to prosperity.

Fee Structure

LUMPSUM – INR 40,000/-

2 INSTALLMENTS – INR 20,000/-

WAIT! I HAVE SOME QUESTIONS

What is the format of the CBO program?

The Program offer a unique pathway that helps you understand and master the critical elements, concepts and models in Investment Banking and Global Markets

The CBO program is structured in an evolutionary pathway that covers the below:

- Comprehensive Banking Domain Training:

- Communication Skills

- Resume Writing

- Email Etiquette

- Relationship management and Presentation Skills

- Customer Service

What is the duration of the program?

The Program is a 21/2 month program.

What study material will be provided to us?

You would be provided with extensive study material throughout the CBO program:

- Detailed notes

- Recommended Textbooks

- Case studies

- Excel frameworks

- Modelling templates

- Trainer slides

- Interview preparation workshops and study notes

What is the eligibility criteria for admission?

EDUCATION

Any Undergraduate Degree holder like BCA, BBA, B.Tech, B.Engg., B.COM. etc. Student pursuing final year can also apply

WORK EXPERIENCE

Work experience is not mandatory.

What is the application process for admission?

The Application process consists of a few simple steps as shown below. An offer of admission would be made to the selected candidates and accepted by the candidates by paying the admission fee.

1. Program Counselling

We have a dedicated admission counsellor who are here to help guide you in applying to the program. They are available to:

- Address questions related to application.

- Assist with Financial Aid (if Required) Guide career role and opportunities after certified.

- Help you to understand the program detail and pedagogy.

2. Application

Complete your application to kick start the admission process.

- Rate your various skills of OOPs language, quantitative and logical ability.

- Submit application fee: ₹ 500/-

- Submit the form successfully and scheduled your interview with us.

3. Interview

Interview is with admission committee, who will review the candidate profile.

Selection will be determined on the basis of academic records, work experience, test scores and interview. Upon qualifying a confirmation letter for admission to the PG Certification will handover to the candidate.

4. Documentation

After interview on the basis of confirmation letter, the required papers mentioned in the mandatory list of documents as per eligibility criteria. You would be required to submit your marksheets, education certificates, work experience proofs amongst other necessary documents.

5. Payment Processing

Block your seat with the initial amount of fees and begin with your prep course and start your Data Science journey. Full or annual program fee to be deposited within 1 week of offer letter / program start –whichever is earlier.

6. Confirmation

Your admission will be confirmed basis the selection procedure, document authentication

and fee payment. A welcome letter, ID card, student number and portal access will be shared upon successful completion of the admission process.

What is Certified Bank Officer?

The BANK OFFICER Program by Bankedge is a specialized training initiative tailored for young graduates aiming for careers in Branch Banking or Back-End Operations within the Private Banking sector. This intensive 2.5-month course is meticulously designed to equip participants with essential banking knowledge and soft skills, ensuring they excel not only in interviews but also in their professional roles.

Why should I choose your program?

Preferred by Employers: Banks prefer hiring trained candidates who can quickly adapt to the job, leading to higher productivity and efficiency.

Career Advancement: The program provides a solid foundation for a prosperous career in the banking sector, with skills that enhance job performance and career growth.

Short-Term Commitment, Long-Term Benefits: In just 2.5 months, graduates are transformed into industry-ready professionals, ready to take on challenging roles in banking.

Targeted Training: The curriculum is specifically designed to meet the demands of the banking industry, focusing on the skills and knowledge that are most relevant and sought after.

What roles can be expected after this specialized CBO?

Account Manager, Customer Service Officer, Teller Service Executive, Transactions Operations Executive, Relationship Officer, Wealth Manger, Executive – Wealth Management, Assistant Acquisition Manager, Officer – Wealth Management, Relationship Manager – Wealth, Relationship Executive, RM – Cross Sell