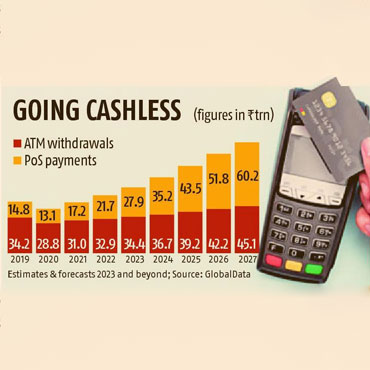

Card payments in India are likely to hit the ₹ 27.9 trillion mark in 2023, up 28.6 per cent yearonyear ( YoY), according to a report by GlobalData, a Londonbased leading data and analytics company.

Card payments´ value in India, GlobalData said, grew 26.2 per cent in 2022, driven by economic growth, consumers´ increasing preference for electronic payments, and efforts by financial authorities to boost cashless payments.

This, GlobalData said, was likely to continue in 2023 and beyond as well. “India has traditionally been a cashdriven economy.

However, the usage of cash for payments is on the decline.

Government measures, such as reducing merchant service fees and providing subsidies to merchants for installing pointofsale (PoS) terminals, are some of the key factors behind card payment market growth in the country,” said Kartik Challa, senior banking and payments analyst at GlobalData.

That said, while there has been a robust rise in card usage for PoS payments over the years, including both at physical PoS terminals and online, Indians´ cash withdrawals at ATMs is slowing down.

Contactless payments, on the other hand, are gaining traction with a rise in demand for ´ touchfree´ payments since the outbreak of the Covid pandemic.

To push contactless payments, the limit was raised from ₹ 2,000 to ₹ 5,000 in January 2021. “In 2023, ATM cash withdrawals are estimated to increase by just 4.6 per cent to reach ₹ 34.4 trillion ($416.2 billion).

The pandemic also highlighted the importance of non-contact payment tools, thereby benefiting card payments,” Challa said.

Meanwhile, to drive card payments and reduce dependence on cash, the government abolished merchant service fees on transactions with state-owned RuPay cards in January 2020, encouraging merchants to accept payments with RuPay cards.

Further, the Reserve Bank of India (RBI) allowed banks to levy cash withdrawal charges of up to ₹ 21 per transaction beyond the monthly free transaction limit, from January 2022, thereby discouraging cash usage.

“Indian consumers are increasingly embracing electronic payments, gradually moving away from cash. While mobile wallets have been the major beneficiary of this trend, card payments are also on the rise.

Card payments are expected to increase at a strong compound annual growth rate (CAGR) of 21.2 per cent over 2023-27, compared to a much slower CAGR of 7 per cent forecast for ATM cash withdrawals during the same period,” the report said.

Courtesy: Business Standards dt. 23rd August 2023