Staving off competition from mutual funds, banks look for ways to regain old depositors and find new ones

Credit growth should not outrun deposits by miles, Reserve Bank of India Governor Shaktikanta Das cautioned in July, as that may lead to structural liquidity issues.

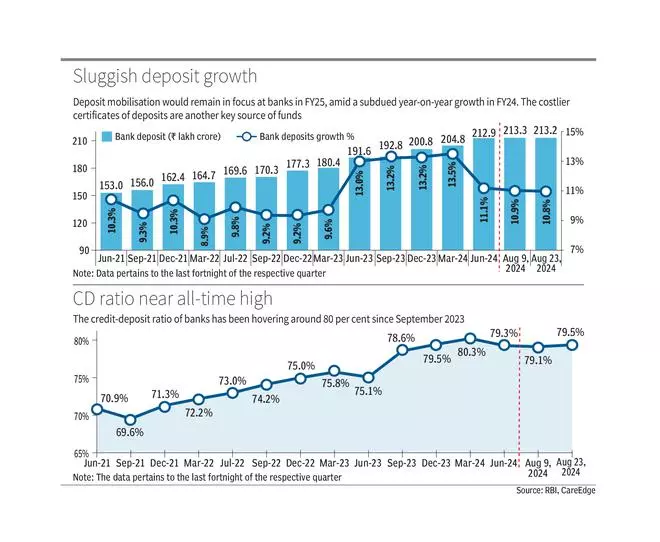

According to the latest RBI data, banks’ credit grew 14 per cent year-on-year (YoY) to ₹169.5 lakh crore during the fortnight ended August 23, while deposits grew 11 per cent to ₹213.2 lakh crore. Since this trend remains unchanged since March 2022, the regulator’s concern appears justified.

While some bankers say that deposit growth is slowing because household savings are increasingly going to the equity market instead of fixed deposits, others counter this by pointing out that capital deployed in equity market eventually enters the banking system through different channels.

Nonetheless, bankers are silently working out ways to attract depositors back to banks.

Innovative products

Bank of Baroda (BoB) MD and CEO Debadatta Chand says that digital banking is more preferred these days than branch banking. Accordingly, lenders can use digital platforms to attract more deposits. Nearly 16 per cent of BoB’s new fixed deposits and 35 per cent of new recurring deposits come through digital channels.

“I feel it (deposit mobilisation) is more of a transient, not a structural issue currently. At the same time, we as a bank need to figure out how to address the change in saving preference. Deposit will no longer be a generic product, it has to be a bundled product now,” he says.

Chand says BoB recently renamed a recurring deposit product as systematic deposit plan or SDP, which offers modest returns and resembles the popular systematic investment plan (SIP) schemes offered by mutual funds.

Multi-pronged move

R Subramaniakumar, MD and CEO at RBL Bank, says the lender aims to ensure that incremental credit growth is supported by deposit growth through a multi-pronged approach.

High-value customers, with significant bank balance, make up 60-65 per cent of the lender’s deposit base. The bank assigns them a relationship manager to deal with all queries.

“This segment (high-value customers) is likely to increase. How? We have a concept called ‘customer related to family’,” he says. If a customer is satisfied with the bank’s services, then it tries to initiate potential business with the customer’s extended family members.

While the bank has a ‘natural ability’ to offer a slightly higher interest rate, it aims to expand its presence in neighbourhoods where it already has a branch. It is holding micro-marketing events at branches, apart from increasing their salesforce by 20 per cent last year and 16 per cent this year to step up deposit growth.

“Digital mobile banking is one of the smartest solutions we are offering, with 70-75 per cent of customers transacting through the digital platform,” the MD says. “Ease of doing business is the most important thing. Account opening, account transaction, engaging with customers, and offer of other products are facilitated through the digital platform.”

RBL Bank’s wholly owned business correspondent subsidiary has around 1,200 branches, of which 75-80 are already referring customers for deposit accounts, he says. “Nearly 300 branches are near tier-I and tier-II cities and can mobilise more customers,” he adds.

Primary choice

Ratan Kesh, the interim MD of Bandhan Bank, stresses on the lender’s deposit-led credit growth strategy. In Q1FY25, its overall deposits rose 23 per cent YoY to ₹1.33 lakh crore, while total advances grew 22 per cent at ₹1.25 lakh crore.

Having transitioned to a new core banking system, the bank can now launch more low-cost current account products, Kesh says. Cash management services or CMS, trade, forex, escrow account and more merchant acquiring products are in the pipeline to attract low-cost deposits. On the savings side, many of the bank’s affluent customers are attracted by its rates, he says.

To encourage customers to make Bandhan Bank their primary bank, it will soon launch products targeted at its affluent banking segment, NRIs, women, and even credit card users. Additionally the bank’s 530 new branches, opened in the last 18 months, will start delivering deposits for the lender, he says.

Regulatory support

While banks are undertaking a host of initiatives to boost deposit growth, the “active participation” of regulators and the government is needed to aid the cause, says Central Bank of India MD and CEO MV Rao. He argues that returns from mutual funds exceed that of bank deposits as deployment of bank resources is highly regulated.

The banking regulator has set a ceiling on the interest rate for many asset products. On the other hand, it is not known whether mutual funds are deployed in the priority sector, MSMEs (micro, small and medium enterprises), or government schemes, he says. Banks make 20 per cent provision even for AAA-rated companies while mutual funds don’t.

“Going forward, we cannot dictate to customers, but we will have to evolve and ensure higher returns to depositors, for which the active participation of the government and regulators will be required,” he says.

He believes 99 per cent of mutual fund investors do not analyse the technicals or fundamentals to make an informed decision. “So, after 6-7 years, when the cycle turns, definitely a lot of systemic risks may come out,” he says, contrasting this with bank deposits as a safer asset class in the long run.

__________________________________________________

Courtesy: Business Line Dt.: 16th September 2024.