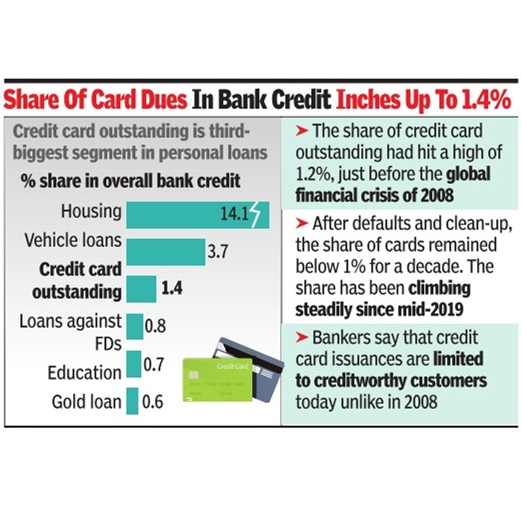

The share of credit card dues had hit a high of 1. 2%, just before the global financial crisis of 2008. After defaults in small-ticket personal loans and the subsequent clean-up, the share of card dues remained below 1% for the next decade. They crossed the 1% mark again in August 2019 and have risen steadily since then.

However, bankers say that card issuances are limited to creditworthy customers today unlike in 2008. Data availability through credit bureaus, account aggregators, tax, and other platforms hasmade appraisals more efficient. Also, since most customers are on-boarded digitally, banks now have a wider reach than target-driven directselling agents.

Despite the rising spending and multiple card ownership, credit card penetration in India is among the lo-west in the world. “As a percentage of the population, less than 5% hold credit cards, which is lower than in many developing countries,” said an executive with a private bank.

According to RBI, in the 12 months that ended in April 2023, the share of the indust-ry in bank credit has dropped to 24. 3% from 26. 3%. Sectors like power, telecom, and sugar have seen outstanding bank credit shrink in that period. The share of services has risen to 26. 4% from 25. 2%, driven by increased credit to finance companies. Personal loans’ share has increased to 29. 7% from 28. 8%, including unsecured loans.

The RBI’s latest bulletin said a robust credit risk assessment can help sustain strong and risk-free growth in retail and overall bank credit portfolio. It noted that retail bank credit played a significant role in its recovery, particularly after the pandemic. This shift towards retail loans by banks is estimated to be cyclical. Retail credit expansion is sensitive to asset quality and interest rates, it added.