Duration

4 Months

Certified by

Bankedge

Course Fee

Rs.90,000/-

(all inclusive)

Installments

9 EMIs

@ 0% Interest

PCPBF – Professional Certificate Program in Banking & Finance is a power-packed 4 months program offered by BANKEDGE Academy of Banking and Finance. This program makes the candidate Job-ready in Retail Branch Banking or Backend Operations of a Private Sector Bank or Financial Institutions. This Program is designed with the objective of nurturing the competencies of working professional and fresh graduates aspiring to work in Private Banking Sector of India. This programme also allows students to balance the work life challenges and professional commitments.

Bankedge PCPBF is designed for aspiring bankers that includes both Freshers and Experienced Working Professionals. This programme is meeting the need of flexibility and convenience through virtual classes, online library and high tech support along with conventional face to face teacher and student interaction during sessions.

This is a power-packed PCPBF Programme focusing on entry level front line banking and backend operations profiles with India’s Leading Private Sector Banks and major Financial Institutions.

Salient Features of the Programme:

- Curriculum designed by academia, industry and skilling partners

- Instructors from the industry

- Access to latest tools and techniques

- Industry project and mentorship

- 24×7 LMS support in learning

- Access to career building soft skills and personality development programs

- 100% placement assistance

OUR STUDENTS ARE PLACED HERE

APPLICATION PROCESS

Candidate to appear for Pre-Selection aptitude Test and Interview

Candidate to submit all required documents upon selection

Subject to satisfactory verification BANKEDGE will issue conditional Offer Letter / welcome letter

ELIGIBILITY

Graduates Aged between 21 to 24 for

Minimum 50% Marks aggregate

Good English Communication Skills

CURRICULUM

Indian Financial System

Money and Interest

RBI and its functions

Accounting Guidelines

Bank Reconciliation

Liabilities products (An overview)

Various types of accounts (Individual, Proprietorship etc.)

Banking Business

KYC guidelines

Banking Laws

Technology in Banking

SB/CA/TD deposits

Third Party products viz MF and Insurance

Cash and Clearing Transactions in Detail

Corporate Banking

Fraud Management

Remittances and Cash Management Service

Details of Credits in Banks

Cardinal Principles

Priority and Non-Priority Sector Advances

Fund Based and Non-Fund based advances

Working capital operating cycle

Projected Net working capital

Term Loan Processes and Disbursement

NPA Management including BASEL Norms and RBI guidelines

Introduction to Foreign Trade

Exchange rate mechanism and SWIFT messages

Forex Offices and Forex Dealings

Imports- RBI and FEMA guidelines, Merchanting Trade, Regulatory Returns

Exports – FEMA guidelines and ICC rules, EEFC, ECGC Guarantee, Regulatory reporting

Forex guarantees, Invocation and Payment

Foreign Inward Remittances, FEMA regulations, Issue of FIRC

Foreign Outward Remittances, FEMA guidelines, Procedure of issuing DD/TT, ESOP, LRS

R-Returns- Guidelines, Technical issues and Documentation

Domestic Trade covering NI Act, Inward and Outward Collections, Supply Bills, Inland LC, Performance Guarantee, Financial Guarantee and others

Investment and Risk Management – Equity and Debt and Alternate Assets

Risk Proling and Asset Allocation

Risk Management through Insurance

Self-Awareness

Self-Monitoring

Team Building

Communication

Social Graces

Interview

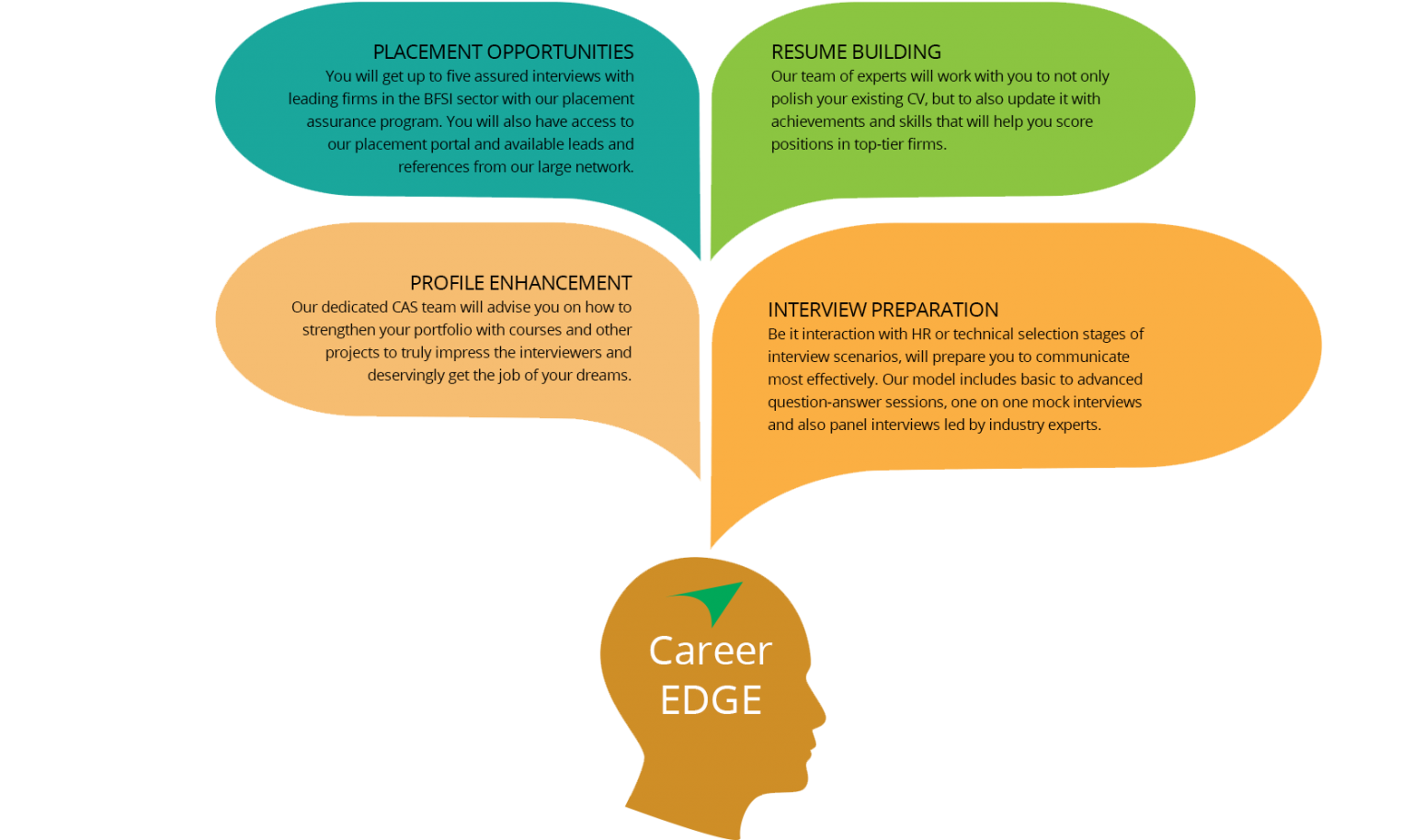

PROFESSIONAL EDGE @ BANKEDGE

- Indian Financial System

- Money and Interest

- RBI and its functions

- Accounting Guidelines

- Bank Reconciliation

- Liabilities products ( An overview)

- Various types of accounts (Individual, Proprietorship etc.)

- Banking Business

- KYC guidelines

- Banking Business

- Technology in Banking

- SB/CA/TD deposits

- Third-Party products viz MF and Insurance

- Cash and Clearing Transaction in Details

- Corporate Banking

- Fraud Management

- Remittances and Cash Management Service

- Details of Credits in Banks

- Cardinal Principles

- Priority and Non-Priority Sector Advances

- Fund Based and Non-Fund based advances

- Working capital operating cycle

- Projected Net working capital

- Term Loan Processes and Disbursement

- NPA Management including BASEL Norms and RBI guidelines

- Introduction to Foreign Trade

- Exchange rate mechanism and SWIFT messages

- Forex Offices and Forex Dealings

- Imports- RBI and FEMA guidelines, Merchanting Trade, Regulatory Returns

- Exports – FEMA guidelines and ICC rules, EEFC, ECGC Guarantee, Regulatory reporting

- Forex guarantees, Invocation and Payment

- Foreign Inward Remittances, FEMA regulations, Issue of FIRC

- Foreign Outward Remittances, FEMA guidelines, Procedure of issuing DD/TT, ESOP, LRS

- R-Returns- Guidelines, Technical issues and Documentation

- Domestic Trade covering NI Act, Inward and Outward Collections, Supply Bills, Inland LC, Performance Guarantee, Financial Guarantee and others

- Investment and Risk Management – Equity and Debt and Alternate Assets

- Risk Proling and Asset Allocation

- Risk Management through Insurance

- Self-Awareness

- Self-Monitoring

- Team Building

- Communication

- Social Graces

- Interview

- Retail Banking

- Indian Financial System

- Money and Interest

- RBI and its functions

- Accounting Guidelines

- Bank Reconciliation

- Liabilities products ( An overview)

- Various types of accounts (Individual, Proprietorship etc.)

- Banking Business

- KYC guidelines

- Banking Business

- Technology in Banking

- SB/CA/TD deposits

- Third-Party products viz MF and Insurance

- Cash and Clearing Transaction in Details

- Corporate Banking

- Fraud Management

- Remittances and Cash Management Service

- Credit Management

- Details of Credits in Banks

- Cardinal Principles

- Priority and Non-Priority Sector Advances

- Fund Based and Non-Fund based advances

- Working capital operating cycle

- Projected Net working capital

- Term Loan Processes and Disbursement

- NPA Management including BASEL Norms and RBI guidelines

- Trade Finance

- Introduction to Foreign Trade

- Exchange rate mechanism and SWIFT messages

- Forex Offices and Forex Dealings

- Imports- RBI and FEMA guidelines, Merchanting Trade, Regulatory Returns

- Exports – FEMA guidelines and ICC rules, EEFC, ECGC Guarantee, Regulatory reporting

- Forex guarantees, Invocation and Payment

- Foreign Inward Remittances, FEMA regulations, Issue of FIRC

- Foreign Outward Remittances, FEMA guidelines, Procedure of issuing DD/TT, ESOP, LRS

- R-Returns- Guidelines, Technical issues and Documentation

- Domestic Trade covering NI Act, Inward and Outward Collections, Supply Bills, Inland LC, Performance Guarantee, Financial Guarantee and others

- Financial Risk Management

- Investment and Risk Management – Equity and Debt and Alternate Assets

- Risk Proling and Asset Allocation

- Risk Management through Insurance

- Personality Development

- Self-Awareness

- Self-Monitoring

- Team Building

- Communication

- Social Graces

- Interview

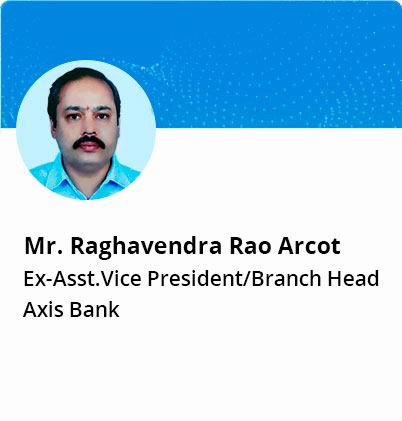

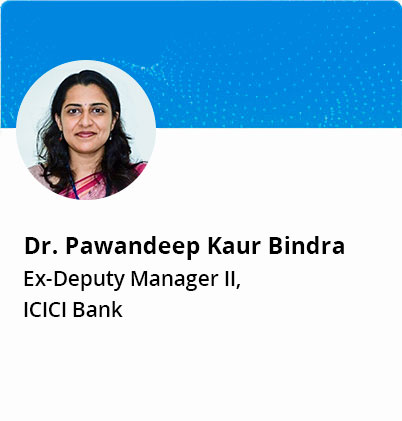

FACULTY

WILL I BE MENTORED?

Yes! For the duration of the program, you will be assigned a dedicated Program Mentor. This experienced faculty member will be your one-point contact for queries, doubts or encouragement.

REASONS TO WORK IN BANKING SECTOR

WHAT’S IN IT FOR ME?

The best use of 200 hours! Because our power-packed Professional Certificate Program in Banking & Finance (PCPBF) course entirely equips you with the fantastic skillsets required to begin a prolific career in banking operations, trade finance and clearing services. All you have to do is learn and we’ll do the rest to ensure that your future is as bright as it should be.

Job Relevant Skills

Master the knowledge that lies within the functioning of retail banking operations. And that’s not all – get an in-depth understanding of complex systems and process know-how.

Get Hired

We are certain of the quality of our program which is why it comes with 100% placement assistance. With 15000+ placements completed with 60% salary hikes, we offer extensive career support to kick start your banking career.

Gain Industry Certifications

Armed with the PCPBF certificate, you will be thrilled to find Bankedgeians successfully employed in most private sector banks and NBFCs. Shine bright among other applicants with our certificate that is recognized by top recruiters across the BFSI sector.

Learn Live

Lived enabled instruction is proven to provide the best student outcomes. Learn from the finest in our state-of-the-art classrooms located across India and carve the career of your dreams.

WHAT IS THIS PROGRAM ABOUT ?

360-Degree Learning

Practical Learning

We include banking simulations and case studies to create a realistic practical experience where true learning takes place.

Industry-Aligned Curriculum

Our retail banking course covers everything from complex systems to basic and advanced knowledge required to prosper in the BFSI sector.

Tech-enabled Learning

Learning Management Systems

We are particular about wanting learning to continue beyond the classroom. And so, you are given full access to our seamless, online LMS.

Tech-Aided

The use of internal and external technology enables you to fruitfully engage with your coursework and keep track of reading material.

Career Services

Placement Assurance

Our career assistance team guides you through the placement process by providing expert tips on the BFSI sector. Their support thoroughly runs from the beginning of your resume building to the conclusion of your interview preparation.

Skill Building

Apart from empowering you with domain-specific knowledge, we ensure that you also develop soft skills that will enhance your ability to effectively communicate and present your ideas.

Learn Live

Industry-Endorsed Curriculum

Crafted by industry experts, our curriculum is holistic, practical and comprehensive. In other words, you are learning the best from the best.

Networking Opportunities

Connect with the experts and our alumni to further augment your learning and maximize every opportunity that comes your way.

WHAT CAN I BECOME?

Trade Finance Executive

Forex Transactions Executive

Trade Finance Officer

Transactions Operations Executive

Account Manager

Customer Service Officer

Credit Relationship Manager

Fraud Management Officer

Assistant Acquisition Manager

Teller Service Executive

Relationship Officer

Wealth Manager

Executive (Wealth Management)

Credit Manager

Fraud Detection & Vigilance Officer

HOW DO YOU TRAIN?

Through practical scenarios, realistic simulations and hands-on assignments, you will cohesively comprehend the BFSI sector and develop a supreme ability to contribute value to the workplace from day one.

Case Studies

Real-world case studies and complex business scenarios prepare you to successfully make the transition from academics to the retail banking industry.

In-class Simulations

Rise above traditional rote learning through the use of simulations that recreate challenges faced by the BFSI sector. Through vivid trading simulations, understand how multi-million dollar transactions flow through banks and affect various processes.

Assessments and Teach-backs

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

Industry Interactions

Make presentations on real-life scenarios and understand how general market dynamics affect the world of retail banking. Also, attend guest lectures from industry experts to reinforce the quality of your theoretical learning.

WHAT SUPPORT CAN I EXPECT?

Learn and we’ll place you! Make a successful transition in your career with partnerships of top tier hiring firms in the BFSI sector.

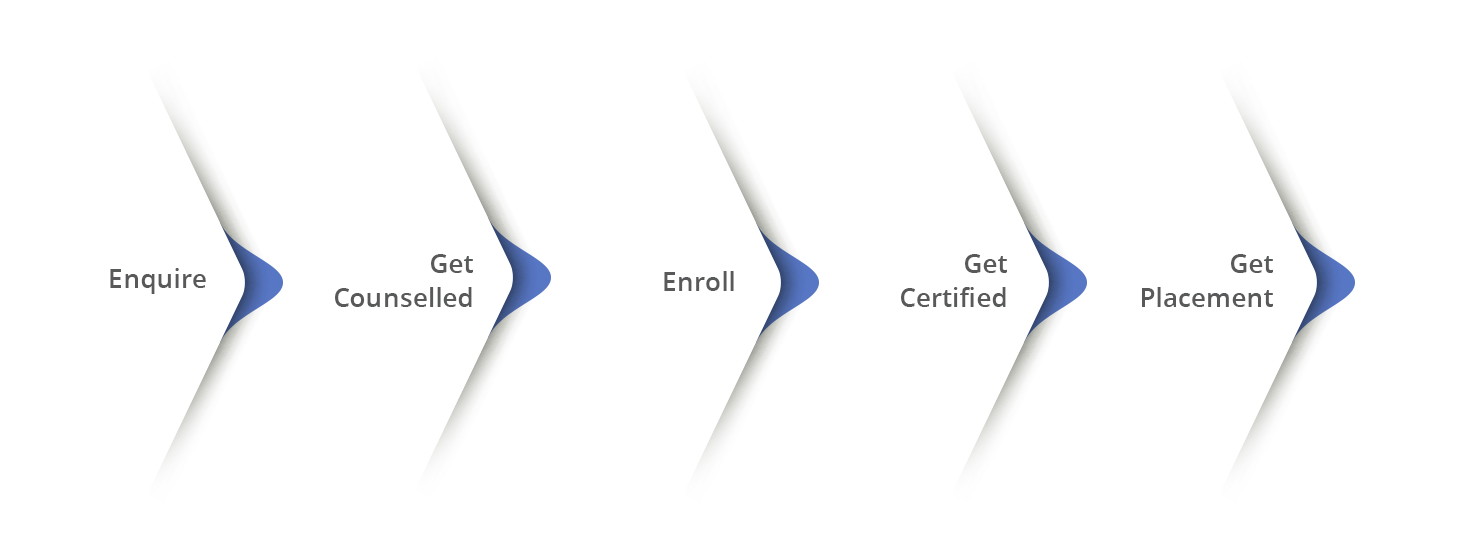

I WANT TO JOIN! HOW CAN I?

The PCPBF program stands tall in the category of finance courses because of its depth, expertise and accurate relevance to the banking industry.

It is a valuable walk from knowledge to prosperity.

Learn with us and get placed at leading institutions in the BFSI sector!

To be eligible for the course, you must be a recent Graduate from any stream with 0-3 years of work experience.

Fee Structure

LUMPSUM – INR 75,000

INSTALLMENT – INR 6,250

WAIT! I HAVE SOME QUESTIONS

What is the Format of the PCPBF Program?

The PCPBF – Professional Certificate Program in Banking & Finance, Immersive Professional Certificate Program in Banking and Finance with specilisation in -Retail Banking, Trade Finance, Credit & Risk Operations.

What is the duration of the Program?

The PCPBF program is an 4 Months. Please contact the information centre for more details.

What is the target audience for this program?

Age between 21 to 24 for Graduates

Minimum 50% Marks aggregate

Good English Communication Skills

What is the admission process?

- Candidates need to appear for the personal /telephonic interview with BANKEDGE

- Candidate who get selected in the interview need pay their Admission Fee and tuition charges, as per the schedule given.

What are the documents required at the time of the enrolment?

Documents required at the time of Enrollment

- Self-Attested Graduation Certificates (Consolidated Mark sheet of 3rd Year & Pass certificate)

- 2 Passport size photographs

- Appointment / Experience Letter of Work Experience

Reference No. cum receipt of Prospectus Purchase

What ate the Career Opportunities post completion of this program?

Diverse Job Roles & Career Opportunities in BFSI sector

Career Opportunities

- The course offers plenty of Job Opportunities in sectors like: Private Banks, NBFCs, Asset management Cos, Distribution Houses/ PMS/ Wealth Advisory, Stock Brooking, Insurance Cos, Mutual Funds etc.

- Job Roles in Banking & Financial Institutions revolve around: Forensic Accounting, International Accounting, General Accounting, Tax Accounting, Information Technology, Research, Trade Finance Specialist, Wealth Management Experts, Credit & Risk Analysts, Cyber Security, Credit Analyst, Credit Relationship Manager, Financial Analyst, Relationship Manager / Executive, Business Development Manager / Executive, Investment Manager, Private Banking Manager, Financial Advisor etc.